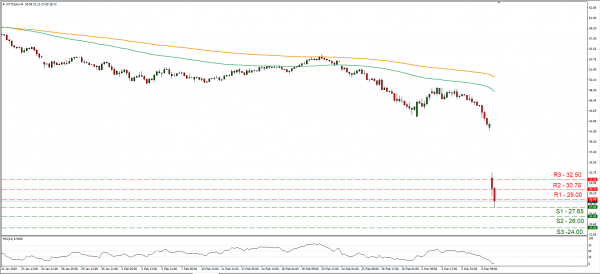

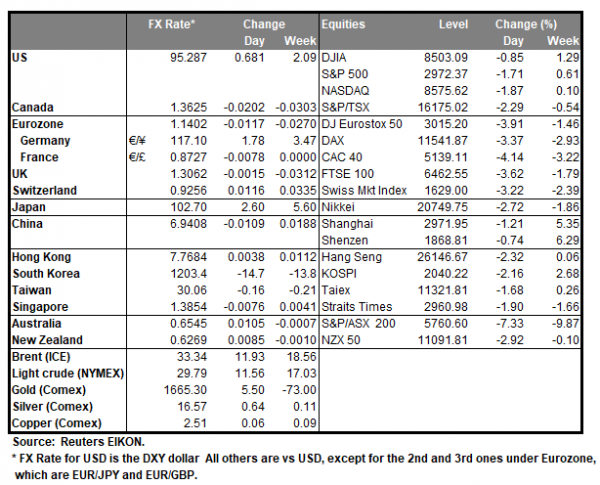

Oil prices dived into the abyss reaching levels below $30 and should low prices persist we could see the possibility of a recession strengthening along with a political crisis on a global scale and especially for producer states. Saudi Arabia stunned the markets with plans to raise its production significantly, after negotiations with Russia to cut production levels practically collapsed, causing the market to expect an abundance of supply for the commodity. The Saudis have plans to raise production above 10 million barrels per day (bpd) and analysts note that should Saudi oil giant Aramco maximize its production, production levels could reach 11 million bpd, possibly triggering a price war for oil, among producers. Should the news also be paired with an expectation for a weakening demand for the commodity, black gold’s prices could weaken further. WTI prices plunged reaching below the level of US$30, for the first time since 2016. Currently the big question is whether the commodity’s prices have bottomed out or not. The RSI indicator below our 4 hour chart confirms the bear’s dominance being well below the reading of 30, yet at the same time the stabilisation of the indicator may also imply a rather overcrowded short position. Should fundamentals continue to imply that production levels could rise even further and demand weaken, we could see oil prices weakening further. On the flip side technically speaking the prices are already at very low levels and could correct higher. We expect that some correction could be in the cards for the commodity’s prices after the initial shock, yet bearish tendencies could continue to be present for oil prices. Should the bears continue to guide oil’s prices, we could see oil’s prices breaking the 27.65 (S1) support line and aim for the 26.00 (S2) support level, if not the 24.00 (S3) support barrier. On the other hand should the bulls take over in an effort for a significant correction, we could see oil prices breaking the 29.00 (R1) resistance line and aim for the 30.75 (R2) resistance level. Should buyers persist with their bid, we could see oil prices testing if not breaking the resistance hurdle of 32.50 (R3).

JPY rallies as a beacon of safety

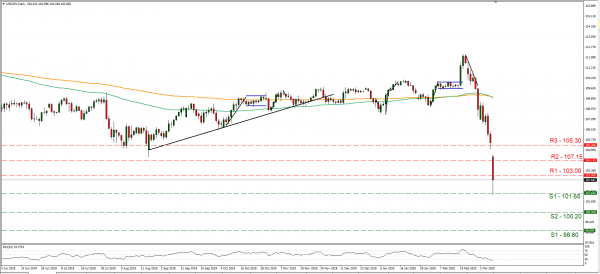

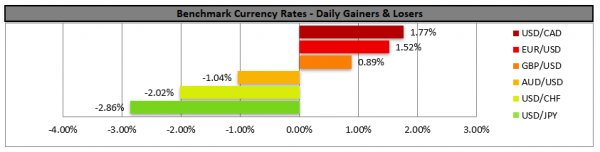

JPY rallied against the USD as a safe haven during today’s Asian session reaching a three year high as worries about the economic effect of the coronavirus strengthened market’s worries. The USD took another hit as US treasury yields weakened once again, reducing even further the attractiveness of the USD. Characteristically as China recovers the rest of the world experiences an intensification of the Coronavirus outbreak, with Italy locking down the Lombardia area along with other areas of Italy’s north, in order to prevent further spreading of the virus. Analysts expect the situation to worsen, and wide volatility to be present in stock markets as well as the FX market in the coming week. USD/JPY reached its lowest level since 2016 as the pair’s prices dropped heavily reaching below the 103.00 (R1) support line, now turned to resistance. We maintain a bearish outlook for the pair, despite some correction higher being also possible, as the pair’s RSI indicator in the 4-hour chart approaches the reading of 30. Should the pair remain under the selling interest of the market, we could see it breaking he 101.65 (S1) support line and aim for the 100.20 S2) support level. Should the pair’s long positions be favored by the market, we could see the pair breaking the 103.00 (R1) resistance line and aim for the 107.15 (R2) resistance level.

Other economic highlights today and early tomorrow

Today during the European session, we get Germany’s trade data and production growth rate for January as well as Eurozone’s Sentix index for March. In the American session, we get Canada’s number of house starts for February. In tomorrow’s Asian session we get Australia’s business confidence and China’s inflation measures both for February

As for the rest of the week

On Tuesday, we get Eurozone’s revised GDP for Q4. On Wednesday, we get Australia’s consumer confidence for March, UK’s GDP as well as UK’s budget will be released and the US inflation rates for February. On Thursday, we get Japan’s corporate goods prices for February, Eurozone’s industrial production for January, the US PPI rates for February and ECB’s interest rate decision. On Friday, we get Germany’s and France’s final HICP rate for February and from the US University of Michigan Consumer Sentiment for March.

Support: 27.65 (S1), 26.00 (S2), 24.00 (S3)

Resistance: 29.00 (R1), 30.75 (R2), 32.50 (R3)

Support: 101.65 (S1), 100.20 (S2), 98.80 (S3)

Resistance: 103.00 (R1), 107.15 (R2), 105.30 (R3)