The US dollar moved up slightly in overnight trading. This is as traders reflected on strong manufacturing data from the Philadelphia Fed. The data showed that the index rose to 36.7 in February. This was higher than the expected 12 and was the highest level since May 2017. Business conditions improved from 38.4 in January to 45.4 this month. New orders rose from 18.2 to 33.6. These numbers show that the US economy is relatively strong, even as the Covid-19 illness spread in Asia. Meanwhile, initial jobless claims rose by 210k while the continuing jobless claims rose to 1,726k. We will receive the January existing home sales data today. We will also receive the flash manufacturing PMI data.

The Japanese yen declined again today as traders reacted to weak inflation data from the country. The national CPI declined from an annualized rate of 0.8% to 0.7%. The core CPI, which excludes volatile food and energy products increased from 0.7% to 0.8%. Worse, the flash manufacturing PMI flashed red signs about the economy. It dropped from 48.8 to 47.6. Data released this week has shown the dire situation the Japanese economy is in. In the fourth quarter, the economy contracted by 1.6%. Machinery orders also declined in December. The danger is that it appears that the stimulus package started by the government is not working. With rates at historic lows, there is little the BOJ can do to stimulate growth.

Today, we will continue to focus on the covid-19 illness. The disease appears to be spreading in South Korea, with 52 new cases reported. In total, the disease has killed more than 2,200 people and infected more than 75k people. As a result, IATA has warned that airlines in the Asia-Pacific region could lose more than $27.8 billion. We will also receive inflation data from the European Union. The headline CPI is expected to remain unchanged at 1.4% while core CPI is expected to remain at 1.1%. We will also receive flash PMI data from the European Union.

EUR/USD

The EUR/USD pair was little changed in overnight trading. It is trading at 1.0790, which is close to this week’s low of 1.0777. The average true range has fallen, which is a sign of low volatility. Similarly, the fore index is along the centreline. Also, the price is along the short and medium-term moving averages. This implies that the pair may break out in either direction.

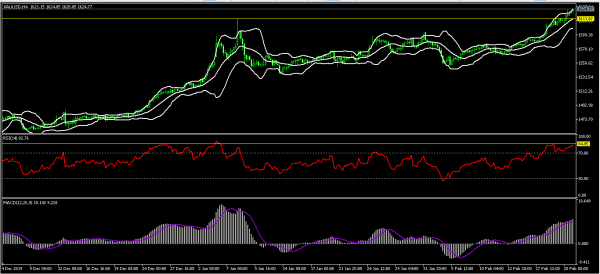

XAU/USD

The XAU/USD pair rose to a high of 1624.50. This is the highest it has been since 2012. The price is above all the short, medium, and long-term moving averages on the four-hour chart. It is also along the upper line of the Bollinger Bands. The RSI has risen to 82, which is the highest level since January this year. The signal and histogram of the MACD have continued to rise. The pair may continue moving higher on rising global risks.

USD/JPY

The USD/JPY pair rose to an intraday high of 112.22. This is the highest it has been since April last year. The price is above the 14-day and 28-day exponential moving averages on the four-hour chart. The RSI is the highest it has been in more than a year. The signal and histogram of the MACD have continued to rise. The pair may continue rising, although a pullback is still possible.