The price of crude oil rose as the market appeared to ignore the impact of the coronavirus disease. The disease has so far killed more than 1,100 people and infected more than 44k people. Most of these inflections and deaths are from China. The disease has had significant impact on companies doing business in China. The US Postal Service said that its deliveries to mainland China are facing delay. Companies like Honda, Toyota, and Tesla have closed or downscaled their operations. Meanwhile, data from the American Petroleum Institute (API) showed that inventories rose by 6 million barrels in the past week. This was after rising by 4.18 million in the previous week. The EIA will release the official inventories data later today.

The kiwi rose in the Asian session after the Reserve Bank of New Zealand (RBNZ) released its interest rates decision. The bank left interest rates unchanged at 1.0% as was widely expected. In the statement, the bank said that the country’s economy remained resilient. Employment is near its maximum sustainable level while inflation was close to the 2% target. The bank also said that it expected the economic impact of coronavirus on the economy to be muted. A statement said:

Economic growth is expected to accelerate over the second half of 2020 driven by monetary and fiscal stimulus, and the high terms of trade. The outlook for government investment is stronger following the government’s announcements in December. There are also indications household spending growth will increase.

Sterling rose as the market reacted to the mixed economic data from the UK. Data showed that the economy flattened in the fourth quarter. It rose by 1.1% this year. Business investment rose by 0.9% while industrial and manufacturing production rose by 0.1% and 0.3% respectively. Meanwhile, Michel Barnier, EU’s chief negotiator warned that the UK would not be granted a permanent deal allowing City of London access to European markets. This shows how challenging the negotiations between the EU and the UK will be.

EUR/USD

The EUR/USD was relatively unchanged as Jerome Powell testified before Congress. The pair is trading at 1.0913, which is a few pips above yesterday’s low of 1.0890. The price is slightly above the 14-day and 28-day exponential moving average. The two averages have provided essential support since the pair started declining in January. The RSI has moved from the oversold level of 30 to the current level of 32. The pair could remain at the current level as Powell continues to testify.

XBR/USD

The XBR/USD pair rose to an intraday high of 55.15. This week, the pair has risen from a low of 53.15. On the hourly chart, the pair appears to have found support. The price is slightly above the 14-day and 28-day exponential moving averages. The two averages have made a bullish crossover. The RSI has been moving upwards while the signal line of the MACD has moved above the neutral level. The pair may continue moving upwards ahead of the official EIA data.

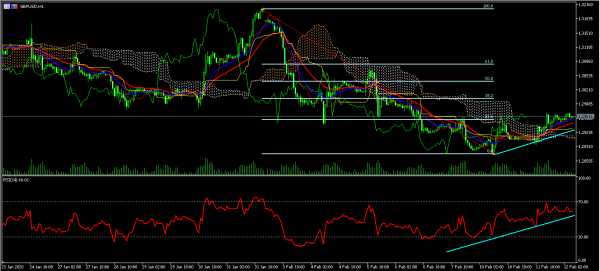

GBP/USD

The GBP/USD pair rose to a high of 1.2960 during the Asian session. The pair has risen from a low of 1.2870 this week. The price is slightly above the 14-day and 28-day EMA. It is also above the Ichimoku cloud. The price is also along the 23.6% Fibonacci Retracement level. The pair may rise to the 38.2% Fibonacci retracement level at 1.3000.