Balancing act

Risk assets overnight are familiarly camped just a few steps away from all-time highs, still weighing up the economic repercussions of a pervasive virus and the likelihood circumstances could peak before the end of February. As highlighted in our week ahead, we think the situation still remains economically fragile and shouldn’t be as easily dismissed as suggested by an increasing number of participants in the market. One thing to stay cognisant of is that reporting definitions have changed, whereby someone who tests positive but does not exhibit symptoms will no longer be counted.

ASX open

Walking into the ASX cash open, expect a marginal start with futures pointing to a 10pt move higher. Price action today is likely guided by reporting season, with earnings from majors starting to roll out in greater numbers. Though, keep an eye out for broader risk appetite in Asia to also flow through to risk sentiment.

Accounting for some combined 15% of the ASX 300’s total market-cap, markets will be watching giants CBA and CSL. Given both have released positive earnings reports earlier this morning and the index has high delta to a 1% move in either stock, this keeps price action supported in my view. Look at depth of book, I can already see some skew imbalance pre-market favouring buyers.

CBA H1 FY20 results:

Net Interest Margin (NIM) 2.11%, up 1bps pcp

Cash NPAT $4,477m, down 4.3% pcp

Interim dividend declared $2, no change pcp

Targeting a gradual return to full-year payout ratio of 70-80%

Expect 2H20 NIM to be impacted by -5bps in 2H20 from cash rate reductions

CSL H1 FY20 results:

Sales revenue US$4.7bn, up 8.4% pcp

NPAT US$1.2bn, up 7.5% pcp

Interim dividend $0.95, up 12% pcp

Expects NPAT for FY20 to be in range of about $2,110bn – $2,170bn

RBNZ meeting

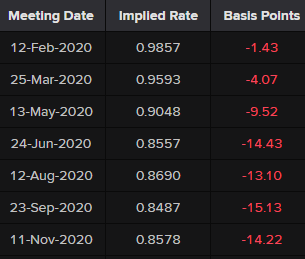

NZDUSD, brushing up against 0.64, has lagged the broader risk rally and likely stays subdued edging towards today’s 12pm AEDT rate decision. We expect caution around Coronavirus concerns to seep into the statement, but equally, positives in better recent domestic data to be highlighted. Depending on the magnitude of concerns emphasised surrounding nCoV, this will likely dictate how flat the NZ rates curve gets.

Given 1.78bps (7%) is priced into this meeting and only 9.24bps (37%) through to May, there’s plenty of room for flattening in the curve (rate cut expectations increase) on release. We think this leads to an asymmetric scenario where NZDUSD falls in any case to re-test yesterday’s lows of 0.638 (-20pips). If greater indication is revealed for a March cut, I wouldn’t be surprised by a fall into 0.63 – November lows.

Relative yield differentials, as noted here, continue to support long AUDNZD plays.

Asia region wary

Trading across Asia EM currencies still capture the lingering concerns around the potential economic fallout from disrupted travel and global supply chains.

KRW – a potential cut at BoK’s Feb 27 meeting pre-empting growth downgrades could see it lag.

SGD – overnight, Tourism chief Keith Tan noted the country’s tourism sector could take a hit of 25 to 30% for tourism arrivals. Markets wait on how the 2020 budget addresses such concerns.

UK strength

Sterling has managed to pick itself up off multi-month lows after a better than expected Q4 GDP print (1.1% y/y, 0.8% est.) driven by improved trade and increased government spending. Trading at some 1.295 levels, it reinforces our view that markets are likely to see more GBPUSD data resilience deeper into 2020. A caveat to this print, however, is that it is backward-looking, therefore, traders will also want better soft data to reaffirm long positioning.

A better feel around the Cable following the print has naturally flowed through to FTSE price action, with futures +0.7% walking into Asia. Other European benchmarks have also fared strongly; DAX and STOXX outperforming overnight.

Elsewhere

USDCAD – a slight bounce in crude to $54.30 has released a bit of upwards pressure in USDCAD in line with our views that Loonie looks good risk/reward at 1.33 levels. Now trading at 1.3283, we think there’s room for more retracement, granted, oil holds up its side of the bargain and doesn’t materially deteriorate.