Finding easy buyers

Risk-on moves have gained momentum overnight as bellwethers of risk surged again to make new all-time highs. It seems the backdrop of an uncertain and significant economic fallout from a Coronavirus that continues to sow disorder across Asia, is becoming ostensibly more benign by the second in the minds of the trader community. That is, despite the fact that reporting protocols have altered to not include patients in the list of confirmed cases, should they test positive but not exhibit any negative symptoms.

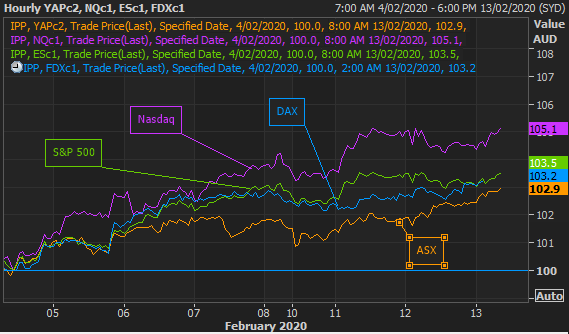

On the list of movers, Nasdaq futures heads the charge reaching above 9,600, while S&P 500 teeters on the edge of 3,400. DAX futures also participated and have rallied to 13,740 walking into Asia. Optimism runs deep for the ASX cash open, with reporting season and healthy risk appetite combining for what’s likely to be a head start to the tune of 42pts. This puts the index back in reach of all-time highs, which in and of itself, could create more upwards pressure.

Indexed Price Performance from 4/2/20. ASX has underperformed the return to positive territory.

ASX reporting in focus

NAB Q1 Results:

Earnings growth up 1% vs 1Q19

CET1 ratio at 10.6%, prev. 10.4%

Unaudited cash earnings 1.65bn

TLS H1 Results:

H1 Revenue of $12,164m vs $12,586m pcp

H1 Profit $1,139 vs $1,233m pcp

Interim ordinary dividend of 5c per share

Interim special dividend of 3c per share

Guidance for FY20 reconfirmed

AMP FY Results:

FY underlying profit $464m, down 32% pcp

AWM Net cash outflows of -$6.3bn vs -$4bn pcp

AWM Earnings $182m, down 50% pcp

Position on dividends to be reviewed after sale of wealth business complete

Sale of ANZ wealth business expected by middle of the year

80% of client remediation program expected to be complete by FY20

AGL H1 Results:

H1 Rev $6,312m vs $6,337m pcp

H1 Underlying profit $432m vs $537m pcp

Interim dividend 47c per share

Expects NPAT for FY to be in upper half of guidance $780m-$860m

RBNZ optimism

NZDUSD has managed to hold its 60pip rally on yesterday’s more neutral than expected RBNZ rate decision, which saw the OCR rate unchanged at 1%. Delving into some of the soundbites that contributed to RBNZ hawkishness was the removal of a dovish sentence, a more positive outlook on nCoV impacts, and little indication given for a rate cut in the near-term. As a result, we’ve seen the NZ yield curve aggressively bear steepen (long-dated rates rising more than short-term), and subsequently only now price in a 32% implied probability of a rate cut at the Nov. meeting.

Sizing it all up, I think this has been a very aggressive move by the market that is probably overextended, given how much room there is for economic disappointment. This, in my view, only increases the asymmetric scenario, where plenty of downside risks in the NZ economy could seep in and disrupt peaky optimism. AUDNZD still looks odds on.

EUR carry playing out

EURUSD has broken through Q3 2019 lows but looks to retrace somewhat to test 76.4% Fibonacci levels. It’s an interesting case study seeing the currency’s clear underperformance and lack of interest across the investor community in a risk-on environment. I think investors are taking advantage of EURUSD carry here, with yield differentials/annualised volatility looking extremely good relative to the rest of G10. This encourages more EUR selling and USD buying.

Elsewhere, in brent crude space, a retest of $57/bbl Feb highs off the back of eased virus concerns should be monitored.

Asia EM

For the rest of Asia, markets continue to edge out virus risks, but still lag the broader risk rally.

THB is better against the USD to the tune of 0.5%, helped by inflows into the equity market on a local IPO deal. Seem to be holding under 31.30 for now.

PHP received a positive outlook from Fitch, forcing structural USD plays to unwind. This sees the currency trading closer to 50.56. Central bank easing expectations will be one to watch in this space given growth concerns.

KRW has eschewed weak unemployment (+4%), pegging itself to broader risk appetite. There could be some weakness here as things settle and data starts to increasingly reflect nCoV impacts.