Monday July 17: Five things the markets are talking about

The markets focus this week shift away from Yellen’s testimony and disappointing U.S data to the ECB meeting (Thursday, July 21), which is expected to result in a further modest adjustment in its risk assessment.

Last week, the Fed chief seemed to hint that she was starting to second-guess whether the recent softness in inflation was just due to ‘transitory’ factors.

Friday’s disappointing U.S CPI and retail sales prints again provides the Fed a mixed picture that is likely to leave the Fed cautious, and it is little wonder markets have lowered the odds of further rate hikes this year (40% for a Dec. hike). Will it delay the start of the Fed’s balance sheet normalization as well?

The market will be looking for signs that the ECB (July 20, 07:45 am EDT) will follow the Fed and begin to curtail its stimulus. No change is expected from the Bank of Japan either early Thursday (July 19).

Elsewhere this week, in Canada, traders will be looking for strength from the consumer in May retail sales data Friday. Australia’s RBA on Tuesday will release minutes of its July 4 gathering and labor market data is due Thursday. In the U.K, round two of Brexit talks get underway in Brussels today.

1. Stocks mixed results

Fed Chair Yellen’s remarks were interpreted as evidence of continued accommodative monetary policy, and from there, global stocks have record multi-month highs.

Note: Japan was closed for a National holiday.

In Hong Kong, stocks rallied for the sixth consecutive session, closing at fresh two-year highs, with sentiment aided by robust China economic growth data (see below) and signs Chinese money inflows are accelerating. The Hang Seng index rose +0.3%, while the China Enterprises Index gained +0.5%.

In China, the Shanghai Composite Index was down -1.4% amid concerns over the implications of a weekend meeting where President Xi Jinping indicated that the PBoC would play a greater role in defending against risks.

Note: At one point the intraday losses were greater than -5%, but he loses were later reversed when Q2 GDP, June industrial production and retail sales came in strong.

Elsewhere, South Korea’s Kospi rallied +0.4%, while Australia’s S&P/ASX was down -0.2%.

In Europe, most indices have reversed earlier gains trading largely lower across the board with the exception of the FTSE 100. Earnings have been the dominant theme this morning and will be in the U.S all week.

U.S stocks are set to open in the red (-0.1%).

Indices: Stoxx50 flat at 3,527, FTSE -0.3% at 7,388, DAX -0.1% at 12,637, CAC-40 -0.1% at 5,240, IBEX-35 +0.2% at 10,677, FTSE MIB flat at 21.531, SMI %+0.2 at 9.026, S&P futures -0.1%

2. Oil higher on U.S drilling slowdown, gold little changed

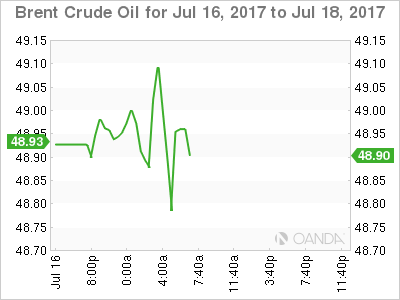

Ahead of the U.S open, oil is better bid as a slowdown in the growth of U.S rigs drilling have eased concern that surging shale supplies will undermine OPEC-led cuts.

Note: Friday’s Baker Hughes report showed that U.S drillers added two oilrigs in the week to July 14, bringing the total to 765 – rig additions over the past month averaged five, the lowest total in nine-months.

Brent crude is up +19c at +$49.10 a barrel, while U.S crude (WTI) is trading at +$46.71, up +17c.

Note: Oil prices continue to trade at half their mid-2014 level because of a persistent glut even after the OPEC, plus Russia started a supply-cutting pact seven months ago.

Also providing support is U.S crude oil inventories in the week to July 7 dropped the most in ten-months – is market rebalancing under way?

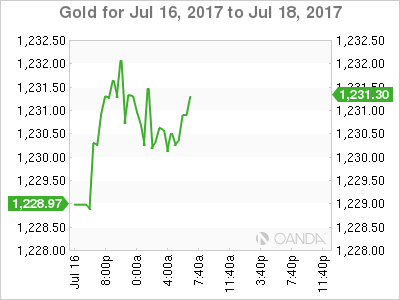

Gold prices (+0.2% to +$1,230.43 per ounce) inches up as prospects for slower U.S rate hikes weigh on the dollar.

3. Yields wait on Central Banks

What to expect from the European Central Bank (ECB) and Bank of Japan (BoJ)?

The market consensus does not believe that the ECB will provide any hints of policy tightening on Thursday.

Many believe that the ECB is still worried about the ‘mini taper tantrum’ following ECB President Draghi’s speech in late June which resulted in a sharp move in yields (Bund 10-years went from -0.25% to +0.58%) and a rapid appreciation of the EUR (€1.1186-€1.1442).

Forward guidance of its exit strategy is expected at the September policy meeting.

The Bank of Japan (BoJ) is expected to stand pat, proceeding with yield control policy.

4. Dollar nurses losses

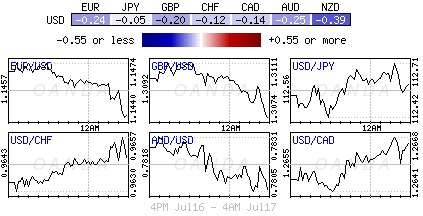

The ‘mighty’ dollar continues to flounder atop of its 10-month lows vs. G10 currency pairs as investors cheer upbeat Chinese data (see below) by piling into leveraged positions such as the AUD (A$0.7817), CAD (C$1.2662) and other high-yielding currencies.

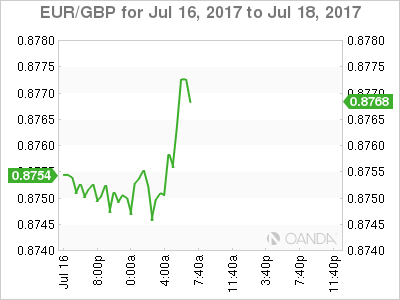

U.K’s Brexit Minister Davis is in Brussels for the first full round of Brexit talks. GBP/USD is holding below the psychological £1.31 level, down -0.3% at £1.3066. The pound had been firmer in recent sessions as U.K government was seen as being more seen flexible on immigration aspects in talks.

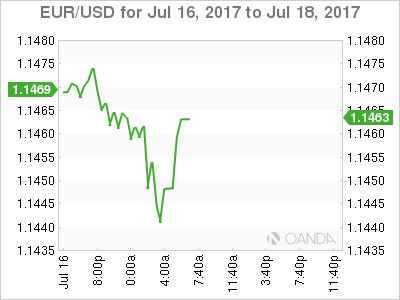

The EUR/USD is a tad lower ahead of the U.S open at €1.1450 as Euro Zone inflation data this morning (see below) keeps the argument for a steady ECB policy this week.

5. China data robust, Euro reports as expected

Data overnight saw China’s Q2 GDP topping forecasts with a rise of +6.9% on the year (vs. +6.5% 2017 target), while retail sale (+11% vs. +10.6%) and industrial output (+7.6% vs. +6.5%) were both strong.

Also China’s President Xi indicated that the PBoC would play a stronger role in defending against risks. Prudent monetary policy should be firmly implemented and the PBOC should take a stronger macro-prudential policy role.

In Europe, June’s Final CPI (+1.3%, y/y) was unrevised and below the target for the third consecutive month ahead of Thursday’s ECB meeting.