Pressures for the BoE to raise rates to fend runaway inflation were eased overnight, as CPI disappointed expectations and producer prices were mixed.

Whilst the numbers overall were not bad by modern standards, this marks the first slowdown since October after hitting a 4-year high in May. The key issue here is that BoE are concerned with inflation overshooting, so any signs of softness is seen by traders as less reason for them to hike or reduce balacne sheet. Despite the setback, Carney said CPI remain in line with the BoE’s projections which is expected to overshoot for some time. The debate over whether or when they may hike hinges around how far inflation overshoots and for how long it remains. After 3 members dissented at the last meeting it appeared Kristin Forbes had drummed up support in her argument that inflation was to overshoot the bank’s projections further and for longer. Yet signals from the BoE have since been mixed, with Carney seemingly shifting between hawkish and dovish between meetings.

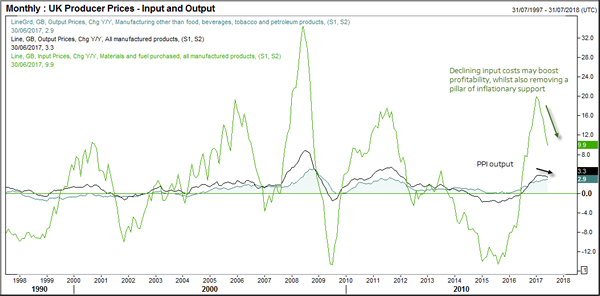

Producer prices fared better with output increasing to 2.9% YoY compared with 2.8% prior and core output MoM% beating expectations to rise 0.2% (versus 0% forecast and 0.1% prior). Broad PPI hit the consensus of 3.3% YoY, which is down from 3.6%. Input prices were mixed as they declined -0.4%, although this was above expectations and prior which sat at -1% and -0.7% respectively. Fuel purchases were the biggest drag on the reads which declined -1.5% MoM, with material purchases declining -0.2% MoM.

GBPAUD provided one of the larger moves overnight, second only to the decline of GBPCHF. We have covered GBPAUD in our recent video but we continue to believe there is more downside potential here. The same can be said for GBPCHF as this is the risk-off play around Brexit. For GBPAUD we are taking advantage of the diverging sentiment surrounding Australia and the UK, following yesterday’s RBA minutes and unfavourable coverage for the UK government in Brexit talks.

The bearish momentum following the break of the rising channel is packing up pace to suggest a similar move we saw from the 1.765 high to the 1.661 low. We have provided the 50% retracement of yesterday’s range as these can become useful areas of resistance upon a retracement. This can in turn aid with trade entry for a sell-limit or stop placement for a sell-stop order of your choosing. Yet before piece can test the 50%, we also have the monthly S1 and 14th April low to content with which provides a potential resistance zone between 1.645-1.657

Our next target area sits around the 1.62 areas which is near the monthly S2 and 30th March low. If we are now witnessing the beginning of an impulsive move, this assumes an eventual break below 1.59 and the 2016 low of 1.5790. From a fundamental perspective, what may aid this development is the growing realisation from the UK government that are not in the controlling seat whatsoever whilst inflation continues to undershoot expectations (less pressure for BoE to rise). From Australia’s perspective, if economic data continues to be okay overall whilst US data disappoints, then GBPAUD downside may move faster than expected.