Focus shifts from a Chinese epidemic to a global pandemic

As February ended the focus for the COVID-19 outbreak shifted from China to the rest of the world. In particular markets shifted attention to the rapidly expanding outbreak in Italy and the early stages of an outbreak forming in the US, and the disruptions this would bring to the European and US economies. This has resulted in quite divergent moves in commodities with crude oil being the key commodity at risk as industrialised economies bunker down while base metals, iron ore and coal remain supported by supply factors and a better demand outlook. Westpac has lowered its near term low for Brent to US$30/bbl in the March quarter and lowered the year end figure to US$50/bbl from US$55/bbl (currently US$47bbl). The collapse in crude has flowed on to our LNG forecasts with a new low of US$4.1/mmbtu in the June quarter and US$5.4mmbtu by year end revised from US$8.2/mmbtu (currently US$8.47/mmbtu). We hold our year end for iron ore at US$65/t (currently around US$90/t) but lift our Qld met coal forecast to US$130/t from US$125/t (currently US$146/t). Gold stands out in a high risk environment and we have lifted the yearend target to US$1,600/oz from US$1,461/oz.

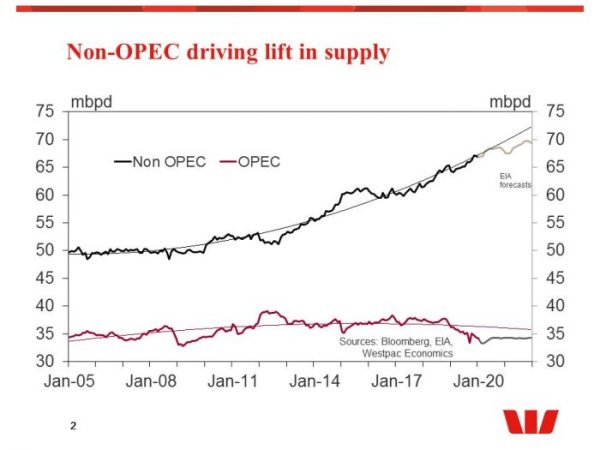

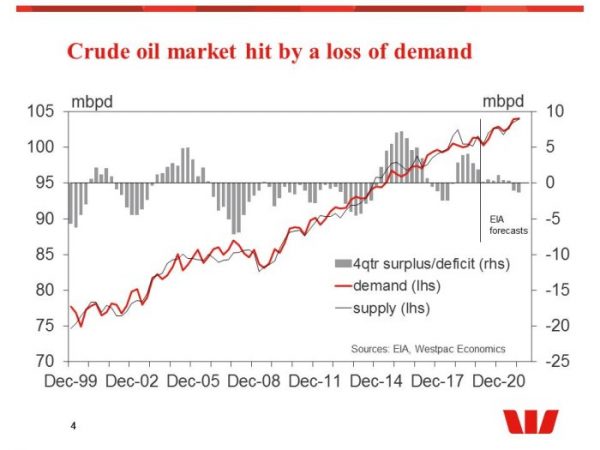

Crude hit by a significant demand shock then Russia & Saudi Arabia play hard ball

Just this week OPEC+ negotiations stalemated when Russia refused to reduce crude oil production in response to the COVID-19 driven collapse in demand. In retaliation Saudi Arabia cut its export prices, a major psychological blow for the market sending Brent tumbling to US$36/bbl. The market is now facing the spectre of unrestrained production once the current OPEC+ agreement expires in March. Given weak demand and the likelihood that this weakness will persist into the second quarter, low cost producers may be keen to raise volumes to offset low prices and maintain incomes. However, outside of Saudi Arabia it will be hard for many of them to meaningfully increase output once the production deal expires. Nevertheless, there remains a significant downside risk for prices from the lack of a production deal as even flat volumes are negative for prices in a softening demand environment. If global economic growth weakens by more than expected and crude demand contracts more sharply than expected prices could easily dip further than expected. This is why we have pencilled in a low of US$30/bbl by end Q1, with a clear risk prices could go lower still, before production cuts in the US and OPEC+ in the second half of the year, plus a modest recovery from COVID-19 disruptions in 2020 H2, lifts prices to US$50/bbl by year end.

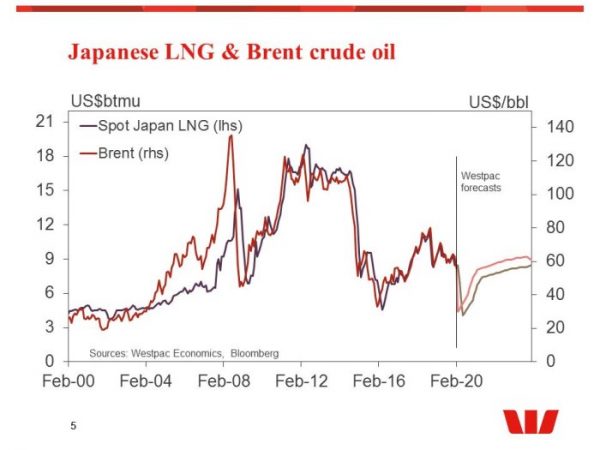

Oversupply and softer demand has seen falling LNG prices.

The dramatic drop in Chinese economic activity on top of a fragile oil market has hit hard the already a cyclically weak global LNG market. The collapse in crude oil prices, and in Chinese LNG demand, has significant implications for our LNG forecasts as this loss in demand come just as we are experiencing a significantly oversupplied market. In December China was briefly the largest importer of LNG, eclipsing Japan, highlighting the exposure to virus disruptions. We have cut our near term forecast to US$4.1/mmbtu in the June quarter due to a growing LNG glut and low US natural gas prices.

Iron ore supported by supply disruptions and better demand.

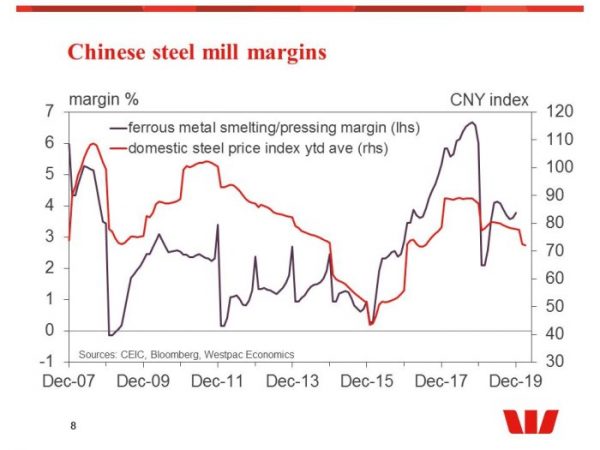

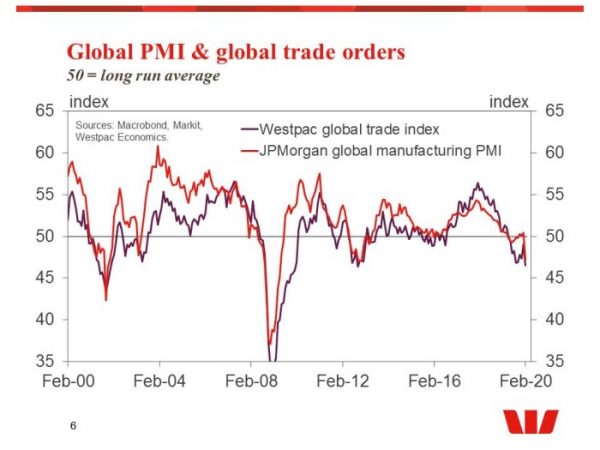

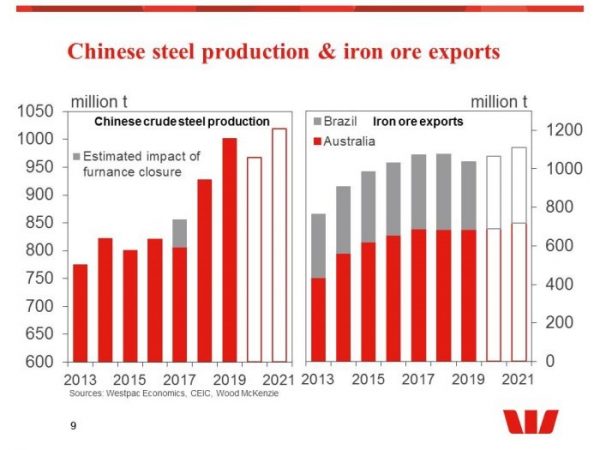

The big surprise this year is just how robust the broader commodity market has been, even with the significant weakening in global PMIs and Westpac’s Global Trade Index in February. The Chinese iron ore market appears to be in balance with prices holding around US$90/t due mostly to weather disruptions in Australian and Brazilian supply supported by robust demand from Chinese steel mills (due to shortages of scrap steel). Westpac’s monthly update on Australian bulk exports revealed that while the Western Australian ports were recovering from Tropical Cyclone Damien, iron ore volumes are down -11%mth/-10%yr in February (see Australian Feb bulk exports – supply rather than demand hit?). However, in February there was a solid rise in steel trader and mill inventories as well as declining profitability in steel mills as steel prices eased.

There is a growing risk that Chinese blast furnaces bring forward maintenance and/or curtail production resulting in weaker iron ore demand just as the seasonal lift in supply kicks in. How quickly Chinese activity returns to normal over the next few weeks (supported by various stimulus measures) will be critical. Our view has Chinese growth stalling in Q1, bouncing in Q2 before returning to a more normal pace in the second half of the year. Our forecasts incorporate a 3% fall in steel production this year and a 5% lift in 2021.

A shortage of Chinese met coal has boosted demand for imports

A shortage of Chinese met coal has boosted demand for imports

Chinese market has been experiencing a shortage in domestic supply for all types of metallurgical coal and thus demand for imported coal has been well supported. Supply shortages out of Australia and Canada further increased the tightness in supply. Between the loss of Moranbah North in Queensland, and logistics issues from cold weather and protest disruptions in Canada, the supply of seaborne met coal remained tight from mid-January through February. Over February, spot Australian premium Low Volatile HCC averaged US$155/t, up from US$151/t in January. As supplies of premium coal dwindled late in February, prices breached US$162/t on the last trading day of the month and are still holding US$161/t as we go to press. Westpac expects supply constraints to ease through Q2 and Q3, along with a return to more normal pace of Chinese growth in the second half of 2020, will see Qld Met Coal ease back to US$130/t from a current $146/t.

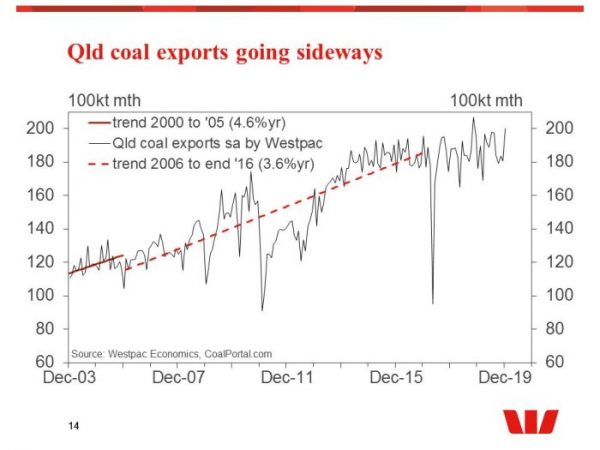

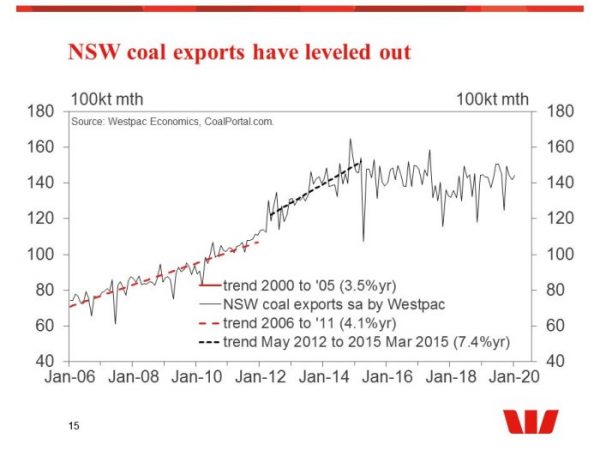

Improving logistics represent a downside risk for thermal coal.

Thermal coal has recently been supported by tight supply condition. As Westpac noted in an earlier report, coal export volumes improved modestly through the second half February though export remain soft with Newcastle exports on track for the second worst month in the last 3 years (see Australian Feb bulk exports – supply rather than demand hit?). Looking forward improving logistics and growth in stocks at key ports have resulted in downward pressure on Chinese domestic coal prices. The unfolding of this dynamic is set to pressure China’s demand for imported coal. Westpac is expecting Newcastle coal prices to hold around US$70/t in Q1 before easing to US$67/t in June then down to UJS$63/t by year end.