US stocks fell sharply yesterday as fears of coronavirus mounted. The Dow dropped by more than 870 points while the S&P500 and Nasdaq dropped by 97 and 255 points respectively. In total, US stocks have lost more than $1.7 trillion in value in the last two days. The same trend continued in Asia-Pacific, where the ASX and Nikkei dropped by 143 and 195 points. The main reason behind these drops is that the virus is spreading internationally. Yesterday, CDC warned that it expects the virus to also spread in the US. It urged companies to start considering remote work and for patients to start thinking of telemedicine.

The dollar index continued to soar. The index, which is trading at $99, is close to the highest level since 2017. The reason is that the US dollar is often considered a safe haven. Another reason is that coronavirus has not spread widely in the US. Also, recent data show that the economy is doing well. Just yesterday, data from the Conference Board showed that the consumer confidence rose to 130.7 from 130.4. The house price index rose from to 0.5% from 0.3%. Today, we will receive the January new home sales data. Another reason is that the price of crude oil has been falling, which is usually a positive thing for the US economy.

The price of crude oil dropped sharply yesterday as fears of coronavirus spread. The price of WTI moved below $50 a barrel while Brent dropped below $54. Earlier today, we received the weekly crude oil inventories from the American Petroleum Institute (API). The data showed that inventories rose by 1.3 million barrels. Later today, we will receive the official inventories by the EIA. Inventories are expected to rise by more than 2 million barrels. This is after rising by just 414k barrels in the previous week.

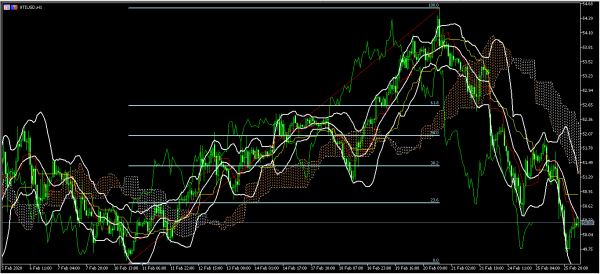

XTI/USD

The XTI/USD pair dropped to a low of 49.68. This was the lowest it has been since February 11. It is an almost 10% decline from its February high of 54.61. The price is along the middle line of the Bollinger Bands. The price is also below the Ichimoku cloud. The pair may attempt to test the important 23.6% Fibonacci Retracement level of 50.68.

EUR/USD

The EUR/USD pair declined slightly in the Asian session. The pair moved from a high of 1.0890 to the current 1.0865. The price has been rising after it bottomed at 1.0777 last week. The RSI is neutral at the current level of 50 while the signal of the MACD is above the centreline. The price may continue moving upwards.

AUS200

The AUS200 index dropped to an intraday low of $6,686. This is significantly lower from Friday’s high of $7,200. The RSI has dropped to the oversold level of 20. The price is below the 14-day and 28-day exponential moving averages. The momentum indicator has dropped to its lowest level in several months. The index may continue moving lower as global risks rise.