For the 24 hours to 23:00 GMT, the EUR declined 0.29% against the USD and closed at 1.0840.

On the macro front, Germany’s consumer price index (CPI) climbed 1.7% on a yearly basis in January, hitting its highest level since July 2019 and compared to an advance of 1.5% in the previous month. The preliminary figures had also recorded a rise of 1.7%.

In the US, seasonally adjusted initial jobless claims rose to a level of 205.0K in the week ended 07 February 2020, less than market expectations. In the previous week, initial jobless claims had recorded a revised reading of 203.0K. Additionally, the CPI advanced 2.5% on an annual basis in January, driven by a rise in prices for food, shelter and medical care services. In the previous month, the CPI had recorded a rise of 2.3%.

In the Asian session, at GMT0400, the pair is trading at 1.0832, with the EUR trading 0.07% lower against the USD from yesterday’s close.

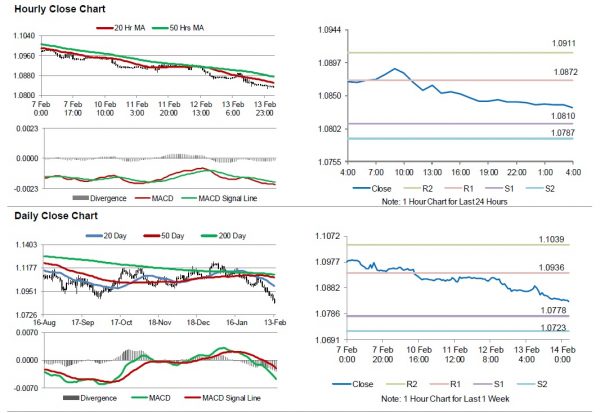

The pair is expected to find support at 1.0810, and a fall through could take it to the next support level of 1.0787. The pair is expected to find its first resistance at 1.0872, and a rise through could take it to the next resistance level of 1.0911.

Moving ahead, investors would closely monitor the flash 4Q GDP figures scheduled to release in the Euro-zone and Germany in a few hours. Additionally, Euro-zone’s trade balance figures for December, will be eyed by traders. Later in the day, the US industrial production and retail sales figures for January, followed by the Michigan consumer sentiment index for February as well as business inventories for December, would pique significant amount of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.