U.S. Highlights

- COVID-19 continues to pose challenges for China’s economy as well as global manufacturing supply chains. Factories have been slow to open as quarantines keep workers at home.

- While the situation on the ground appears to be improving, global supply chains are starting to feel the impact. Some multinationals have already warned sales would be hit in the first quarter.

- The Fed remains alert to the risks to U.S. growth posed by the virus and will act if necessary. However, it expects the shock to be temporary. On the plus side, past rate cuts are feeding through to gains in the housing sector.

Canadian Highlights

- Financial markets continued to weigh the impacts of COVID-19 this week. Risk-off sentiment prevailed, but the S&P/TSX Composite managed to eke out a modest 0.2% gain.

- Domestically, news on upcoming changes to mortgage stress testing rules are expected to reduce benchmark mortgage rates in the near-term.

- On the data front, weak manufacturing and retail sales prints reaffirmed a soft Q4. Headline CPI inflation came in slightly higher than expectations, but the core measures edged lower to 2%.

U.S. – All Eyes On COVID-19

Another busy week comes to a close, with markets hanging on to every development, rumored or not, from the COVID-19 outbreak in China. The S&P500 hit a record high on Wednesday, but promptly retreated on Thursday upon news that many multinationals (i.e. Adidas, Puma, P&G) warned that COVID-19 might impact sales in the first quarter. At the time of writing, the S&P500 stood 1% lower than where it was at the start of the week.

COVID-19 continues to depress China’s economy. Recent reports indicate that factories have been slow to open as quarantines continue to keep workers stuck in their homes. The Chinese authorities have issued guidelines to local officials to help get people back to work, but this would have to be done carefully so as not to undermine containment efforts.

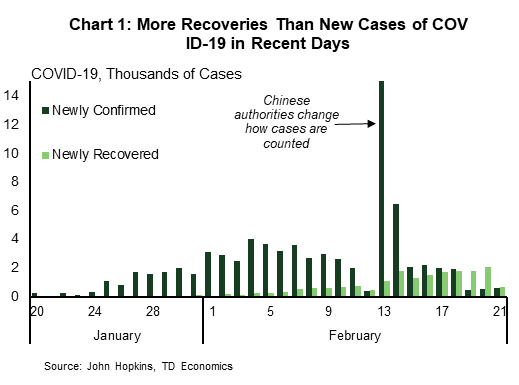

It appears that the virus is slowly being brought under control. As of now, 76,775 people have been infected with COVID-19, and 2,247 have died. The number new cases have come down significantly over the past few days, and the number of recoveries has steadily risen since the start of the month (Chart 1).

Despite the good signs, global manufacturing supply chains are beginning to feel the effects of the virus. Foxconn, Samsung, and various car manufacturers have all faced supply chain disruptions. Companies have also looked to continue production by bypassing China. Samsung, for example, has moved parts of its manufacturing process for its newest Galaxy phone from China to Vietnam. The longer China takes to contain the virus, the more likely it is that manufacturers will explore other locations.

The Federal Reserve is closely watching how the impact of COVID-19 is felt by global economies. In the first Federal Open Market Committee meeting of the year, participants saw tentative signs of stabilization in global growth, but they judged the outbreak to be a key uncertainty in their outlook. If the virus has a greater and more meaningful impact on growth, the Fed may provide more monetary support this year.

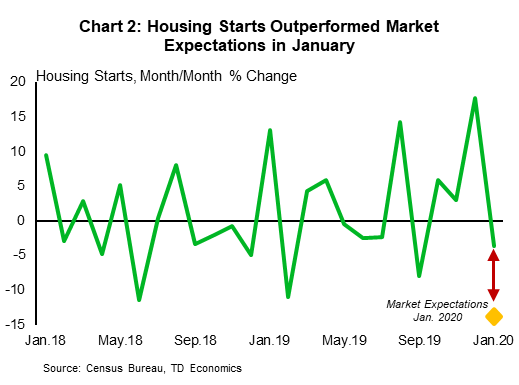

If the virus is contained, and Chinese factories are back to normal production soon, we expect the Fed to stand pat in 2020, as it watches the effects of past interest rate cuts move through the economy. Indeed, we have already seen this in the housing market, which finished 2019 on solid footing, and is showing signs of continued momentum in 2020. Although housing starts declined in January by 3.6% month-over-month, it was coming off of a strong December and it was significantly stronger than market expectations of -11.2% (Chart 2). Part of this was likely due to warmer weather, but it is also a testament to the underlying strength in the property sector.

Like housing starts, existing home sales also contracted in January, also coming off a solid December. On the other hand, permits rose strongly in January. With labor markets healthy, mortgage rates low, and a large number of millennials still to move into homeownership, we could continue to see strength in the housing market this year.

Canada – More Soft Signals

This was a relatively eventful week both globally and domestically. Financial markets continued to weigh the impacts of the coronavirus outbreak. The S&P/TSX edged up only 0.2% higher on the week. As of writing, the benchmark WTI oil price was up near 2% on the week as markets weighed supply-side risks in Libya and Venezuela against weakening demand expectations. Reflecting deteriorating risk sentiment, a further downshift in bond yields, and renewed market expectations of central bank stimulus, gold prices shot up to around US$1,640, the highest level since 2013.

In Canada, changes to stress testing rules announced by the Minister of Finance Bill Morneau made headlines. While further details are still likely to emerge, these changes are expected to modestly bring down benchmark rates in the near term. The changes may prompt modest upward revisions in home sales and price forecasts, especially amid notably tight housing markets.

Provincially, British Columbia kicked off the budget release schedule, showcasing a largely “stay the course” budget that aims to remain in the black for the next three years. The budget contained little in the way of policy changes, but highlighted a hefty capital spending package that may lift the province’s net debt to GDP ratio. All told, B.C. still maintains one of the healthiest fiscal positions in Canada.

On the economic data front, Statistics Canada released three reports this week that served to confirm the narrative of a weak Q4 and soft momentum heading into 2020. Manufacturing sales saw 0.7% headline decline and a 0.4% drop in volumes. Transitory factors have been contributing to the weakness in shipments. However, the overall trend has been unambiguously weak, and the sector suffers from an inventory overhang that will weigh on future production. On a related note, the continuation of the rail blockades for a second week will likely weigh on February’s shipments and contribute further to inventory build-ups.

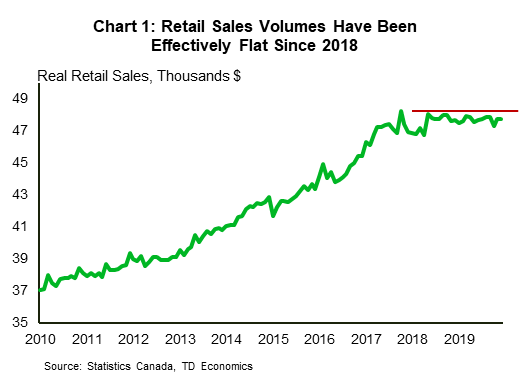

Also disappointing, nominal and real retail sales were flat in December. The sector capped off its worst performance seen since 2009, despite surging population. While e-commerce sales were up an impressive 31.5% y/y, this category still represents a relatively small share of overall retail trade.

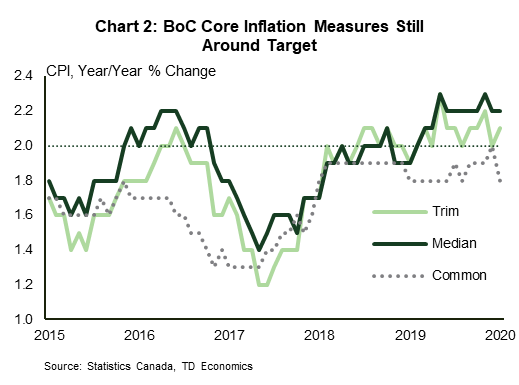

Finally, headline CPI inflation came in at 2.4%, slightly higher than expectations. A a range of transitory factors (e.g. oil prices) have driven the headline higher. The Bank of Canada’s core measures edged lower in January to average 2.0%. With lackluster economic growth in Q4 and soft momentum heading into 2020, a widening output gap may put downward pressure on prices in the months ahead.

These weak signals are unlikely to go by unnoticed to the Bank of Canada, which has turned more dovish in its recent communications. Indeed, the central bank has been paying close attention to consumer spending, which has remained lackluster. Financial stability concerns and well-anchored inflation were reasons the central bank remained on hold last year, but with downside risks building we still expect a rate cut in the second quarter of this year.

U.S: Upcoming Key Economic Releases

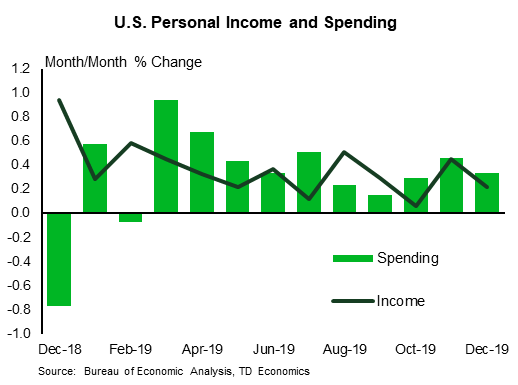

U.S. Personal Income & Spending- January

Release Date: February 28th, 2020

Previous: Spending 0.1% m/m; income: 0.2%

TD Forecast: Spending 0.1% m/m; income: 0.5%

Consensus: Spending 0.1% m/m; income: 0.3%

CPI and PPI data point to an above-trend 0.3% m/m rise in the core PCE index; we estimate 0.28% before rounding. The y/y change likely rose to 1.8% from 1.6%, due in part to base effects, with more risk of 1.9% than 1.7%. (Core prices rose just 0.04% m/m in January 2019.) Even so, the pace remains below the 2.0-2.5% range that Fed officials appear to be aiming for “for a time.” We’re also looking for fairly solid increases in personal income and spending at 0.5% and 0.4% m/m, respectively. The gain in income should reflect the COLA adjustment as well as a rise in federal government pay, while spending was likely led by the auto and food segments.

Canada: Upcoming Key Economic Releases

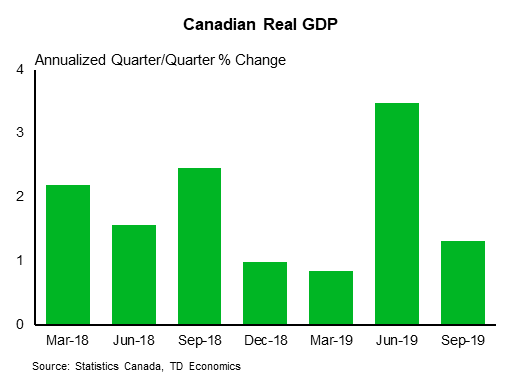

Canadian Real GDP- Q4 & December

Release Date: February 28th, 2020

Previous: 0.1%

TD Forecast: 0.1%

Consensus: 0.1%

The Canadian economy likely came to a standstill in the fourth quarter, with our final growth tracking 0.0% (q/q, annualized). Weakness appears widespread. Consumer spending, which has been soft throughout the year, looks to have slowed further in Q4, with durable spending likely contracting (led by a pullback in auto sales). Fixed investment – both residential and non – probably grew, but at a slower pace than in the double-digit growth recorded in the previous quarter. Inventories, meanwhile, likely subtracted from growth once again, marking the third quarter in a row. Finally, both exports and imports look to have pulled back in the quarter, but with exports falling more, net-trade will once again pull down the headline.

Turning to the monthly figures TD looks for industry-level GDP to increase by 0.1% in December on a relatively strong showing from the services sector. The transport sector should see a tailwind with the resolution of the CN Rail strike on November 27th, while the real estate sector is also forecast to provide a modest lift to overall activity. The picture is murkier on the goods side of the economy however: real manufacturing shipments fell by 0.4% in December, and the utilities sector could have an outsized drag on activity following a period of unusually mild weather.