Strong growth and concerns for household debt trigger rate decision

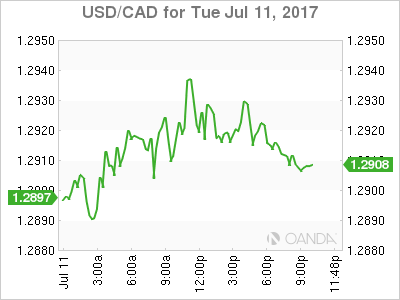

The USD/CAD was trading above 1.34 in mid June when Bank of Canada (BoC) Deputy Governor Carolyn Wilkins delivered a speech to a business school crowd and started a swift recovery of the loonie that has the currency pair trading at 1.2927. The central bank cut rates twice in 2015 and has stayed in the sidelines since then, but it is now widely anticipated that the BoC will hike rates this year, with the July meeting firmly on the table.

The Bank of Canada (BoC) will release its rate statement on Wednesday, July 12 at 10:00 am EDT. The Canadian central bank joined the hawkish chorus in June taking the market by surprise and quickly pricing in a rate hike after repeated comments from senior BoC policy makers. The bond market is pricing in a rate hike of 25 basis points to leave the benchmark rate at 0.75 percent based on the remarks by the central bank Governor Stephen Poloz although some financial institutions remain unconvinced that the strong GDP growth does not warrant as a reduction in monetary stimulus. There will be a press conference at 11:15 am EDT where more details will be shared by the BoC Governor.

Fed Chair Janet Yellen will be giving her semiannual monetary policy report to the US House Financial Services Committee on Wednesday, July 12 at 10:00 am EDT and to the Senate Banking Committee on Thursday, July 13 at 10:00 am EDT. FOMC members will be speaking during the week reiterating the high probability of another rate hike and the imminent start of the central bank’s balance sheet reduction sooner rather than later.

The USD/CAD rose 0.288 percent in the last 24 hours. The currency is trading at 1.2916 ahead of the Bank of Canada (BoC) rate statement announcement on Wednesday. The loonie has lost some momentum as risk aversion triggered by the release of Donald Trump Jr’s emails have once again put political uncertainty in the US agenda. The bond market is pricing in a move by the BoC, but there are plenty of doubters amongst economists as evidenced by the Reuters poll published last week. Fourteen of 31 economists expect a rate hike on Wednesday. The quick change in stance from the BoC makes some question the timing but there is no denying that growth has been stronger than forecasted and the impact of falling oil prices has been contained.

Domestically there are concerns about the ballooning of household debt as cheap rates fuelled various real estate bubbles in the country. The move to a tighter monetary policy will be gradual although it could include a second rate hike before the end of the year if the economy continues to perform and other central banks continue to move towards the end of low rates.

Oil rose 1.412 percent on Tuesday. The price of West Texas Intermediate is trading at $45.02 after forecasts for US production were lower and there is increasing talk about Nigeria and Libya after having resumed their full output will now have to participate in the production cut agreement.

US output has not grown at the same pace of the Organization of the Petroleum Exporting Countries (OPEC) agreed cuts with other producers forcing a reduction in forecasts for next year. Rigs in the US have been coming back online at a slower pace than expected and comments form Russia being open on further reducing output boosted crude prices.

The OPEC and other majors producers joined up in an attempt to lift oil prices from the floor by agreeing to cut production for 6 months in 2016 and adding a 9 month extension that will take the deal into 2018. The monitoring committee will meet in Russia on July 22 to discuss the state of affairs. Nigeria has been invited to attend in a move that could signal its inclusion into the production limit that it was previously exempt.

The release of the US weekly crude inventories will be followed by traders looking for more data on US production. The Energy Information Administration (EIA) will release the weekly report on Wednesday, at 10:30 am EDT. A 3.2 million barrel drawdown is expected to follow the 6.3 million barrel drop from the report published last week.

Market events to watch this week:

Wednesday, July 12

4:30am GBP Average Earnings Index 3m/y

10:00am CAD BOC Monetary Policy Report

10:00am CAD BOC Rate Statement

10:00am USD Fed Chair Yellen Testifies

10:30am USD Crude Oil Inventories

11:15am CAD BOC Press Conference

Thursday, July 13

8:30am USD PPI m/m

8:30am USD Unemployment Claims

10:00am USD Fed Chair Yellen Testifies

Friday, July 14

8:30am USD CPI m/m

8:30am USD Core CPI m/m

8:30am USD Core Retail Sales m/m

8:30am USD Retail Sales m/m