For the 24 hours to 23:00 GMT, the EUR declined 0.46% against the USD and closed at 1.1256.

In US, the consumer price index rose 2.3% on an annual basis in February, beating market expectations for a rise of 2.2% and compared to an advance of 2.5% in the prior month. Additionally, the MBA mortgage applications surged 55.4% on a weekly basis in the week ended 06 March 2020, compared to rise of 15.1% in the previous week. Moreover, budget deficit widened to $235.0 billion in February, less than market consensus and compared to deficit of $33.0 billion in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.1310, with the EUR trading 0.48% higher against the USD from yesterday’s close.

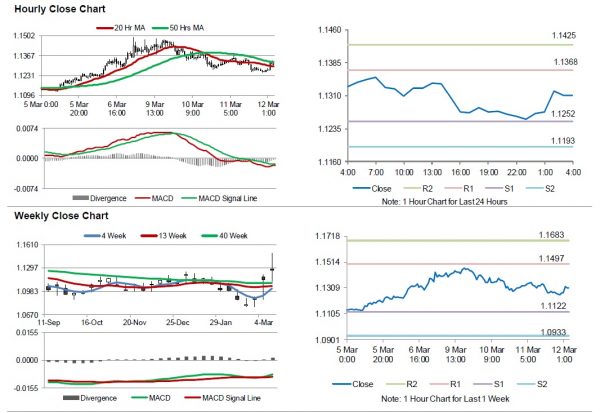

The pair is expected to find support at 1.1252, and a fall through could take it to the next support level of 1.1193. The pair is expected to find its first resistance at 1.1368, and a rise through could take it to the next resistance level of 1.1425.

Looking ahead, investor would keep a watch on Euro-zone’s industrial production for January along with the European Central Bank’s interest rate decision, slated to release in few hours. Later in the day, the US producer price index for February as well as initial jobless claims, would keep investors on their toes.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.