Risk in good shape

Risk appetite has remained healthy overnight as US exceptionalism, driven by a solid set of US data, helped balance the developing Coronavirus situation in Asia. However, price action has been somewhat selective, as Nasdaq (flat on the session) uncharacteristically underperforms the moderate risk rally while S&P 500 teeters on the edge of all-time highs.

I’ve seen reports that a “cure” for the virus might have been found, but this has been played down by top health officials. What is pleasing though about the situation is that the recovered/death ratio continues to eke higher, albeit remains a fraction of a large number of cases. It’s clear the situation remains extremely fragile as soundbites hit the news wires offering different accounts of the unknown economic impacts. Equities are broadly higher, as are bond yields. USDJPY steps higher again to settle at 109.8.

Strong US data helps

What seems to have helped prop up sentiment came in the form of an extremely strong ADP print (291k vs 156k est.), which should help anchor Friday’s NFPs, though it isn’t a lock in terms of predictiveness. There was also the release of a highly anticipated ISM Non-mfg PMI number that came in at 55.5 vs 55.1 consensus expectations. Both of these build on Monday’s feel good ISM Mfg PMI print of 50.9 vs 48.5 est. and continues to support longer-term USD strength.

ASX open

At time of writing, the ASX looks for a 60pt rally at the open according to SPI futures, which therefore pushes the ASX back up above the coveted 7k level. However, reporting season is right around the corner and is priming to spell a different story for the Australian business landscape. We see this as being a concern over the next couple of weeks given net weakness is expected across the board.

Pre-open, furniture retailer Nick Scali (NCK) releases 1H FY20 results. The share price has gained 4.2% ytd and is hoping for better days ahead on an improved Aussie housing sector, and after difficult trading conditions in the first three months of current FY. 1H NPAT is expected to be in the range of $17-$19m.

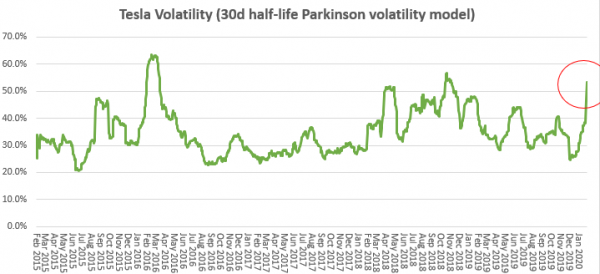

Tesla chop

Following up on our Tesla coverage yesterday, volatility in the incumbent electric car maker continues to rise with another big swing in trading. The share price is down 17% at time of writing, keeping around $740 levels. This is a huge difference to last night’s highs of $970 and could be a significant turning point for what’s arguably been a hype rally, backed by retail with little institutional support. As most mania stories go, smart money takes advantage of overextended moves at the peak and rotates, while retail money still piles in at the peak before a capitulation back to lower levels, especially as more and more latecomers bottleneck the exit door.

Antipodeans

Up ahead in the calendar, there’s a couple of data points in Aussie retail sales (est. -0.2% m/m, prev. 0.9% m/m) and trade balance data (est. 5.95bn, prev. 5.8bn) at 11.30am AEDT that could make minor waves in the Antipodean space. Though, they’re unlikely to overpower the implications of yesterday’s RBA speech titled “The Year Ahead”, which saw the Aussie yield curve lift across 2020. March pricing now sees only 12% likelihood the RBA cut at the next meeting.

AUDUSD has been able to push into 0.677 overnight but the move has been faded since into 0.674 levels. Domestic challenges remain embedded in my mind, so I retain a short AUDUSD bias. Though, I think opportunity presents itself in AUDNZD given a better showing of Aussie data in recent times. In the chart below, AUDNZD also looks like its hit a multi-month double-bottom, coupled with a tick higher in the AUS 10y – NZ 10y yield spread

Asia CBs

In regional Asia, SGD continued to weaken overnight and has been the worst performer across Asia FX space surging 0.82% at time of writing above 1.38 levels. This comes off the back of unexpected guidance from the Monetary Authority of Singapore (MAS). MAS noted that there could be more room to accommodate weakness in real terms, easing SGD consistent with weakening economic conditions.

Thailand also deserves a notable mention after its central bank unexpectedly, yet unanimously cut the policy rate by 25bps. This makes sense given how exposed Thailand’s economy is to a downturn in tourism. Drought and the country’s budget bill also look to be key factors in whether a big growth downgrade will come. THB trades weaker brushing 31 levels.

For those interested in the Philippines space, a key central bank decision by the BSP will be due out at 7pm AEDT/4pm Manilla Time. It looks like the scales are tipping in favour of a rate cut in line with economist expectations. This would be the first of what’s likely to be two in 2020. And seems to be appreciated given nCoV has well and truly reached Philippines and presents a fair bit of downside risks to the country’s economy.