- Greenback outperforms as incoming data reaffirm strength of US economy

- Pound crumbles after soft retail sales enhance case for a BoE rate cut next week

- Bank of Japan rate decision coming up; supply disruptions boost oil

Solid US data lift dollar, catapult US stocks to fresh records

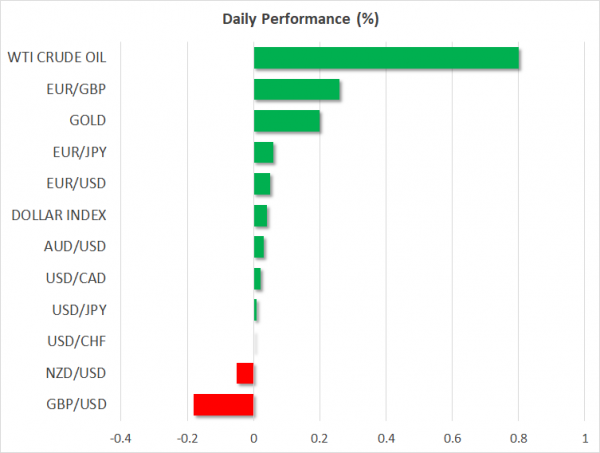

The dollar was the star performer in the FX market on Friday, advancing across the board after the latest batch of US data beat forecasts, feeding the narrative that the American economy continues to fire on more cylinders than other major regions. Specifically, US housing starts rose by an overwhelming 16.9% from the previous month, while consumer sentiment in the University of Michigan survey remained elevated, further dispelling concerns about a looming economic slowdown or worse yet, a recession.

Wall Street cheered the encouraging news too, with all three major US stock indices closing at new record highs. The tech-heavy Nasdaq 100 outperformed (+0.53%), the benchmark S&P 500 gained 0.39%, while the Dow Jones lagged (+0.17%) as another tumble in Boeing shares (-2.36%) limited the advance of the price-weighted index.

What stood out was the yen, which was almost as strong as the greenback, even in an environment characterized by solid risk appetite. Likewise, gold prices closed the session in the green and are also on the march higher today, despite the stronger dollar and the uptick in US bond yields – both of which are typically negative for bullion. It seems that for all the market euphoria, caution still lingers and investors are quietly hedging their riskier bets, perhaps worried that the parabolic rally in equities cannot continue uninterrupted for much longer, especially without any new positive themes.

US markets will remain closed today for the Martin Luther King holiday. Thus, liquidity may be thinner than usual, generating the risk of sharp price moves without much news.

Soft UK data sink pound, Brexit worries push it even lower

The jump in the dollar was also aided by some weakness in the British pound, which fell off the cliff after the latest UK retail sales data disappointed, sending the implied probability for a Bank of England rate cut next week to ~70%, from roughly ~60% earlier.

That wasn’t all. Cable also opened with a considerable gap lower today, after UK Chancellor Sajid Javid said businesses should ‘adjust’ to a future where Britain no longer adheres to EU regulations. He implied that the future trading relationship London is aiming for may not be as ‘close’ as many firms would like, reigniting concerns about high barriers to trade, especially given the EU’s position that frictionless trade is not possible without regulatory alignment.

This week, the main event for the pound will be the preliminary PMIs for January, due on Friday. BoE officials seem keen to examine some post-election data before drawing any real conclusions, so if these PMIs don’t show a convincing enough rebound to calm the BoE’s nerves, the odds for a rate cut next week might shoot even higher, keeping sterling under pressure.

Bank of Japan decision coming up; Oil in focus too

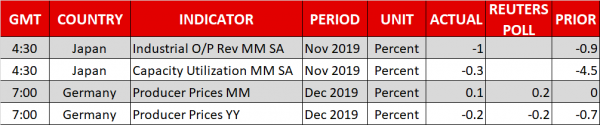

The economic calendar is empty today. Things could get more interesting overnight though, when the Bank of Japan (BoJ) completes its policy meeting. No action is expected but considering the mild improvement in economic data lately and the de-escalation in global risks, policymakers could strike a slightly more optimistic tone. On the margin, that might support the yen. That said, it remains to be seen whether the defensive currency can hold onto any gains amid the broader risk-on market atmosphere.

In energy markets, oil prices are higher today following news of major supply disruptions in both Libya and Iraq. Of course, the sustainability of this upswing will depend on whether these disruptions are permanent or temporary.