Global stocks bounced back yesterday as traders started hoping for a stimulus from central banks and governments. In the United States, the Dow and Nasdaq rose by 1293 and 384 points respectively. In Asia, the Nikkei and Shanghai composite rose by 12 and 40 points respectively. Market participants believe that there will be a coordinated global monetary policy easing. They also believe that stocks and the global economy will start to recover and that last week’s price action let to stocks being oversold. Additionally, in the US, they believe that Joe Biden will win most delegates in today’s 14 primaries.

The Australian dollar rose during the Asian session after the RBA delivered a surprise 25-basis points rate cut in response to the global coronavirus outbreak. Traders were expecting the bank to leave rates unchanged at 0.75%. In the statement, Andrew Lowe said that the disease is expected to delay progress in Australia towards full employment and the inflation target. He also said that the unemployment rate had increased from 5.2% to 5.3% while wage growth was subdued. He added that the outbreak had brought a significant effect on the economy, particularly in the education and travel sectors. Therefore, the bank hopes that the rate cut will help to stabilize the market.

The euro eased slightly against the USD in overnight trading as traders reflected on data from the US. Data from Markit and ISM showed that manufacturing PMI in the country dropped to 50.7 and 50.1 respectively. In February, the PMI had risen to 51.9 and 50.9 respectively. The decline is mostly because of the coronavirus disease. On a positive note, construction spending rose by 1.8% in January while manufacturing employment rose from 46.6 to 46.9. Today, we will receive the CPI data from the European Union. In February, the headline CPI and core CPI are expected to have declined by 1.0% and 1.7% respectively. The unemployment rate is expected to have remained unchanged at 7.4%.

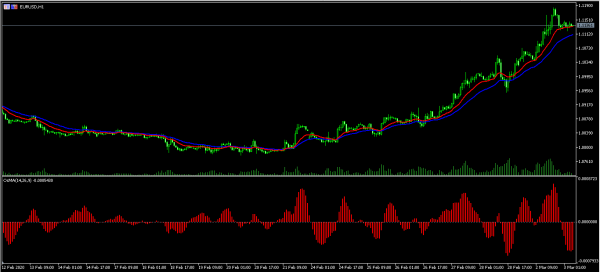

EUR/USD

The EUR/USD pair declined to a low of 1.1119 from yesterday’s high of 1.1183. The price is along the 14-day EMA and slightly above the 28-day EMA. It is also forming a head and shoulders pattern on the hourly chart. The moving average of oscillator has also declined. The pair may move lower to test the 28-day EMA level of 1.1100.

XBR/USD

The XBR/USD pair rose to an intraday high of 53.64. The pair has been soaring after hitting a bottom of 48.84 on Friday last week. The momentum indicator has continued to rise while the price is along the 38.2% Fibonacci Retracement level. The pair may continue moving upwards ahead of the OPEC meeting on Thursday and Friday.

AUS200

The AUS200 index rose to an intraday high of $6521 after the RBA slashed interest rates. The price is along the 14-day exponential moving average on the hourly chart. It is also slightly below the 28-day EMA. The signal line of the MACD has made a bullish crossover while the two lines of the Relative Vigor Index (RVI) have crossed the centreline. The index may continue rallying as optimism returns in the market.