US stocks declined yesterday as the markets reacted to a fatal respiratory virus that is spreading in Asia. The virus started in China’s southern district and has killed six people. The concern is that the disease will impact the Lunar New Year holiday, which is a major shopping period in China. The market also reacted to more bad news from Boeing, which pushed back the expected 737-Max return. The company said that it does not expect the jet to come back until at least the middle of the year.

Meanwhile, US futures rose after positive results from IBM. The company reported revenue of $21.78 billion and an EPS of $4.71. Netflix reported mixed results, which caused shares to rise by 2.3% in after-hours trading. The company missed its forecast for US subscriber growth for the third straight quarter. It added 423k domestic subscribers, which was lower than the expected 600k. The companies to watch today will be Johnson & Johnson, Ally Financial, Abbot Laboratories, Northern Trust, Citrix, Raymond Jones, and Dover among others.

The Canadian dollar eased against the USD as the Bank of Canada (BOC) started its first monetary policy statement of the year. The central bank is expected to leave interest rates unchanged at 1.75%. Still, the market will be waiting to hear comments from the bank governor. Following relatively weak economic data it’s thought the bank may slash rates this year. In addition to the rates decision, the market will release the CPI data from the country. The consensus estimate is that the headline CPI will remain unchanged at 1.9%.

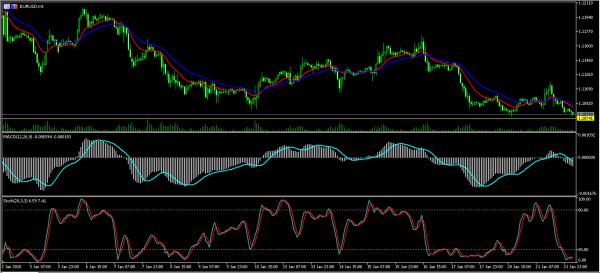

EUR/USD

The EUR/USD pair declined to an intraday low of 1.1078. This is an important double bottom level as shown on the hourly chart below. The short and medium moving averages have made a bearish crossover while the signal line of the MACD has continued to move lower. The signal and main lines of the Stochastic oscillator have moved to the oversold level. The pair may continue to move lower today. However, there may be an upward reversal since the pair has formed a double bottom pattern.

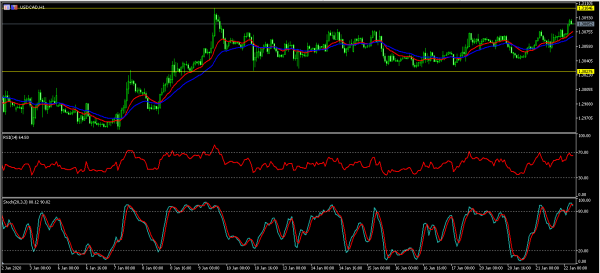

USD/CAD

The USD/CAD pair rose ahead of the Bank of Canada decision. The pair rose from a low of 1.3042 to a high of 1.3092. The price is above the 14-day and 28-day exponential moving averages. The RSI and the two lines of the Stochastic oscillator have reached the overbought level. The pair may continue moving higher as it attempts to test the important resistance level of 1.3105.

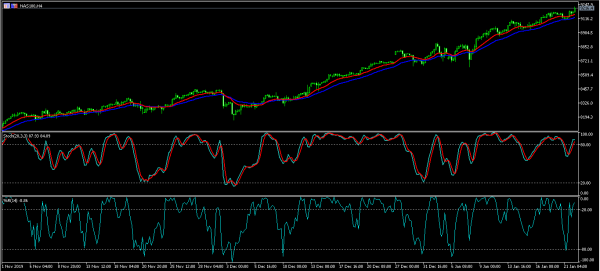

NAS100

The NAS100 eased slightly yesterday as the market focused on the new virus in China. The index remains close to the highest level ever. It is trading at $9213, which is above all the short, medium, and long-term moving averages. The William’s Percentage Range and the two lines of the Stochastic oscillator have remained above the overbought level. The index may continue moving higher today on positive corporate earnings.