The pandemonium in financial markets has calmed down somewhat, but that serenity seems fragile and investors will keep a close eye on how fast the virus is spreading in America, which is now entering the most painful phase. On the bright side, Europe looks close to a ‘peak’ in new cases. That said, markets will probably remain nervous until the US shows signs of stabilization too, and since that point might be weeks away, risk aversion could linger. As for events and data, the weekly US jobless claims and the OPEC+ meeting could be the most exciting.

Dollar shines despite worsening US outbreak

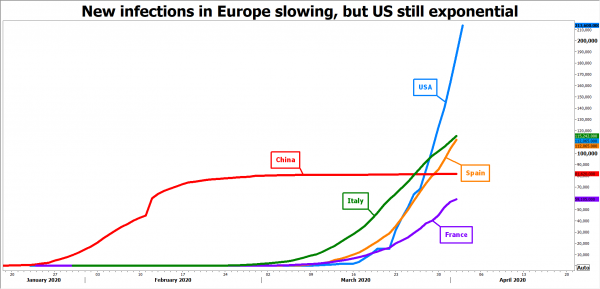

The United States has sadly become the epicentre of the global pandemic, surpassing 200,000 total infections this week, leading Vice President Pence to warn that the nation may be on a similar trajectory to virus-ravaged Italy.

The good news is that Europe is showing some early signs of improvement, with infection rates slowing down in most of the worst-hit countries, igniting hopes that the lockdowns are starting to bear fruit and that the outbreak is reaching a plateau. The bad news is that the US has adopted less draconian quarantine measures than Europe, and enacted them weeks later, so America is probably still far away from ‘peak virus’.

In financial markets, things have stabilized a little. Governments around the world have announced respectable spending packages to prevent this crisis from evolving into a depression, and central banks have likewise done everything they can to mitigate the blow, cutting rates to zero and announcing enormous QE programs. The rays of light in Europe probably helped too.

However, it remains to be seen how long this serenity will last. Most of this stimulus is now priced in, and while investors seem to be front running a rebound in the global economy, will they remain so calm in the coming weeks as economic data fall off a cliff, unemployment soars, and corporate earnings forecasts are slashed to oblivion? Not to mention the prospect of the lockdowns being extended, or defaults by companies that have seen their revenues dry up.

The answer is probably not, and for the stock market to truly bottom, traders might need to see two things: a clear timeline for when economies will be reopened and a peak in new US virus cases. We aren’t there yet, so calls of a bottom seem premature.

In the FX market, this would imply a stronger dollar, because the US currency has been acting like a haven asset amid all the chaos. In fact, the greenback has been the market’s go-to safe haven lately, gaining even when US data disappoint as fear-related buying overpowers everything else.

In this sense, the most important release next week will be the initial jobless claims on Thursday. This is the most up-to-date economic indicator right now, and another disappointing print could see the dollar climb as stocks sell off. The second most crucial release will be the University of Michigan consumer sentiment index for April, due on Thursday too, which will reveal how badly the US consumer has been hit. The minutes of the latest FOMC meeting on Wednesday and the CPI inflation numbers on Friday could be seen as outdated.

Loonie recovers with oil prices ahead of jobs data

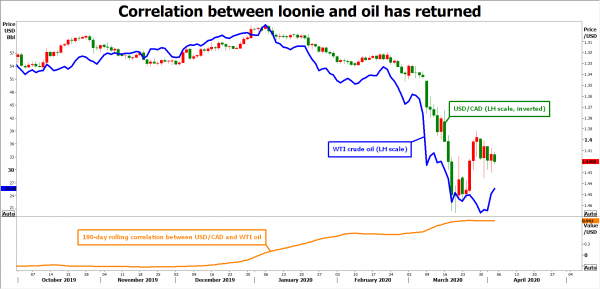

Over in Canada, the loonie has once again become a proxy for oil prices. The correlation between the two has jumped, as crude prices collapsed amid an unprecedented destruction in demand due to the lockdowns. Domestically, the Bank of Canada (BoC) slashed interest rates to near zero last week and launched its own QE programme to shield the economy, which is likely to be ravaged due to its reliance on energy exports and global trade.

With the BoC now almost out of ammunition, monetary policy is suddenly not as important for the loonie as say, oil movements. Hence, while economic data – such as the jobs data for March on Thursday – could shake the loonie, the real trend-setting driver will probably be what happens with oil prices.

In fact, these data are likely to be seen as outdated, as the survey was conducted in the second week of March, before the nation went into lockdown and before reports of soaring unemployment hit the wires.

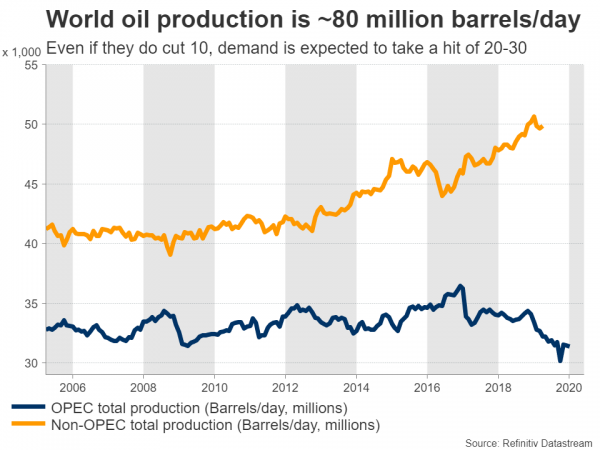

On the oil front, things are looking grim too. Even though we saw a sizeable rebound lately, after President Trump said that Saudi Arabia and Russia will cut 10-15 million barrels from their production, those gains look fragile. The Kingdom said it’s willing to cut its own production only if many countries – beyond Russia and OPEC members – also cut theirs.

Moreover, the size of the proposed cuts is extremely large. Even if everything goes smoothly with this production deal and everyone chips in, which is a big assumption, it’s still difficult to imagine any cut bigger than 5 million barrels, and that would do next to nothing to balance an oil market that is about to see 20-30 million barrels in demand wiped out. In other words, even if this deal happens, there’s a good chance markets will be disappointed by its size, which makes the latest recovery look quite vulnerable.

A virtual meeting between the major oil producers is expected on Monday.

RBA meets as aussie’s rebound falters

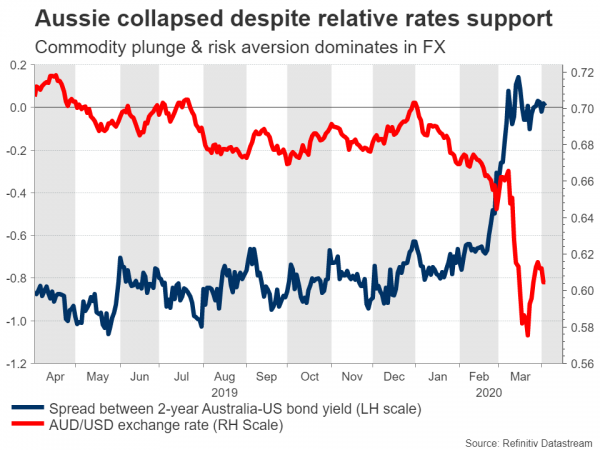

The Australian dollar staged a minor comeback in recent weeks, recovering alongside stock markets and risk appetite, and capitalizing on the retreat in the US dollar. Yet, that rebound seems to be running out of steam, and a lot will depend on what the Reserve Bank of Australia (RBA) does – or doesn’t do – at its upcoming meeting on Tuesday.

The RBA held an emergency meeting on March 18, where the central bank cut rates and launched its first ever Quantitative Easing (QE) program, to help negate the virus shock on the economy. The minutes of that meeting showed that while policymakers wholeheartedly supported these actions, they also agreed the cash rate was now at its effective lower bound, meaning they aren’t willing to cut rates into negative territory.

Hence, another rate cut is off the cards for now, and the question is whether the RBA will expand the size of its QE program, or do nothing, having acted two weeks ago.

On balance, doing nothing seems more appropriate. The RBA doesn’t have a lot of firepower left, so it may prefer to save its precious final bullets in case the situation worsens. In the markets, that could lift the aussie, but only slightly, and any upside reaction might remain short-lived in an environment characterized by risk aversion, struggling commodity prices, and collapsing global trade.

UK data and ECB minutes on the radar

Over in Europe, GDP figures for February out of the UK and the minutes of the latest ECB meeting will probably pass unnoticed, as traders instead focus on how quickly contagion rates level off.

The most important variable for the European economies right now is when they will be reopened, and that depends entirely on how quickly infection rates come down. Hence, the increase in new cases is the real metric to watch.

Finally, China’s CPI and PPI numbers for March are due on Friday, and they won’t be pretty.