For the 24 hours to 23:00 GMT, the EUR rose 0.26% against the USD and closed at 1.1427.

On the data front, Euro-zone’s Sentix investor confidence index fell to -17.1 in March, marking its lowest level since April 2013 and amid fears of a global recession. In the previous month, the index had recorded a level of 5.2 in the previous month. Separately, Germany’s trade surplus narrowed to €18.5 billion in January, less than market expectations and compared to revised surplus of €19.0 billion in the prior month. Additionally, seasonally adjusted industrial production rose 3.0% on a monthly basis in January, more than market anticipations. In the prior month, industrial production had recorded a revised drop of 2.2%. Meanwhile, seasonally adjusted current account surplus narrowed to €16.6 billion in January, more than market anticipations and compared to revised surplus of €24.8 billion in the previous month.

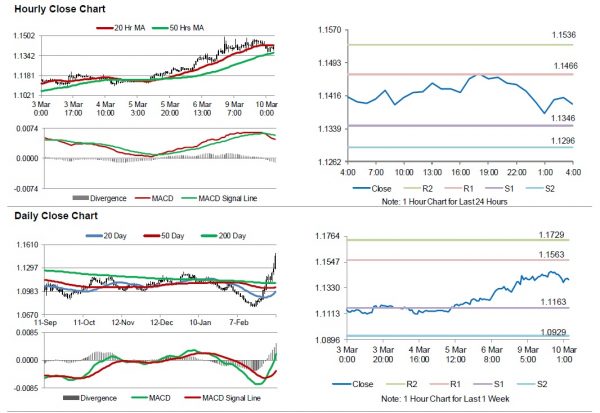

In the Asian session, at GMT0400, the pair is trading at 1.1397, with the EUR trading 0.26% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1346, and a fall through could take it to the next support level of 1.1296. The pair is expected to find its first resistance at 1.1466, and a rise through could take it to the next resistance level of 1.1536.

Looking forward, investors would keep a close watch on Euro-zone’s gross domestic product for 4Q 2019, slated to release in a few hours. Later in the day, the US NFIB business optimism index for February, would keep investors on their toes.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.