The sterling rose after Sajid Javid resigned abruptly as UK chancellor. He had served for eight months. Media reports say that he resigned after losing a power struggle with Dominic Cummings. Cummings is the chief economic advisor to Boris Johnson. He was immediately replaced by Rishi Sunak. His resignation means that the budget could be delayed as the new minister reviews the one Javid had prepared. This news came a few hours after RICS reported the house price balance for January. The balance rose by 17%. It was the first time it was positive since September 2018.

Asia-Pacific stocks were mixed as the market continued to focus on coronavirus. In Japan, the Nikkei dropped by 123 points while in Australia the ASX rose by 30 points. In China, the Shanghai and China A50 rose by 15 and 87 points respectively. The market is hoping that the Chinese government will add more stimulus to the economy. This is after the previous $22 billion stimulus package that was announced earlier this month. The number of coronavirus cases have continued to rise. The disease has infected more than 60k people and killed more than 1,400 people.

Later today, the market will receive crucial economic data from Europe. Germany will release the preliminary quarterly GDP data. Economists surveyed by Reuters predict that the economy grew by 0.1% in the quarter. They expect that the economy rose by 0.2% in 2019. We will also receive inflation numbers from Spain and the overall GDP growth from the European Union. From the United States, we await the retail sales data and the export and import price index. We will also receive the industrial production data.

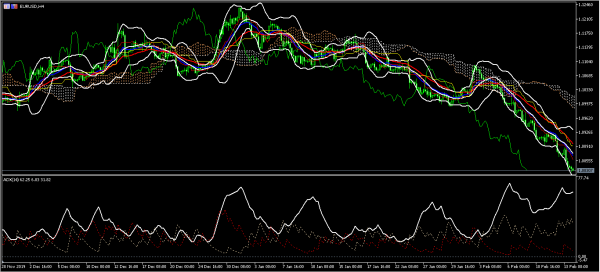

EUR/USD

The EUR/USD pair declined to a low of 1.0832. This was the lowest level since 2017. The price is below all the short and medium-term moving averages on the four-hour chart. The average directional index has risen to above 62. The ADX measures the strength of a trend. The price is also below the Ichimoku Kinko Hyo. The pair may continue with the current downward trend.

GBP/USD

The GBP/USD pair soared after the resignation of Sajid Javid. This jump was a continuation of the upward trend that started on Monday, when the pair was trading at 1.2871. It is now trading at 1.3040. On the four-hour chart, the price is along the 50% Fibonacci Retracement level. The price is slightly above the 14-day and 28-day EMA. The pair might have a pullback to retest the 38.2% Fibonacci level of 1.3000.

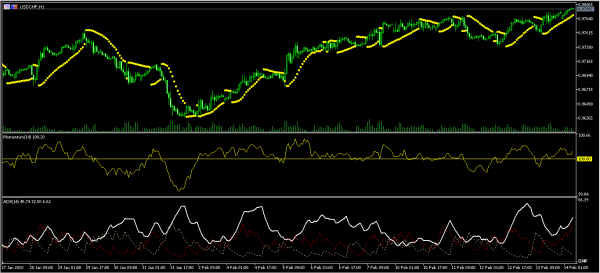

USD/CHF

The USD/CHF pair has been on a strong upward rally since January 31. In this time, the price has risen from a low of 0.9628 to today’s high of 0.9800. The momentum indicator has remained above the neutral line of 100. The average directional index has risen to the current 45. The dots of the Parabolic SAR are below the price. The upward momentum may continue to rise today.