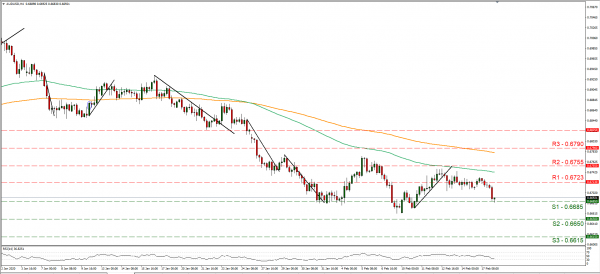

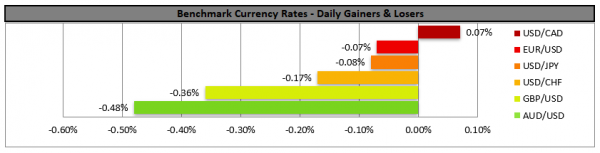

The Aussie slipped early during the Asian session against the US, as the release of the minutes of RBA’s meeting revived the prospect of a possible rate cut. The minutes showed that the bank had discussed the case for easing yet chose to maintain the current level as it is allready quite low. However, it should be noted that the bank also remains prepared to ease policy further if needed and there was the opinion that a further cut could speed up the process for the bank to reach its targets regarding inflation and employment. At the same time the bank also seems to weigh the possible negative risks of even lower rates, while at the same time monitors closely the labour market. Please bear in mind that the market seems to be pricing in a possible rate cut by the bank as early as July of the current year. It should be noted that the bank also highlighted the ongoing risk deriving from the novel coronavirus for the Australian economy. Gauging market sentiment about the coronavirus, albeit the Chinese government’s recent efforts to address the risks related to the virus, the announcement by Apple that it would miss its Q1 revenue targets seems to have shook the markets somewhat. We expect the AUD to be more data driven in the next few days as employment data are due out, yet also to keep an eye out for Coronavirus developments. AUD/USD dropped testing the 0.6685 (S1) support line. We could see the pair correcting somewhat, yet we maintain a bearish outlook for the pair. Should the pair come under the selling interest of the market, we could see it breaking the 0.6685 (S1) support line and aim for the 0.6650 (S2) support level. On the flip side, should the pair’s long positions be favoured by the market, we could see it breaking the 0.6723 (R1) resistance line and aim for higher grounds.

GBP slips ahead of string of financial releases

The pound lost some ground against the USD yesterday as the initial euphoria caused by the replacement of UK’s finance minister starts to fade away. The pound enjoyed a great last week as expectations about a higher fiscal stimulus were building up among investors. It should be noted that the new finance minister Sunak seems ready to loosen the fiscal rules for the UK and deliver on such expectations. However, the next few days are expected to be a reality check for the GBP as a string of financial data for the UK are due out. On a different note, UK’s Brexit negotiator Frost, stated that the UK must have the ability to set laws that suit the UK, creating some worries about the oncoming negotiations. We expect the pound to be data driven until Friday, yet also the oncoming negotiations with the EU, could also affect its direction. Cable slipped yesterday breaking just below the 1.3015 (R1) support line, now turned to resistance. We maintain a bearish outlook for the pair, yet today’s financial releases could affect the pair’s direction. Should the bears be in charge of the pair’s direction, we could see it aiming for the 1.2820 (S1) support line. If the bulls take over, we could see cable breaking the 1.3015 (R1) resistance line and aim for the 1.3170 (R2) resistance level.

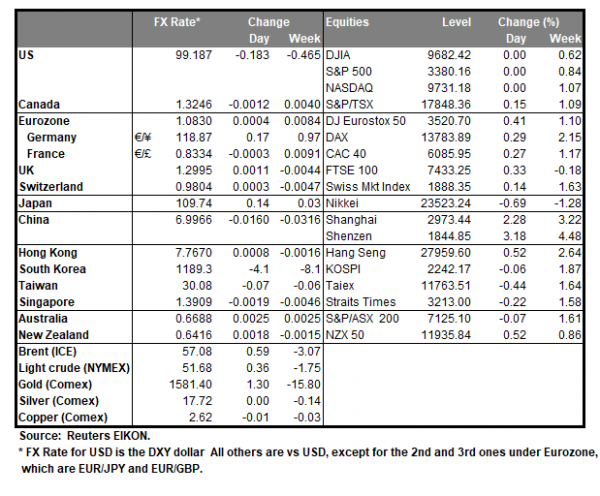

Other economic highlights today and early tomorrow

Today during the European session, we get UK’s employment data for December, Germany’s ZEW economic sentiment for February, and New Zealand’s milk auctions figures. In the American session, we get from the US the NY Fed Manufacturing Index and Canada’s manufacturing sales growth rate for December. During tomorrow’s Asian session, we get from Japan the machinery orders growth rate for December and the trade data for January, while from Australia we get the Wages Price index for Q4. As for speakers Riksbank’s Governor Stefan Ingves and Minneapolis Fed President Kashkari speak.

Support: 0.6685 (S1), 0.6650 (S2), 0.6615 (S3)

Resistance: 0.6723 (R1), 0.6755 (R2), 0.6790 (R3)

Support: 1.2820 (S1), 1.2600 (S2), 1.2385 (S3)

Resistance: 1.3015 (R1), 1.3170 (R2), 1.3340 (R3)