GOLD

Gold briefly rallied to the 1226.00 regions overnight as Yellen’s semi-annual testimony on the Hill was unexpectedly dovish and the U.S. Dollar fell. Gold was unable to sustain its gains though and dropped to finish unchanged on the session at around 1221.00, disappointing bulls hoping for a continuation of the week’s recovery rally.

Today’s 2nd day of testimony will now be very carefully watched by traders looking to see if the Fed’s dovish theme has continued and whether they have “blinked” on their transitory inflation rhetoric. Gold’s fate in the short term will undoubtedly be decided on Friday now by the U.S. CPI data which is indeed shaping up to be a major driver for the big Dollar, equities and bonds as well. A 4th undershoot in a row could see the U.S. Dollar coming under pressure which could be supportive of gold in the absence of other factors.

For now, the street is completely ignoring any political risk around the globe.

Gold traded at 1222.00 in early Asia with initial resistance at the overnight highs of 1226.00. It faces much more formidable resistance at the 1230/1231 area, the July 5th high and home to the 200-day moving average. Short term support lies at 1217.00 and 1213.25.

OIL

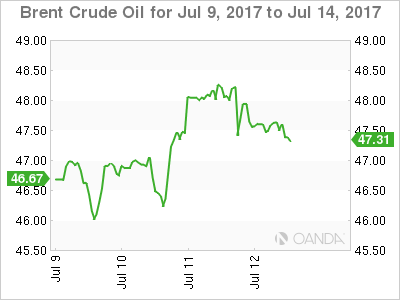

Both Brent and WTI jumped by over two percent at one stage overnight following a larger than forecast fall in official U.S. Crude Inventories of 7.6 million barrels. It followed the massive drawdown in the API Inventories the night before. The rally was short lived though as a dig through the figures revealed still tepid gasoline demand.

OPEC then delivered the nail in the coffin by forecasting lower than expected global oil demand next year and a continuing surplus. As the dust settled on the session, both contracts finished some 50 cents lower than their opening prices in what can only be described as disappointing price action. Traders may well have chosen to book short term profits after the decent rally from the start of the week.

Attention will now turn to Friday’s U.S. CPI after a dovish Yellen testimony overnight, with price action to be choppy in the short term and subject to the nuances of the U.S. Dollar rather than developments in the oil market itself. The rally from Monday may well have run its course for now.

Brent spot trades at 47.50 this morning with resistance at 48.60 and 49.00 with support at 47.00 and then a more distant 46.00.

WTI spot is trading at 45.30 with solid resistance at the 46.40 double top and then 47.15. Support lies nearby at 45.00 followed by a lot of clear air down to the chart double bottom at 43.50.