For the 24 hours to 23:00 GMT, the AUD declined 10.67% against the USD and closed at 0.6167.

The Reserve Bank of Australia (RBA), in its interest rate decision, kept its key interest unchanged at 0.25%. However, the central bank warned that it expects the economy to register a “very large” contraction in the second quarter due to the coronavirus pandemic.

In a statement following the interest rate decision, RBA Governor, Philip Lowe, stated that the central bank will not increase the cash rate target until progress is being made towards the goals for full employment and inflation target range of 2%-3%.

LME Copper prices rose 4.1% or $200.5/MT to $5,067.5/MT. Aluminium prices climbed 2.2% or $31.0/MT to $1,455.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.6136, with the AUD trading 0.50% lower against the USD from yesterday’s close, after S&P Global Ratings slashed Australia’s rating outlook to negative.

Overnight data showed that Australia’s home loan approvals fell 1.7% in February, compared to a revised rise of 3.1% in the previous month.

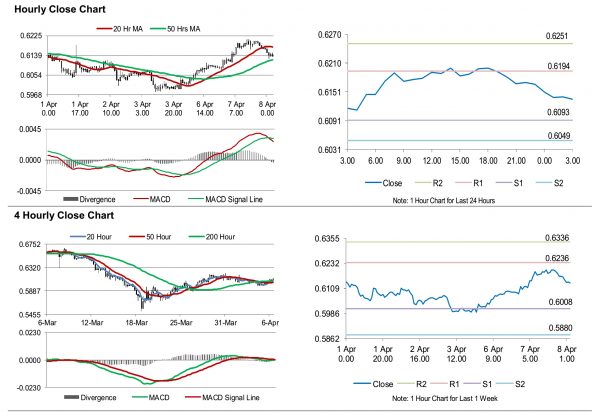

The pair is expected to find support at 0.6093, and a fall through could take it to the next support level of 0.6049. The pair is expected to find its first resistance at 0.6194, and a rise through could take it to the next resistance level of 0.6251.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.