First, a review of last week’s events:

EUR/USD. The euro is falling again, and it has lost about 70 points to the dollar over the past five days. There are two reasons for this: the coronavirus epidemic in China and the very cautious new ECB Head Christine Lagarde.

It is well known that the Eurozone economy is strongly correlated with the Chinese economy, as has recently been demonstrated by the trade wars. And if the economy of China is sick, then the European one is also experiencing a strong malaise. In 2003, a pandemic in China killed more than 700 people and caused retail sales to fall by almost half. But despite the fact that the new virus is considered less dangerous, it can now spread much faster than at the beginning of the century. The reason for this is the infrastructure of China, which has become much more developed during this time. Oil prices were the first to react to the new attack, but the foreign exchange market was not long in reacting.

As for Ms. Lagarde, she really disappointed investors, saying that the revision of the ECB’s strategy is a long process that will only be completed by the end of 2020. Moreover, against the background of the US President Trump’s warnings about the possible introduction of increased duties on European exports, Ms. Lagarde considered that “the risks for the euro zone are still skewed towards the decline of the economy.” And so the European regulator will have to maintain an ultra-soft approach to its monetary policy.

Against the background of such statements by the head of the ECB and the Chinese epidemic, even favorable data on business activity in Germany (PMI) did not help the euro, and the EUR/USD pair fell to the level of 1.1020 by the end of the week. Last week, 40% of experts and the absolute majority of indicators warned that it would attack the 1.1000 level. Among the oscillators on H4 there are 75% of them, on D1 – 65%, among the trend indicators, 100% on H4 and 90% on D1 point to the south.

GBP/USD. Thanks to the growth of business activity (PMI) on Friday, January 24, the British currency reached a two-week high at 1.3172, but then went down again. Expectations of an interest rate cut at the Bank of England meeting on January 30, as well as the same notorious Chinese coronavirus, contributed to the fall.

The dynamics of the movement of the GBP/USD pair was most accurately predicted last week by graphical analysis. As for the final chord, the pair ended the trading session at 1.3080, slightly correcting the mid-term Pivot Point zone in the upward direction – to the range of 1.3050-1.3085;

USD/JPY. According to some experts, the extremely low volatility of the EUR/USD pair indicates that a certain balance has been established between these two major currencies. And now the euro and the dollar are in the balance on the one hand, and emerging market currencies and stocks on the other. And these markets, especially those of neighboring countries, may be particularly affected by the crisis caused by the spread of the Chinese coronavirus.

As it turned out, the yen gained the most from such anxious but vague expectations, being a safe haven that can shelter investors’ capital from unpredictable financial storms. A third of the experts who voted for the fall of the pair, and even more so the oscillators that gave signals about its overbought, could not know about the coronavirus pandemic, but, nevertheless, gave the correct forecast. The pair quickly turned the support of 109.65-109.70 into resistance, and then found a local bottom at the level of 109.17. As for the end of the trading session, it finished it very close, at the level of 109.27;

cryptocurrencies. If someone dreamed of cryptocurrencies as an independent and free from state control financial system, they could forget about it. Just one example. The Minister of Finance of Ukraine announced that the state financial monitoring service will investigate where the citizens of this country got the cryptocurrency from. According to the Minister, the tools available to this organization allow them to determine both the origin of digital assets and what they were spent on. Moreover, this service has the authority to block cryptocurrencies and seize assets illegally obtained by Ukrainian citizens.

It is clear that this news did not contribute to the fall of Bitcoin, but the fact remains that the reference cryptocurrency could not gain a foothold above $9,000 and on Friday, January 24, it fell to the $8,250-8,450 zone.

According to some experts, what is to blame for this fall… is the Chinese New Year. Comparing the results of trading in this period over the past few years, they noted that the risk of a drawdown of the main coin is present even against the background of the overall growth dynamics. According to their calculations, in Asia, about 10 percent of residents have savings in cryptocurrency. And before the New Year, they start cashing in assets and spending money on gifts and holiday parties.

Altcoins: Ethereum (ETH/USD), Litecoin (LTC/USD) and Ripple (XRP/USD), as usual, followed in the wake of the main cryptocurrency. The total capitalization of the crypto market decreased from $251 to $236 billion.

As for the forecast for the coming week, summarizing the opinions of a number of experts, as well as forecasts made on the basis of various methods of technical and graphical analysis, we can say the following:

EUR/USD. As already mentioned, for the ECB, a weak euro is now preferable to a strong one. Realizing this, the bulls do not want to take risks, which makes the European currency even weaker. Its nearest target in the downtrend is 1.1000, followed by 1.0960. This is followed by the low of October 01, 2019 -1.0880. 55% of analysts now vote for the fall, supported by 85% of oscillators and 100% of trend indicators not only on H4 and D1, but also on W1.

The opposite view is expressed by 45% of experts and 15% of oscillators in the oversold zone. Moreover, when switching from a weekly forecast to a monthly one, the number of bull supporters increases to 70%. The immediate task is to overcome the strong resistance in the 1.1065 zone, followed by the 1.1100 and 1.1175 resistances.

As for the Fed’s decision on the interest rate on January 29, it is likely that it will remain at the same level – 1.75%, and this meeting will not have much impact on the dynamics of the pair;

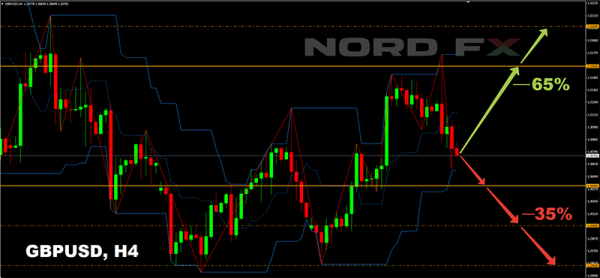

GBP/USD. Done! Here it is, the X day, Friday 31 January, which will be followed by the UK’s farewell to the European Union. Brexit, which everyone has been talking about for so long, can be considered accomplished. However, we think that at the moment this event will put more moral pressure on the market – the relatively smooth process of the country’s exit from the EU significantly reduces investment risks. Moreover, the current low rate of the pound helps the British economy in many ways, strengthening its competitiveness in foreign markets.

If there are no unexpected unpleasant surprises from Brexit, the pound may feel relatively calm. And it is not excluded that it will grow not only against the euro, but also against the dollar. So, 65% of experts expect it to move north – first to the resistance of 1.3160, and then to the height of 1.3200.

An alternative forecast is given by 35% of experts, according to whom the GBP/USD pair is expected to fall further. This scenario is especially likely if the Bank of England meeting on Thursday, January 30, gives at least a hint of a possible interest rate cut. In this case, the British currency has every chance to continue its journey to the south, in which, after breaking through the supports of 1.3040, 1.3000 and 1.2960, it can reach the lows of last December in the 1.2900 zone. Graphic analysis on D1 actively supports this development;

USD/JPY. There is some confusion among the indicators, but 10% of the oscillators are already giving clear signals that this pair is oversold. 60% of analysts supported by graphical analysis on D1 believe that it will stop falling as well. The goal is to rise to the zone 110.20-110.30. The next resistance is at 110.80;

The remaining 40% of experts side with the bears, who believe that the downward trend of the past week will continue. The Dow Jones index is aiming for 30.000, and the USD/JPY pair should break through the 109 mark, which will lead to further losses for all cross-pairs related to the Japanese currency. The main support is at 108.40, the next one is 60 points lower;

cryptocurrencies. Along with the fall of the main cryptocurrency, the Crypto Fear & Greed Index also fell slightly down, from 54 to 40. This is not yet a fear of the market, but investors are no longer particularly attracted to opening long positions.

Even some of the crypto prophets have tempered their appetites. In a recent tweet, trader and crypto analyst Josh Rager expressed the opinion that, as in other markets, Bitcoin has a “law of decreasing the rate of return”, and there is a decrease in its profitability in each cycle. “The next Bitcoin maximum will not be as high as most people think. Some point to $100,000, $300,000, and $1 million. One should also take into account the decrease in the profit margin by about 20% in each cycle. Therefore, I think the next high will be in the range of $75,000 to $85,000,” the analyst wrote. Rager’s position on this issue was also supported by the cryptocurrency analytical company ByteTree.

If we talk about forecasts for the near future, they are not so optimistic. 50% of experts expect the BTC/USD pair to fall to the $7,500-8,000 zone, 30% voted for a sideways trend and only 20% – for the pair to rise above the $9,000 horizon. However, when switching to the monthly forecast, the number of crypto optimists increases to 70%.