- US shares rally on Fed liquidity boost but futures turn negative as virus uncertainty lingers

- Trump pushes for $1 trillion stimulus as governments step up virus response

- Dollar funding squeeze eases, giving other currencies a reprieve

Stock markets unable to stop the bleeding

Stocks were on the slide again on Wednesday as yesterday’s sharp rebound on Wall Street proved unsustainable amid fears all countries affected by the coronavirus are headed for a complete and possibly prolonged lockdown. Such a scenario would have been unthinkable just a couple of weeks ago but is fast becoming the new reality, meaning economic activity around the world could soon be coming to a standstill, with devastating consequences for corporate cash flow.

Investor sentiment had brightened up slightly on Tuesday after the Federal Reserve reopened its Commercial Paper Funding Facility – a key tool used in the 2008 financial crisis to address funding shortages in credit markets. There had been hopes that these emergency loan facilities would have been included in the Fed’s stimulus announcement on Sunday but nevertheless markets initially rallied on the move. The S&P 500 and the Nasdaq Composite closed up by about 6%.

However, it wasn’t long before US stock futures turned lower and Asian and European equities have today resumed their losses, with Sydney plummeting by more than 6% at the close and London opening 3.5% lower.

Will a $1 trillion stimulus save stock markets?

Growing optimism that the fiscal package in the works in Washington could top $1 trillion also failed to soothe the pain in equity markets. Aside from providing aid to industries hard hit by the virus fallout, the package could also include a handout of $1,000 for every American over the age of 18, if Republicans get their way.

Whilst it’s possible investors are holding out until – and if – such a big stimulus gets finalized by Congress, the muted response in the markets is still quite worrying, especially as the Fed has now pretty much exhausted its crisis-era toolbox.

If the freefall in stock markets doesn’t ease up soon, we could soon be looking at the possibility of trading getting suspended indefinitely until the virus turmoil blows over. US Treasury Secretary Steven Mnuchin has so far assured that he plans to keep markets open through the crisis, though he did signal trading hours could be shortened.

Hard to keep the dollar down

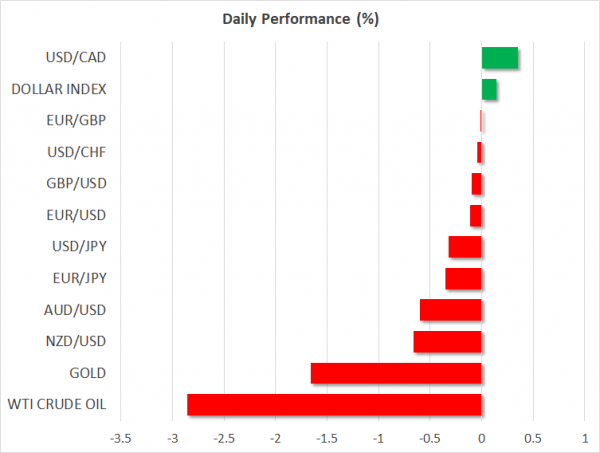

There were some signs late yesterday that the recent actions by the Fed and other central banks is alleviating the dollar liquidity squeeze, which had led to a rush in demand for the world’s reserve currency in recent days. However, the pullback didn’t last long as the greenback is on the up again as the losses in stock markets deepen.

The dollar index has hit a one-month high, with the euro and pound falling below key levels. The pound’s decline, in particular, from $1.31 just over a week ago to $1.20 now has been incredible. Not even the announcement by the UK government yesterday of a £330 billion loan package to businesses was able to arrest sterling’s slide, with cable brushing 6½-month lows below the $1.20 level today.

The Australian, Canadian and New Zealand dollars managed to start the day on a firmer footing but are now slipping again, following commodity prices lower. Copper prices have tumbled to more than 3-year lows, while WTI and Brent crude prices are close to breaching their lows from 2016.