The Canadian economy continues to be buffeted by a growing list of ‘transitory’ factors – the latest being the threat to global growth from the COVID-19 breakout in China and ongoing domestic rail disruptions. The week ahead includes the admittedly rear-view release of Canadian GDP growth for the fourth quarter of last year, and data available to-date suggest little if any growth in the quarter. Housing activity looks like it continued to pick up, but consumer spending probably increased only modestly and business investment is expected to tick lower.

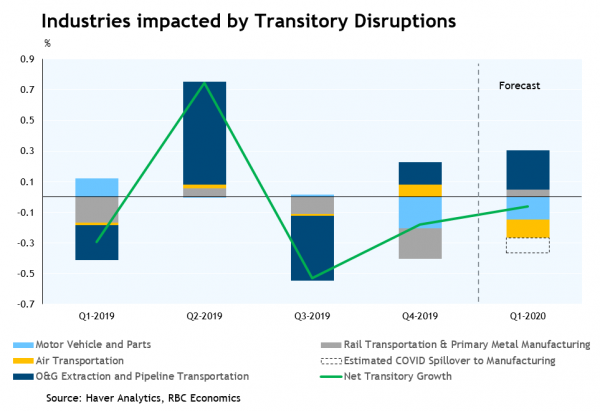

Temporary disruptions were also distorting growth late last year – the CN rail strike and keystone pipeline shutdown in November, and earlier spill-overs to Canadian manufacturing from a major US auto sector. But, by our count, those events added up to about half a percentage point drag on headline Q4 GDP growth, leaving the underlying increase excluding those factors still at less than a percentage point. It is that slowing as much as temporary growth disruptions that is probably concerning monetary policymakers at the Bank of Canada and has markets pricing in a 25 basis point interest rate cut by the summer. Monthly GDP in December (released alongside the Q4 numbers) should actually look a little better, supported by a rebound in transportation industries from November declines and a pickup in oil sands output. But growth early in 2020 will nonetheless likely be soft again as the latest transitory disruptions take their toll. We are currently tracking just a 1.2% increase in Q1 GDP growth after the soft outcome we expect in Q4.

To be sure, not all economic growth data has been bad. We should expect slower GDP growth at this point in the economic cycle when low unemployment limits available labour supply. And labour markets have still looked strong early in 2020 with wages continuing to grow at a solid pace. Consumer confidence has remained resilient and household debt growth has begun to reaccelerate as housing markets in much of the country have heated up. Statistics Canada will also release a key annual survey of business investment intentions over the week ahead. That should help gauge how confident businesses were feeling late last year, before the latest disruptions to economic growth but also prior to the US-China phase 1 deal. We expect economic data out the United States will remain, by and large, positive over the next week. But we still think that slower underlying growth trends in Canada will more likely than not push the BoC to cut the overnight rate by 25 basis points in the second quarter of this year.