December Quarter Consumer Price Index (CPI) Headline CPI 0.69%qtr/1.8%yr, Trimmed mean 0.43%qtr/1.8%yr, Weighted median 0.36%qtr/1.3%yr

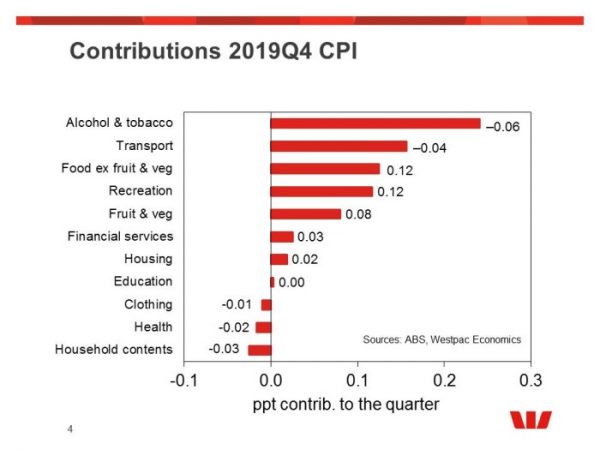

Fuel & tobacco are the key sources of inflationary pressure. There is some sign we are seeing very modest pass-through from a weaker AUD, plus some drought effect in food prices but they are nowhere near enough to change overall picture of a benign inflationary environment.

The December Quarter CPI rose 0.7%, with the market median and Westpac’s forecast of 0.6%. At two decimal places, the CPI gained 0.69% (Westpac’s forecast 0.61%) with the annual rate lifting a touch to 1.8%yr from 1.7%yr.

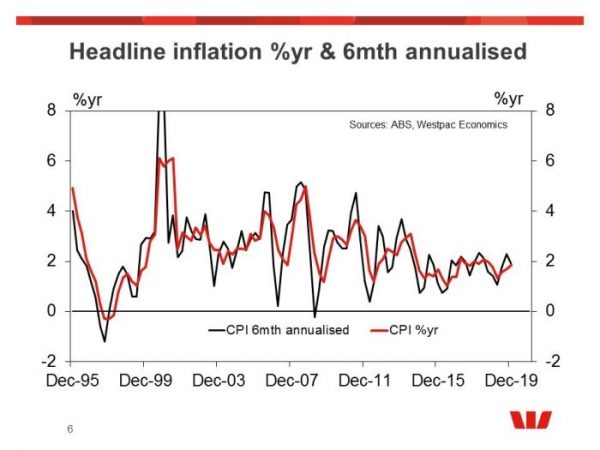

Inflationary momentum, as measured by the six month annualised pace of the seasonally adjusted series, eased a touch to 1.9%yr in Q4 from 2.3%yr in Q3. Australian inflationary momentum has been very patchy moving between 1.6%yr and 2.3%yr and we expect it to continue to do so for at least the medium term.

As 2018 ended Westpac argued that while it appeared that the disinflationary pulse has found a base, we could not see the roots of an emergence of a meaningful inflationary pulse. The lack of widespread inflationary pressure continued through 2019 even though, at the margin, there were some signs that the deprecation in the AUD was starting to be passed through to retail prices. As the year ended there was some further sign of this pass-through with clothing a footwear falling less than expected (–0.3% vs –1.5% forecast) and a stronger than expected rise in holiday travel (1.9% vs 0.7% expected).

As expected, housing costs were subdued (0.1% vs. 0.2% forecast) with the stronger dwelling prices (0.4% vs. 0.1% expected) being offset by falling utilities (–0.6% vs 0.9% expected). This modest gain in housing prices is constraining both headline and core inflation.

The trimmed mean, which is seasonally adjusted and excludes extreme moves, rose 0.43% holding the annual rate at 1.6%yr. The market was expecting a 0.4% rise in the quarter. In the quarter, the weighted median lifted 0.36%qtr/1.3%yr.

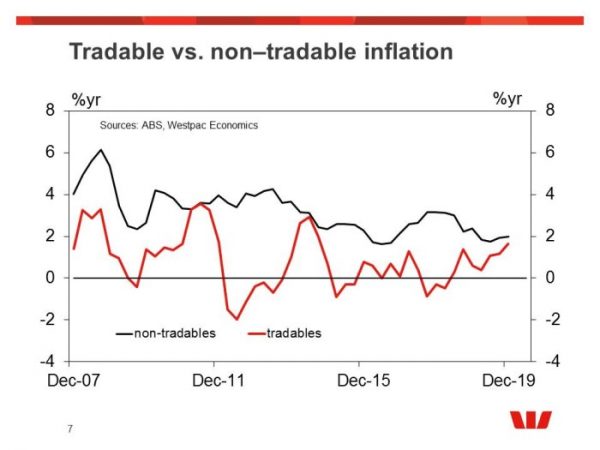

Tradables rose 0.2%qtr/1.7%yr in the December quarter. Tradable goods rose 0.5% mainly due to automotive fuel (+4.4%) and fruit (+6.8%). Tradable services fell 2.8% mainly due to international holiday, travel and accommodation (-2.9%).

Non-tradables rose 1.0%qtr/2.0%yr in the December quarter. Non-tradable goods rose 1.3%, mainly due to tobacco (+8.4%). Non-tradable services rose 0.8% mainly due to domestic holiday, travel and accommodation (+7.3%).

Despite some AUD pass-through, and the recovery in dwelling prices, inflation is below the target band. While the headline rate may drift into the band in 2020, it is likely to be transitory and the core measures will remain below.

There are signs that we are getting some AUD deprecation pass-through to inflation in clothing & footwear (for some selected groups), household goods & furnishings and in automotive vehicles. But it is harder to find any broader impact or wider inflationary pulse.

With housing having a significant weighting in the CPI (22%), trends in this group have a meaningful impact on both inflation and core inflation. We are watching the recovery in dwelling prices in Melbourne and Brisbane which has appeared a little earlier than anticipated. Nevertheless, even with our forecasts of dwelling prices to continue to lift from here there is little in today’s report to suggest any risk of a meaningful acceleration in core inflation that would sustainably lift it back into the RBA’s target band.