Wall Street bagged another record close for the S&P500 and Nasdaq. This happened as traders geared up for the start of Q4 corporate earnings that will start today. The so-called earnings season will start with the release of earnings from major banks like Bank of America, Citigroup, and Wells Fargo. These earnings will set the stage of what traders will expect when other companies in the S&P500 start releasing. The S&P and Nasdaq rose by 0.7% and 1.3%. These indices were boosted by technology companies like Apple and Salesforce and materials companies like Nvidia and Skyworks. Futures tied to the two indices have risen by 4 and 14 points respectively.

The US dollar index was relatively unchanged during the American and Asian markets. Traders are still reflecting on the disappointing jobs numbers that were released on Friday. Today, the Bureau of Economic Analysis will release the consumer price index numbers for December. The CPI data is an essential measure of inflation. The headline CPI is expected to have risen by an annualised rate of 2.3%. This will be slightly above the previous 2.1%. It is expected to remain unchanged at 0.3% on a MoM basis. The core CPI, which strips the volatile food and energy prices, is expected to remain unchanged at 2.3% and 0.2%. These inflation numbers will be watched closely because of the slowdown in wage growth that was experienced in December.

Sterling was relatively unchanged during the American and Asian sessions. This was shortly after the currency declined following the release of mixed economic data. The numbers from the Office of National Statistics (ONS) showed that the economy contracted by -0.3% in November. This was a month before the general election. There was also weakness in the manufacturing and industrial sectors. The only positive was in the construction sector. These numbers made many to believe that the Bank of England will slash rates in the upcoming meeting. There will be no economic data from the UK today. The ONS will release the CPI and retail sales data tomorrow and on Friday respectively.

EUR/USD

The EUR/USD pair was little changed during the Asian session. The pair is trading at 1.1136, which is slightly below yesterday’s high of 1.1146. It is also above Friday’s low of 1.1085. The price is between the 38.2% and 23.6% Fibonacci Retracement level and slightly above the 14-day and 28-day exponential moving averages. The pair is also along the important resistance level shown in white below. Therefore, the pair may either move above the resistance or resume the previous downward trend.

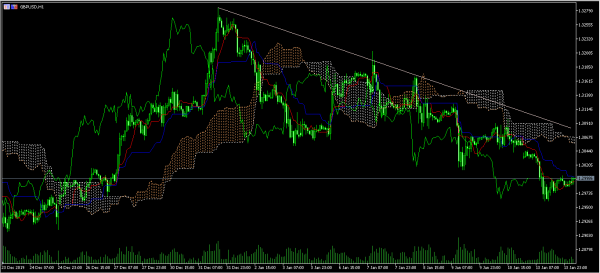

GBP/USD

The GBP/USD pair was unchanged during the Asian and American sessions. It is now trading at the psychologically important level of 1.3000, which is slightly above yesterday’s low of 1.2960. The price is below the Ichimoku cloud and on the same level as Kijun-sen and Tenkan-sen. The pair has also been on a downward trend as shown by the white resistance line. The pair may continue moving lower today.

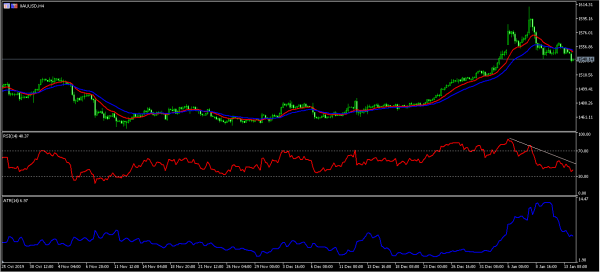

XAU/USD

The XAU/USD pair declined during the Asian session. This was a continuation of a decline that started last week when the pair reached a high of 1611. The pair reached a low of 1535.90. The RSI has moved from a high of 88.38 to a low of 40 while the average true range too has been declining. The pair may decline further if the US releases weak CPI data.