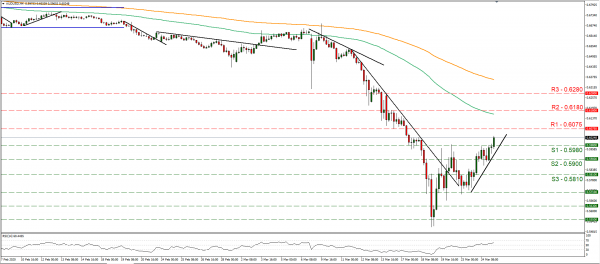

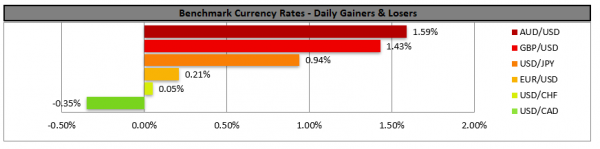

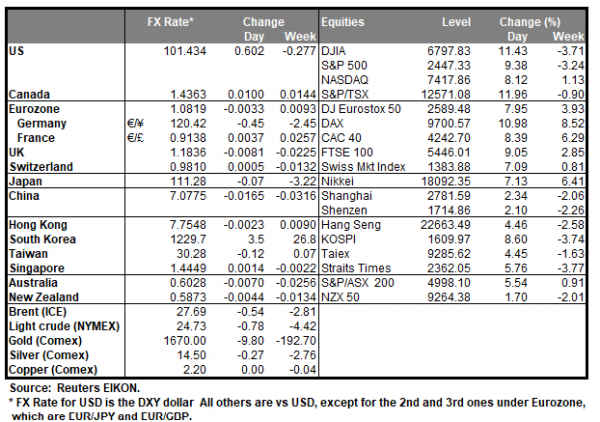

The USD eased against a number of its counterparts yesterday, with the exception of JPY and CHF as the risk sentiment seemed to improve in the markets. Nevertheless, rising coronavirus cases still tend to keep markets on edge and uncertainty at high levels. Spain recorded the sharpest rise in cases overnight as per media, while WHO stated that New York could be the next epicenter of the pandemic. It was characteristic that analysts tented to be uncertain if the current market mood is to remain in the next few sessions. After the wide monetary stimulus provided by the Fed through its unlimited QE, investors turn their attention to the US fiscal stimulus which as we mentioned seems stuck at the US Congress currently. As per Reuters, the program seems to reach 2 trillion USD, including a $500 billion for hard-hit industries, a similar amount for direct payments of up to $3,000 to millions of U.S. families, as well as $350 billion for small-business loans, $250 billion for expanded unemployment aid and $75 billion for hospitals. The package is substantial and there could be a vote today during the American session and should it be approved, such amounts could provide substantial comfort for the markets, improving further the risk sentiment and weakening the USD. However please note that UK’s inflation measures due out today could affect the pound’s direction as well. AUD/USD continued to rise yesterday and during today’s Asian session, broke the 0.5980 (S1) resistance line now turned to support. We maintain a bullish outlook for the pair as it remains above the upward trendline incepted since Monday the 23rd of the month. Should the bulls maintain control over the pair’s direction, we could see it breaking the 0.6075 (R1) resistance line and aim for the 0.6180 (R2) resistance level. Should the bears take over, we could see the pair breaking the 0.5980 (S1) line and aim for the 0.5900 (S2) support level.

GBP jumps yet uncertainty remains

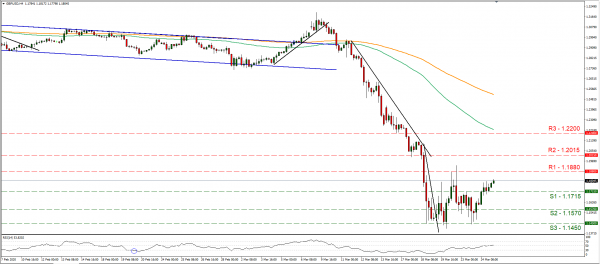

The pound jumped against the USD and JPY yesterday, yet weakened against the common currency, as the risk sentiment improved in the market. However, analysts tend to note that the outlook for the pound remains bearish as wide uncertainty about the UK economic outlook remains and at the same time tend to point a finger at UK’s substantial current account deficit. Indicative of the situation would be the wide drop of UK’s preliminary PMIs for March which hit record lows, implying a wide contraction of economic activity across the board in the UK for the current month. Such readings could imply as per analysts that the UK economy is shrinking at rate faster even than the 2008-09 financial crisis. Please note that the readings are for March and given that the UK came under lockdown only as late as yesterday, we could see the figures getting worse at their final readings and in April. Overall, we agree with the opinions above and maintain a bearish outlook for GBP, albeit currently cable could benefit from the improved risk sentiment of the markets. Cable rose yesterday breaking the 1.1715 (S1) resistance line, now turned to support. We could see the pair rising further, as an upward trendline seems to have started to form yesterday, yet more data seem to be required to confirm that tendency. Should cable’s long positions continue to be favored by the market, we could see it breaking the 1.1880 (R1) line and aim for the 1.2015 (R2) level. Should the pair come under the selling interest of the market we could see it breaking the 1.1715 (S1) line and aim for the 1.1570 (S2) level.

Other economic highlights today and early tomorrow

Today during the European session, we get Germany’s Ifo Business climate indicator for March as well as UK’s inflation rates for February and UK’s CBI distributive trades indicator for March. In the American session we get the US durable goods orders growth rates for February as well as the EIA crude oil inventory reading for past week. During tomorrow’s Asian session please note that BoJ’s summary of opinions of the bank’s emergency meeting on the 16th of March are to be released.

Support: 0.5980 (S1), 0.5900 (S2), 0.5810 (S3)

Resistance: 0.6075 (R1), 0.6180 (R2), 0.6280 (R3)

Support: 1.1715 (S1), 1.1570 (S2), 1.1450 (S3)

Resistance: 1.1880 (R1), 1.2015 (R2), 1.2200 (R3)