- US data, virus bill, Biden boost lift stocks but sentiment shaky as virus continues to spread

- Dollar rebound short-lived as more rate cuts expected

- BoC follows Fed and RBA in cutting rates; are ECB and BoE next?

- Oil steady as OPEC begins meeting to discuss output cuts

Virus stimulus and US politics boost equities

Stocks in the US surged overnight as government and central bank action in response to the coronavirus outbreak, as well as a change in fortunes in Joe Biden’s campaign to become the Democratic nominee for the 2020 election boosted market sentiment.

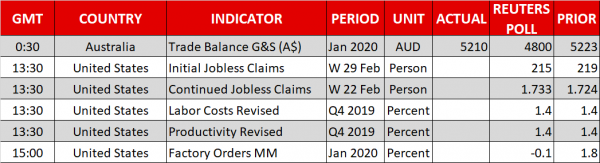

The House of Representatives in the US passed a $8.3 billion funding bill aimed at helping the country deal with the virus outbreak. It follows signals of fiscal stimulus in Japan and Australia in recent days to combat the epidemic, while on the monetary policy front, central banks in Australia, the United States and Canada have all cut interest rates this week to ease the impact of the virus on their economies.

The Dow Jones and the S&P 500 both rallied by more than 4%, recouping about half of their losses from the virus-induced sell-off. US equities were additionally buoyed by Joe Biden’s spectacular performance on Super Tuesday, who just a week ago appeared close to dropping out of the race but now stands a strong chance of winning the Democratic party’s nomination to face Trump in November’s presidential election. Before Biden’s resurgence, Bernie Sanders – a progressive and an anti-Wall Street candidate – was considered to be the front runner.

Asian stocks also posted a strong rebound today but gains in Europe were more limited as the number of cases in Italy and neighbouring countries continue to rise in worrying numbers.

Dollar struggles as rate cut expectations keep the lid on yields

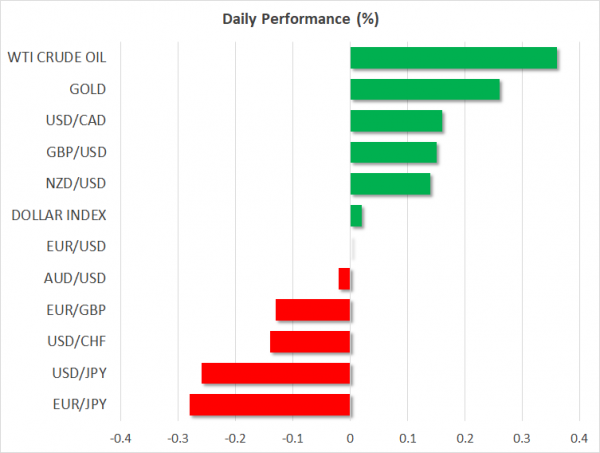

The US dollar struggled to hold onto its modest gains on Thursday as investors bet that the Federal Reserve will be forced to make more rate cuts in the coming months as the coronavirus outbreak pushes global growth to its weakest since the 2008-9 financial crisis.

The 10-year Treasury yield was barely able to hold above 1% after plunging to record lows on Tuesday. Market think there’s a good chance the Fed will follow up this week’s emergency 50-bps cut with a further 25 bps reduction at its scheduled meeting in two weeks.

The greenback pulled away from 5-month lows versus the yen yesterday after data showed the US economy entered the virus crisis in strong form. The closely watched ISM non-manufacturing PMI unexpectedly rose in February, while the ADP employment report also topped the forecasts.

However, given the Fed’s bigger ammunition compared to its peers and its willingness to provide further monetary support as the virus outbreak unfolds, the dollar is likely to remain on the backfoot for some time. Dollar/yen slipped to around 107.20, having earlier recovered to 107.73.

Bank of Canada slashes rates, will ECB and BoE follow?

The Bank of Canada became the third major central bank to ease policy this week in the face growing risks from the virus epidemic, cutting its overnight rate by a larger-than-expected 50 basis points on Wednesday. The Canadian dollar initially dropped sharply on the announcement, hitting a 9-month low of C$1.3464 before firming slightly.

The big question now is whether policymakers in Europe will follow suit. The European Central Bank is scheduled to hold its meeting in a week’s time and markets have priced a near 85% chance that the Bank will lower its deposit rate by 10 basis points. But with rates already deep in negative territory, it’s quite likely the ECB may opt for other measures to support Eurozone business.

The Bank of England’s next meeting is three weeks ago and there had been some speculation that it might join the Fed in making an emergency rate cut. However, speaking to lawmakers yesterday, incoming BoE governor, Andrew Bailey, suggested he would prefer to see more evidence of the economic damage from the coronavirus before taking action.

This lent some support to the pound, which crawled higher to re-test the $1.29 level. The euro, meanwhile, held steady around $1.1135.

Oil steady on talk of large output cut

OPEC meets today to decide by how much to restrict output as a deteriorating global growth outlook has led to sharp downgrades to oil demand. Saudi Arabia is reportedly pressuring its allies for a production cut of up to 1.5 million bpd but there are doubts as to whether Russia will approve such a large reduction. A decision isn’t expected until tomorrow when Russia and other non-OPEC countries will join the meeting.

But despite talk of a substantial cut, the lack of unity among OPEC+ countries as well as the uncertain outlook has kept oil prices on a down path. Both WTI and Brent crude were steady ahead of the meeting, trading at $46.82 and $51.16 a barrel respectively.