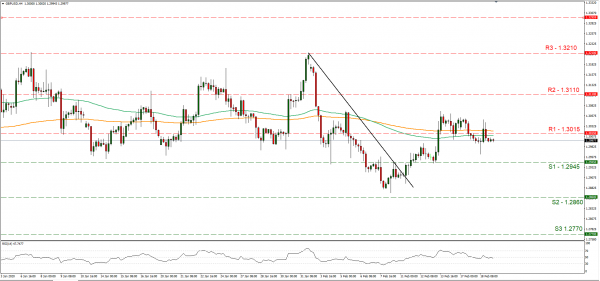

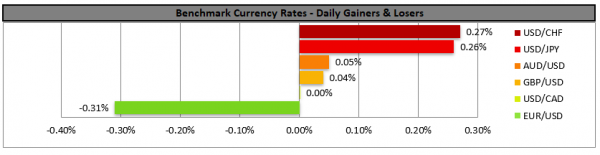

The pound was supported against the USD, yesterday as UK’s finance minister confirmed that he would deliver the budget as planed on the 11th of March. Mr. Sunak’s (new UK finance minister) comments eased any worries for a possible delay in the delivering the budget after a replacement of UK’s finance minister last week. The news practically boosted the market’s confidence about a possible widening of the UK Government’s fiscal spending supporting the sterling. Also, the announcement helped the pound after UK’s employment readings sent mixed messages, as the average earnings growth rate slowed more than expected, while on the other hand the employment change figure dropped yet remained above market expectations. The pound later relented any gains made against the USD and pound traders seem to be zooming in UK’s CPI rates due out today. Cable temporarily broke the 1.3015 (R1) resistance line yesterday, yet later relented any gains made and continued to hover below it. We maintain a bias for a sideways motion for the pair yet once again today’s financial and monetary releases could affect the pair’s direction. On a technical basis we have to mention that we recalibrated the support and resistance lines in order to bring them closer to the actual price action of the pair. Should the pair come under the selling interest of the market, we could see it breaking the 1.2945 (S1) support line and aim for lower grounds. On the flip side should the cable’s long positions be favoured by the market, we could see the pair breaking the 1.3015 (R1) resistance line and aim for the 1.3110.

EUR continues to slip on weak investor sentiment

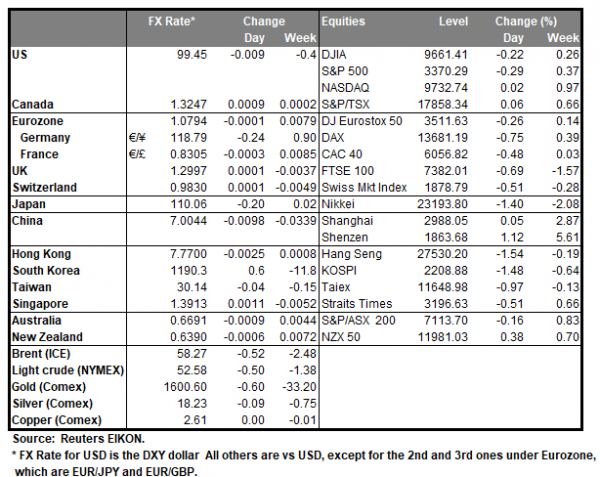

The common currency continued to slip against the USD as a continuance of last week, with investors losing confidence in the area’s growth prospects. Characteristically confidence for the Eurozone’s prospects over the next six months dropped more than expected for February as released yesterday by ZEW. More worrisome is the fact that the trading bloc’s powerhouse Germany scored even worse. On the other hand, the USD seems to continue to shine yet analysts are underscoring that trader’s preference for the USD may be also dictated by the . USD’s direction today, could be influenced by the release of the minutes of FOMC’s last meeting when the bank seemed quite content with the US economy. EUR/USD continued to drop yesterday, clearly breaking the 1.0830 (R1) resistance line. We maintain a bearish outlook for the pair, as long as the downward trendline incepted since the beginning of the month. It would be indicative that the RSI indicator, below our 4 hour chart remains steadily near the reading of 30, indirectly confirming the bear’s dominance. Should the bears maintain control over the pair’s direction we could see it breaking the 1.0770 (S1) support line and aim for the 1.0700 (S2) support level. Should the bulls take over on the other hand, we could see it breaking the 1.0830 (R1) resistance line and aim for the 1.0885 (R2) resistance level.

Other economic highlights today and early tomorrow

Today during the European session, we get Sweden’s and UK’s inflation rates for January, while later on we get from Turkey, CBRT’s interest rate decision. In the American session, we get from the US the PPI rate for January, Canada’s inflation rates also for January and just before the Asian session starts the API weekly crude oil inventories figure. During tomorrow’s Asian session, Australia’s employment data for January are due out. As for speakers, Atlanta Fed President Bostic, Cleveland Fed President Mester, Minneapolis Fed President Kashkari, Dallas Fed President Kaplan and Richmond Fed President Barkin are scheduled to speak. Also don’t forget the release of FOMC’s meeting minutes during the American session today.

Support: 1.2945 (S1),1.2860 (S2), 1.2770 (S3)

Resistance: 1.3015 (R1), 1.3110 (R2), 1.3210 (R3)

Support: 1.0770 (S1), 1.0700 (S2), 1.0630 (S3)

Resistance: 1.0830 (R1), 1.0885 (R2), 1.0940 (R3)