Executive Summary

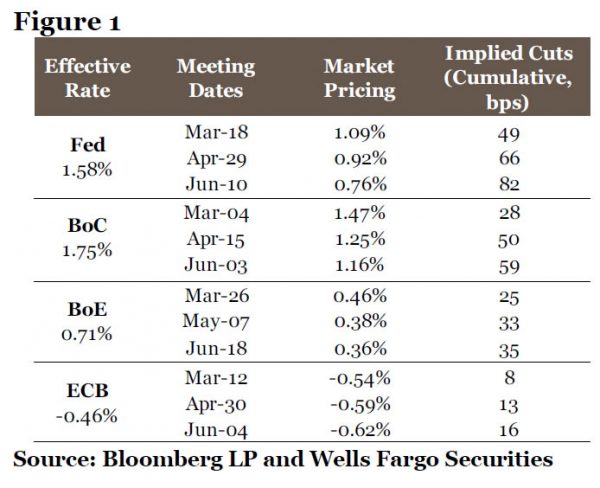

- Our U.S. Economics team now sees 100 bps of rate cuts from the Federal Reserve this year amid the coronavirus outbreak and the impact on the economy. Against this backdrop, we are also revising our global outlook substantially to reflect easing from other major central banks as well, including the ECB, BoE and BoC.

- Specifically, we now expect the BoC to cut rates 75 bps, the BoE to cut rates 50 bps and the ECB to cut rates 20 bps by Q2-2020. The timing of these moves is still extremely uncertain, but we would generally argue that these moves are more likely to happen sooner rather than later. While these central banks are unlikely to all act at precisely the same time, the likelihood that all four will cut rates within roughly a month or two of each other is in our view enough to be deemed “coordinated easing.”

Central Banks Edging Closer to Coordination

Central bankers and finance ministers from the G7 countries are scheduled to hold a conference call on March 3 at 7am EST to discuss potential responses to the coronavirus and the corresponding economic and financial market fallout. In short, it seems that fiscal and monetary authorities are ready and willing to take action as they see fit to shore up confidence in the global economy and financial markets. Our U.S. Economics team recently made substantial revisions to its Federal Reserve policy outlook, as it now sees 100 bps of rate cuts by the end of Q2-2020. In that context, we are also making substantial changes to our foreign central bank views.

Let us start with the Bank of Canada (BoC), which already has a scheduled policy announcement this coming Wednesday, March 4. The BoC’s policy rate currently stands at 1.75%, suggesting it has roughly as much policy space as the Federal Reserve, and in any case far more than nearly any other central bank in the advanced economies. BoC policymakers have yet to make any notable comments on the virus outbreak, but at their last meeting said the door was open to a rate cut if needed. In our view, that suggests the BoC may be ready to cut rates as soon as this week, especially considering interest rate markets are fully pricing a 25 bps cut for that meeting. We see little upside for the BoC in not cutting rates at this week’s meeting considering the fragility of the global economy and financial markets, and thus we expect the BoC to cut rates at this week’s meeting.

Beyond that, we expect two additional 25 bps rate cuts from the BoC between now and the end of Q2, for a cumulative 75 bps of easing over that time. One particularly key factor for the BoC is likely to be the path of global oil prices, which are already down roughly 25% year-to-date. Further demand concerns have the potential to push oil prices even lower in the short term, in our view, which will likely keep the BoC in easing mode through the rest of the first half of the year. Overall, we view the risks around this updated BoC view as reasonably balanced.

For the Bank of England (BoE), there is a bit less room to maneuver, as the policy rate currently stands at just 0.75%. That said, we would expect at least one 25 bps rate cut from the BoE, likely on or before its scheduled meeting on March 26. The G7 conference call on March 3 will of course be telling in terms of whether central banks such as the BoE will take proactive action before their scheduled meetings, but in any sense, we think one 25 bps BoE cut by the end of this month is extremely likely at this point. In addition, we are penciling in another 25 bps of easing by the end of Q2-2020, although we have slightly less confidence in this additional easing and generally view the risks as skewed toward just one 25 bps cut. There is generally a high level of uncertainty around the BoE outlook versus other central banks given March’s meeting will be the first for new BoE Governor Andrew Bailey, while we have also heard little to no comments from policymakers on how they might respond to the current environment from a monetary policy perspective.

Finally, we come to the European Central Bank (ECB), which has among the least policy space of the major central banks with a policy rate at -0.50%. Even before the virus hit, the ECB had been adamant for some time that fiscal policy needs to lead the way in terms of easing, which in our view partly reflects the fact that it has such little room to maneuver. As we wrote last week, reports have indicated Germany’s government is considering suspending the rules limiting deficit spending amid the virus outbreak, and could announce stimulus with the potential to boost annual Eurozone GDP by roughly 0.1-0.2 percentage points. However, these reports have been unconfirmed as of yet, and there will undoubtedly be much focus on Germany’s finance minister during the G7 conference call. In our view, the probability of fiscal action from Germany has only increased in recent days, and we would not be surprised to see an announcement on the order of €20 billion or more in support from Germany’s government.

Coming back to monetary policy, we think the ECB will likely cut rates at least 10 bps either in March or April. If G7 central bankers decide that an unscheduled and coordinated policy response is warranted, the ECB will likely join that effort and cut rates this month, but if central bankers instead offer a verbal pledge to support sentiment, the ECB may wait until April to take action given how limited its policy space is. We would also expect the ECB to follow that rate cut up with additional policy support, likely either an additional 10 bps cut or perhaps an acceleration in the pace of asset purchases of €5-10 billion per month. We do not have substantial conviction on which path the ECB would choose here, but lean slightly toward an additional 10 bps rate cut given the central bank is already pressing up against its issuer limits on certain sovereigns.

For the Bank of Japan (BoJ), we do not at this time feel compelled to add a rate cut or other substantial monetary policy action to our forecast. The BoJ took steps to calm financial markets over the weekend as it ramped up its purchases of ETFs and offerings of liquidity through the repo market. In our view, it will likely continue to resort to these short-term liquidity measures and other policy tweaks rather than a more fundamental easing of policy through more traditional channels such as short-term interest rate cuts or changes to its 10-year JGB target yield. That said, given the virus outbreak, as well as ongoing weakness in Japanese economic data following last year’s tax hike, we acknowledge that the risks of BoJ easing are substantially higher than they were a few months ago.