U.S. Review

A Case in Exogenous Shocks

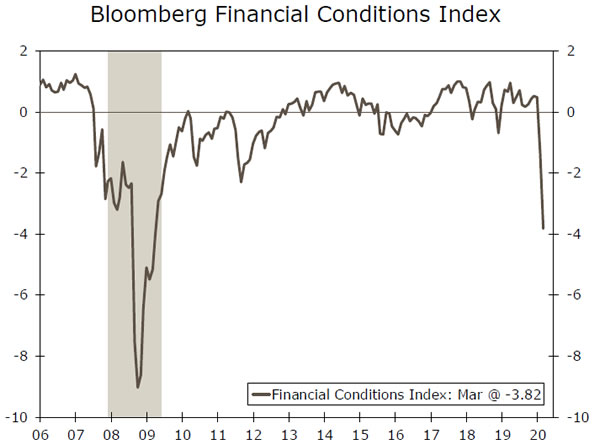

- Financial conditions tightened sharply this week as concerns over the coronavirus and the economic fallout of containment efforts mounted.

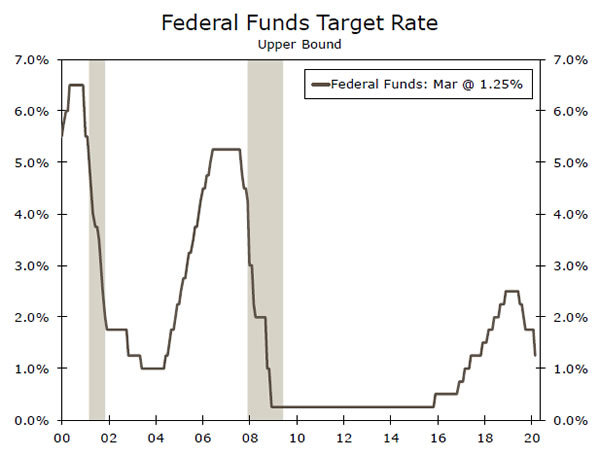

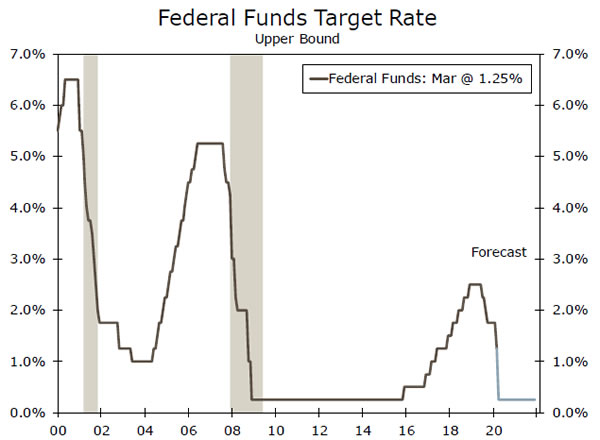

- We now look for the FOMC to cut the federal funds rate (FFR) 100 bps at next week’s meeting, which would be the largest single-meeting move on record and bring the FFR lower-bound back to zero.

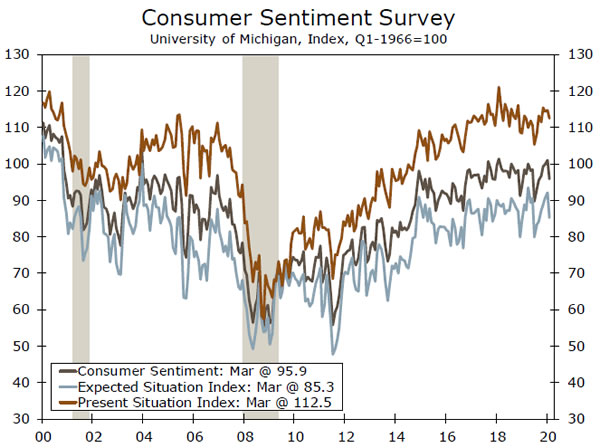

- Much of the economic data out this week does not yet cover recent weeks’ turmoil, but the University of Michigan’s preliminary Consumer Sentiment survey showed signs of consumer confidence beginning to fade.

A Case In Exogenous Shocks

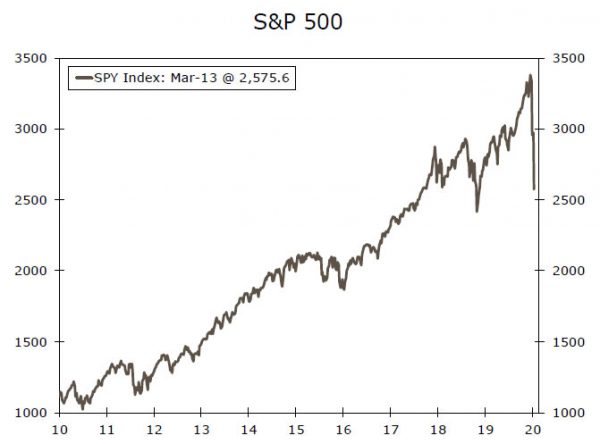

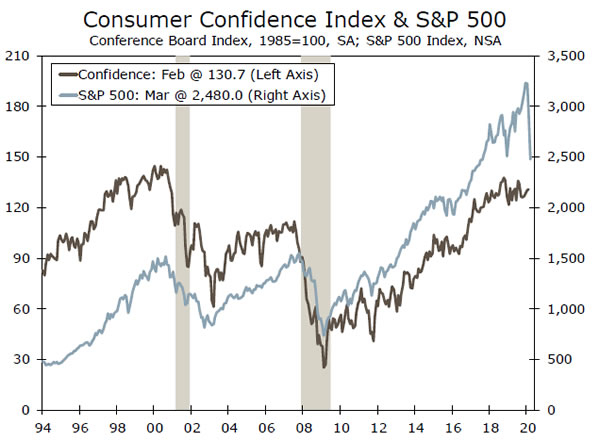

Economic data out this week took a back seat to financial market developments. Equities officially entered a bear market, with the S&P 500 index down more than 20% from its all-time high less than a month ago (top chart). The rapid descent included a 9.5% drop on Thursday alone, marking the steepest one day drop since “Black Monday” in 1987. Meanwhile, both investment grade and high yield credit spreads widened to the highest levels since early 2016 and signal investors anticipate more stress in the corporate space. Overall financial conditions are now the tightest they have been since the global financial crisis (see chart on page 1).

Driving the stress has been the rising toll of the coronavirus. New cases continue to proliferate, and more extreme measures to curtail its spread are occurring across the country. A number of companies from industries most directly impacted by the virus have reportedly started to draw on credit facilities, marking strains in activity that less-timely economic data have yet to capture. At the same time, details on any sort of fiscal policy response have been slow to come by, and any large scale fiscal stimulus is still likely weeks away from getting passed, in our view.

On Thursday, the Fed significantly stepped up its repo offerings to help calm liquidity concerns and announced its previously planned $60 billion of “reserve management” Treasury purchases would be conducted across maturities, and not just T-Bills. The Fed also looks likely to aggressively cut the fed funds rate 100 bps next week, which would bring it back to the zero lower bound (see our Interest Rate Watch on Page 6 for more detail).

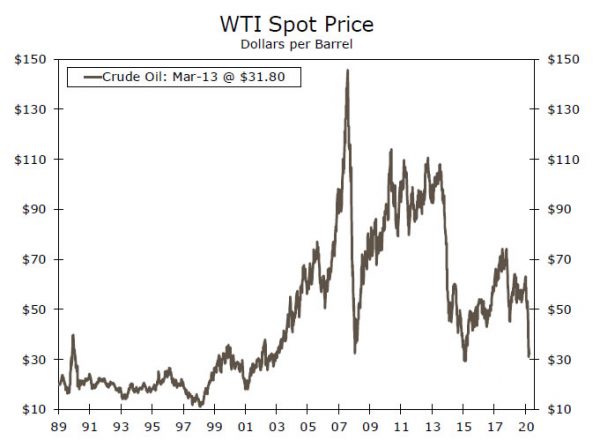

The price stability side of the Fed’s mandate gives no reason for the Fed to hesitate in undertaking such bold action. Consumer and producer price inflation eased up in February as energy prices declined. A further slowdown is in train. The downdraft in financial markets early in the week was in part triggered by a plunge in oil prices after the OPEC+ alliance unraveled and Saudi Arabia announced an increase in production despite a quickly deteriorating demand picture (middle chart). The sharp decline will drag down energy-related capex over the coming months, while the more moderate rate of inflation is unlikely to help personal spending in the near term, given that concerns over COVID-19 are keeping consumers at home.

Jobless claims through the first week of March dipped slightly and give no sign of the labor market unraveling at this point. However, with layoffs only half of the net hiring equation, we still anticipate slower payroll growth ahead as businesses start to bring on fewer new workers.

Sentiment indicators are only now beginning to overlap with the period in which the coronavirus began to clearly spread beyond China, let alone the recent financial market volatility. The preliminary March University of Michigan Consumer Sentiment Survey, which gathered responses from February 27 to March 11, shows signs of households’ confidence beginning to buckle. The index fell to 95.9 and supports our expectation that consumer spending is set to weaken dramatically in the near term.

U.S. Outlook

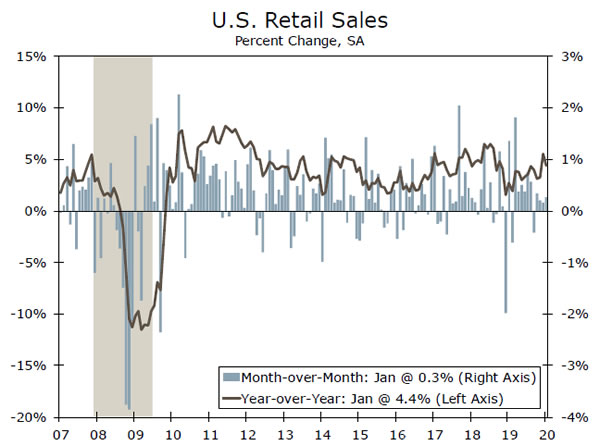

Retail Sales • Tuesday

Retails sales have been steady, if somewhat uninspiring in recent months. The 0.3% increase in January was the fourth consecutive monthly gain, and we look for another modest gain when the February numbers are released on Tuesday.

The current month has the potential to be a blowout for retail sales given anecdotal evidence of unavailable parking and long lines at grocery stores and discount warehouses. The “prepper” mentality has gone mainstream amid reports of shortages of essentials like toilet paper.

Of course, the offset here is obvious with restaurants and bars clearing out as consumers follow guidelines from the CDC to avoid unnecessary public contact and observe social distancing. In the longer run, consumer spending, particularly goods-spending is headed much lower in the months to come.

Previous: 0.3% Wells Fargo: 0.1% Consensus: 0.1% (Month-over-Month)

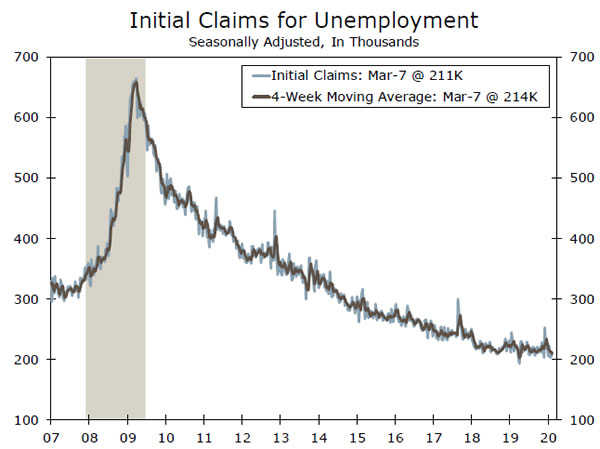

Initial Jobless Claims • Thursday

The typical lag with economic data can lead to frustration in times like these when there is a major new development that is not yet being reflected in the data. For that reason, the sometimes overlooked weekly jobless claims figures which give a more contemporaneous snapshot of labor market activity suddenly become fashionable for market watchers.

So valuable are these data as a leading indicator that the Leading Economic Index includes it as one of its variables. By the way, the LEI comes out on Thursday and may show a scant increase (our forecast is actually for no change, but the LEI data will be for the month of February, whereas the claims figures will be for the week of March 14). “One week does not a trend make,” but a sustained uptick in joblessness would obviously be a warning sign for the labor market.

Previous: 211K Consensus: 220K

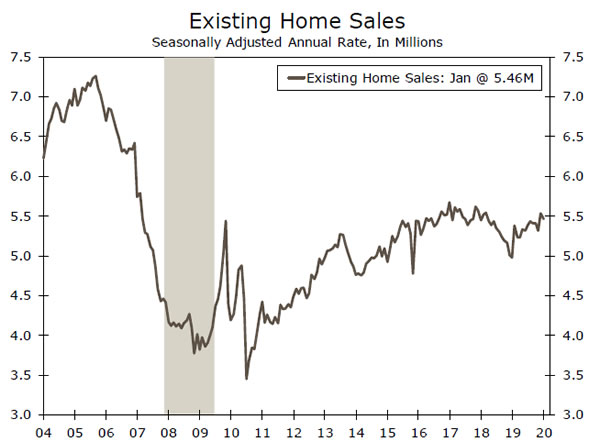

Existing Home Sales • Friday

Existing home sales fell in February, but not for a lack of would-be buyers. The problem in the existing home market is the lack of supply. The 1.42 million units of inventory for sale in January is the lowest since 1999. The trend for existing sales has been upward and the upshot of rising sales and falling inventories is that homes are selling quickly and often above the asking price.

The key question now of course is whether the interest in buying a home remains strong after the steep declines in financial markets and worries about how COVID-19 will manifest themselves in the economy. Lower mortgage rates might entice on-the-fence homebuyers to take the plunge, but despite Treasury yields having hit all-time lows in recent weeks, mortgage rates haven’t budged. That may change if the Fed rethinks its approach to purchases of mortgage-backed securities.

Previous: 5.46M Wells Fargo: 5.53M Consensus: 5.54M

Global Review

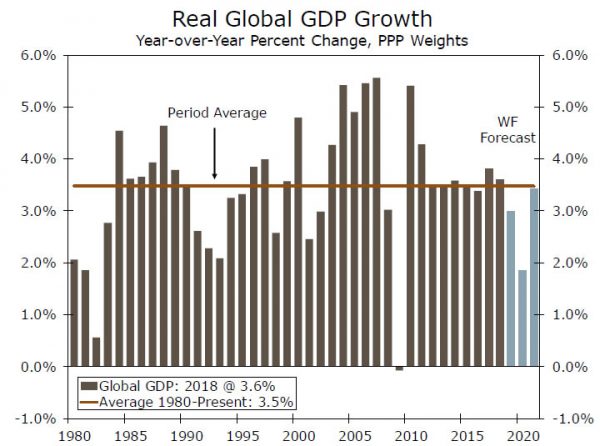

Global Economy Peering Over the Growth Cliff

- It has been another tumultuous week for global financial markets as the global outlook continues to darken quickly. Earlier this week, we cut our 2020 global GDP forecast sharply to 1.9%, though the risks to even that revised forecast are likely now tilted to the downside.

- Given the fast-changing situation, policymakers are reacting rapidly. The Bank of England surprised with an emergency rate cut this week and the U.K. government announced fiscal stimulus, while the European Central Bank eased monetary policy as well. Look for further global central bank easing in the weeks and months ahead.

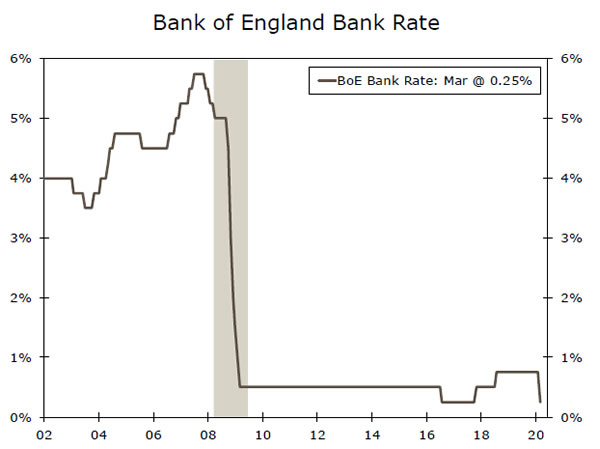

BOE Delivers Emergency Rate Cut

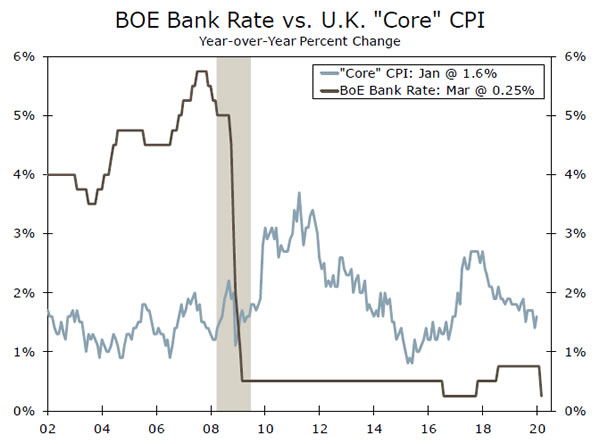

The Bank of England (BoE) sprung a significant surprise this week with an unscheduled emergency rate cut aimed at cushioning the economy against the negative effects of COVID-19, along with a range of other measures. The BoE cut its Bank Rate 50 bps to 0.25%, and announced a new Term Funding Scheme with incentives for small and medium-sized enterprises. Essentially this program provides low cost loans to banks for lending on to companies. The central bank also said it would reduce to the required countercyclical buffer for the nation’s banks. Finally, both BoE governor Carney and incoming governor Bailey said the central bank could ease further if needed, which in our view would mostly take the form of further asset purchases.

In a show of policy coordination, the U.K. government also announced a stimulative budget to support the economy. The measures included, among other things, welfare spending including more generous statutory paid sick leave, a temporary lending scheme for small businesses affected by the virus, business rates or taxes abolished for certain business sectors for 12 months, and cash grants for the smallest U.K. business. Altogether, the measures and others previously announced amount to around £30 billion (0r 1.3% of GDP) in net new stimulus this year. While these policy measures will help, they will far from fully offset the negative economic effects of the virus, and we forecast U.K. GDP growth of only 0.7% for 2020.

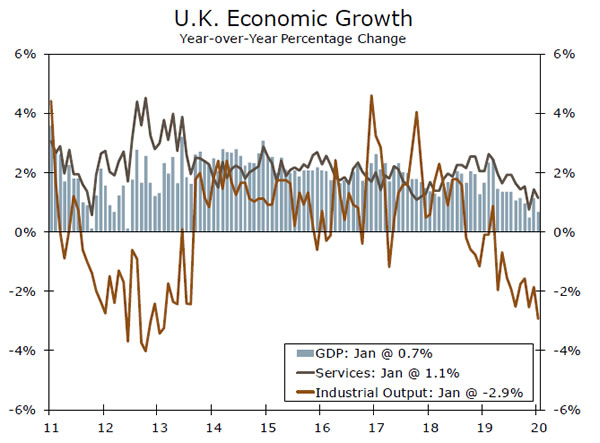

Indeed, the monetary and fiscal easing announced this week represents opportune timing, as recent data show the U.K. economy had only modest momentum at the start of 2020. GDP was flat for the month of January, with services output edging up 0.1% month-over-month, while industrial output dipped by 0.1%. On an annual basis, U.K. GDP growth slowed to just 0.7% year-over-year, near the slowest pace of growth since 2012. Overall, the slowdown in the economy appears relatively broadbased, and the monetary and fiscal policy measures announced will likely be the key elements introduced by policymakers in its efforts to avoid or limit the extent of any possible U.K. recession.

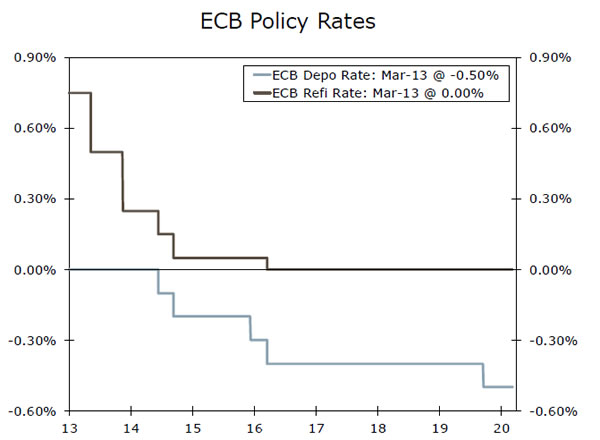

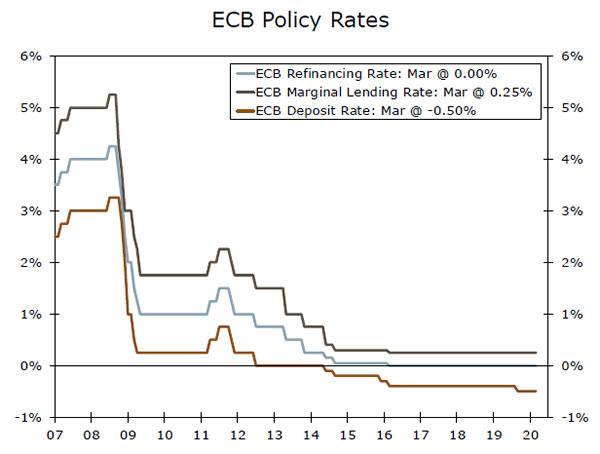

ECB Eases Monetary Policy

The European Central Bank (ECB) also eased monetary policy this week, although its moves were not as aggressive as those by the BOE. The ECB made no changes to any of its benchmark policy interest rates, but instead adjusted some of its other monetary policy levers. The central bank announced an additional €120 billion of asset purchases through until the end of 2020, with those additional purchases focused on corporate bonds. The ECB also announced a new long-term refinancing operation (LTRO) as well as improved terms and conditions for the third targeted LTRO operations from June 2020 to June 2021. The central bank also reduced capital ratio requirements due to the coronavirus.

In economic data, Eurozone January industrial output was quite solid, rising 2.3% month-over-month. However, that increase reflects pre-virus trends and the Eurozone still faces tough going. Indeed, we think a relapse in activity (both in manufacturing and services) is likely in the coming months, and we now forecast a mild recession during the first half of this year.

Global Outlook

China Retail & Industrial Data • Sunday

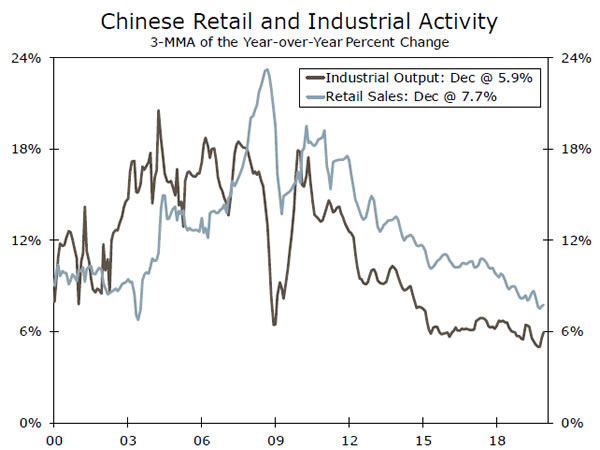

Next week sees the release of some critical economic figures, in the form of retail sales and industrial output data covering the January- February period. These figures are the most significant hard data so far in terms of providing insight into just how much economic growth might slow due to the virus.

Confidence surveys already suggest the economic damage has been severe, as the official manufacturing and service sector PMIs both fell to record lows in February. Economists also expect that damage to be reflected in the retail and industrial figures, which are both expected to show outright contraction during early 2020. January- February retail sales are expected to fall 4.0% year-over-year, while industrial output is expected to fall 3.0% during the same period. Rounding out the negative numbers, fixed asset investment is forecast to fall 2.0%. Overall, those figures would be consistent with our view of a large quarter-over-quarter decline in Q1 GDP.

Previous: Retail Sales 8.0%; Industrial Output 6.9% Consensus: -4.0%; -3.0% (Year-over-Year)

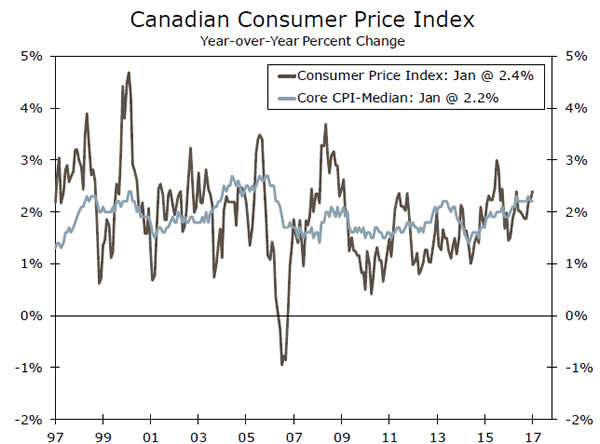

Canada CPI • Wednesday

Canada publishes its February CPI next week, a release that may be monitored for any hints the Bank of Canada may accelerate the pace of its monetary easing. Inflation trends have been for the most part “well-behaved,” with the headline CPI at 2.4% year-over-year in January, while the central bank’s core inflation measures are all close to the 2.0% inflation target.

While it might be too soon for much of the recent slump in oil prices to show through in the February report, headline inflation will clearly slow sharply in the months ahead. More indirectly, to the extent lower oil prices reinforce subdued Canadian economic growth, we would expect core CPI inflation trends to slow in the months ahead as well. The Bank of Canada already delivered a 50 bps cut in early March to its policy rate, which currently stands at 1.25%. We would not rule out another rate cut this month, especially with the Fed expected to ease policy again next week.

Previous: 2.4% (Year-over-Year)

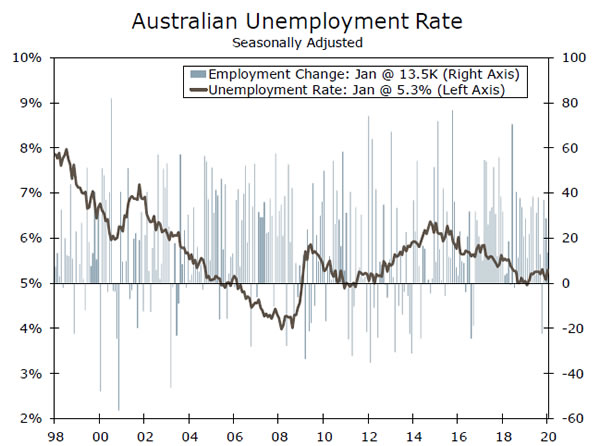

Australia Employment • Thursday

Australia’s February jobs report, which is released next week, will be watched for any insights on whether the central bank could ease policy further, following its rate cut in early March. Employment growth has been steady over the past six months, with an average gain of 17,900, while Q4 GDP also showed respectable growth. However, Australia is arguably among the economies most exposed to China, posing some downside risk to Australia’s outlook. For February, employment is expected to rise by 8,500 and the jobless rate hold steady at 5.3%. However a significant downside surprise— perhaps negative job growth—might be enough to the central bank to at least contemplate more easing later this year.

In Japan, February inflation figures are released, with the core CPI expected to slow to 0.6% year-over-year. With growth also suffering a post-tax-hike slump, there is some focus on the Bank on Japan, although no policy change is expected at next week’s meeting.

Previous: 13,500 Consensus: 8,500 (Monthly employment change)

Point of View

Interest Rate Watch

More Easing Coming, Fast

Following the Fed’s emergency 50 bps rate cut on March 3, other major central banks got into action this week. As we described in a separate report, the Bank of England (BoE) cut rates 50 bps on March 11, taking its Bank Rate back to its low of 0.25% (top chart). The BoE also announced a program that it hopes will incentivize commercial banks to lend more.

A day later, the European Central Bank (ECB) decided to keep its three main policy rates unchanged (middle chart). However, the ECB did announce further steps to incentivize banks to lend more as well as an increase in its QE operations. On Friday, the People’s Bank of China also announced steps aimed at incentivizing banks to make more loans.

The FOMC is scheduled to meet on March 18. We originally had looked for it to cut rates 50 bps at that meeting with a final 50 bps at its next meeting on April 29. However, with the economy about to swoon and with financial markets in free fall, we now expect the committee to slash rates 100 bps next week, returning the fed funds rate to the 0.00% to 0.25% target range in which it traded between December 2008 and December 2015 (bottom chart).

As we also wrote in the report that updated our fed funds call, we suspect that the committee will, at a minimum, halt the runoff of mortgage-backed securities (MBS) from its balance sheet. The FOMC may even announce outright purchases again of MBS (i.e., more quantitative easing) to reverse some of the dislocations that have occurred in the MBS market in recent days. In our view, the committee stands ready to provide liquidity to other segments of the credit markets that are showing signs of locking down. The Fed created a number of lending programs during the financial crisis to reliquefy credit markets, and the committee could potentially re-employ those tools, if needed.

That said, the Fed only has a limited ability to respond to the current crisis. Ultimately, there will need to be a fiscal policy response.

Credit Market Insights

Remember the Market on Monday?

Demand for safe-haven Treasuries increased this week as the spread of the coronavirus continued to disrupt markets, in addition to the oil price shock. Global crude oil plunged more than 30% on Monday, after the collapse of the OPEC+ alliance led to a price war among crudeproducing nations. As a result, U.S. Treasury yields declined to record lows, with the 10-year down as much as 45 bps on Monday and pushed the entire curve below 1% for the first time ever.

The meltdown spread across financial markets as oil-dependent economies such as Norway and Canada also saw markets plunge. Canadian stocks tumbled over 10% on Monday—the largest drop since the October 1987 crash—only to be topped by a 16% drop on Thursday. In Norway, the 10-year yield fell over 20 bps though it has pared some of this drop over the week. Italian bonds and stocks also tumbled at the start of the week as the Italian government issued further restrictions with millions of people now in quarantine and closed public spaces like gyms, restaurants and museums in an effort to stop the spread of the virus. That said, the spread between the closely watched Italian/German 10-year bonds spiked about 30 bps on Monday, the widest since August 2019, as demand for safehaven German bunds grew following lower oil prices. The overall market remains extremely volatile, however. In Germany, the DAX index went from up 9% to flat on the day in only a matter of hours.

Topic of the Week

When Stocks Fall and a Country Closes Its Doors

This week was one for the history books. As of this writing midday Friday we appear to be in a relief rally after the steepest one-day selloff since Black Monday in 1987. Ordinarily the economy and the markets do not necessarily move in lock-step. But in this hair-whitening environment with record drops in the stock market, consumer and business confidence often follow.

Interest Rate Watch on Page 6 spells out our latest thinking on the Fed and why we now look for the committee to slash its target range for the fed fund rate 100 bps on March 18, and to rethink its asset purchases.

We generally avoid words like “crash” in our written work, but it is an apt way to describe the 4,714 point drop in the Dow over the first four days of the week. An 18.2% drop in the span of less than a week is the sort of thing that materially impacts spending decisions in the real economy. So do mass closings of schools, events and sports leagues across the country, indeed across the world. On that basis, we need to make some changes to our economic forecast. We initially looked for a mild contraction in U.S. GDP in the second quarter with some bounce-back later this year. It looks increasingly likely that the coming contraction will be deeper than we were anticipating just a few days ago.

The airline and hotel industries are in free fall, and there will be multiplier effects from cutbacks in those industries. Moreover, banks likely will begin to tighten credit standards—credit spreads in the corporate bond market have already widened significantly—and the uncertainty that pervades the nation at present is an awful backdrop for business fixed investment spending. Businesses may be loath to displace workers right now, but layoffs will eventually commence when order book begin to dry up. We will be sending out an updated forecast that looks for a deeper contraction in U.S. GDP, as well as updates to our foreign economic forecasts, in coming days.