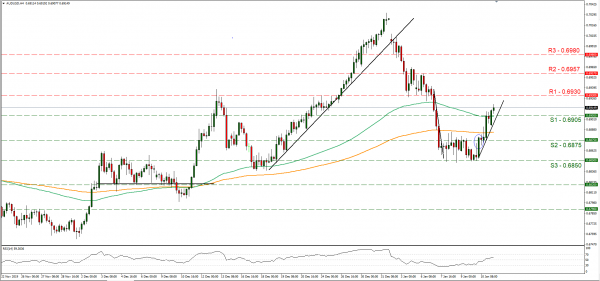

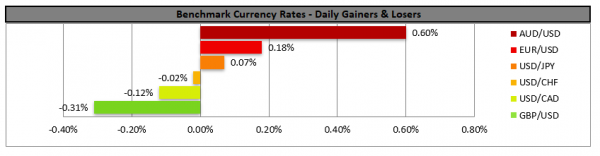

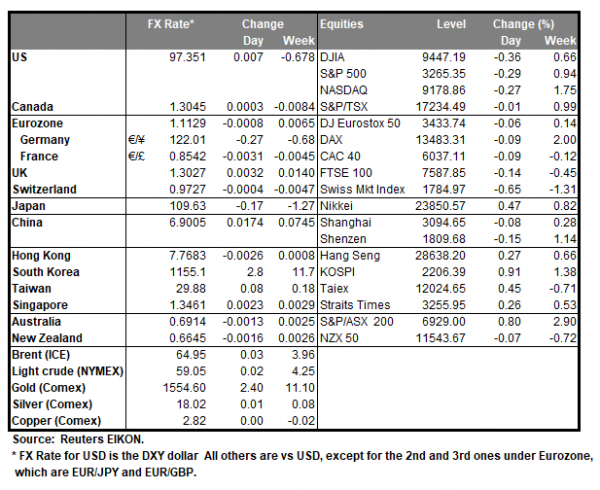

The USD seems to have started to recover during today’s Asian session as it strengthened against a number of currencies due to hopes for the possibility of an imminent signing of the US –Sino phase 1 trade deal. The deal is to be signed at a ceremony on the 15th of January as Chinese Prime Minister Liu He is to visit Washington leading a trade delegation. Analysts tend to note that the possible signing of the deal is to produce a substantial number of positive headlines as the world’s largest economies are to enter a new trade deal. Also, it should be noted that the USD had suffered a hit on Friday as the US December Employment report was below market expectations. Should positive headlines about the signing of the US-Sino trade deal multiply, we could see the Aussie getting some further strength. AUD/USD continued to rise on Friday and during today’s Asian session, breaking the 0.6905 (S1) resistance line, now turned to support. We maintain a bullish outlook for the pair as the upward trendline incepted since the 10th of the month seems to continue to guide the pair’s direction. Should the bulls remain in charge of the pair’s direction, we could see the pair breaking the 0.6930 (R1) resistance line and aim for the 0.6957 (R2) resistance level. Should on the other hand the bears take over, we could see it breaking the 0.6905 (S1) support line aiming for the 0.6875 (S2) support hurdle.

…while the pound seems to be under pressure…

The pound seems to be under pressure as hints about a possible rate cut by the BoE continued to surface over the weekend. BoE policymaker Vlieghe said over the weekend that he would vote for a rate cut later this month, for an “imminent and significant” improvement of the economy’s growth indicators. It should be noted that Vlieghe is the third consecutive BoE official hinting towards a rate cut, after statements made by BoE’s Tenreyro on Friday and from BoE Governor Mark Carney on Thursday. Should the dark clouds of an imminent rate cut continue to gather over the pound we could see it weakening further. Cable slipped today during the Asian session opening with a negative gap and testing the 1.3015 (S1) support line. We maintain a bearish outlook for the pair and for it to change we would require the pair’s price action to break the downward trendline incepted since the 7th of January. Should the pair continue to move southwards, we could see it breaking the 1.3015 (S1) support line and aim for the 1.2820 (S2) support barrier. Should the pair long positions be favoured by the market, on the other hand, we could see it breaking the prementioned downward trendline and aim if not break the 1.3170 (R1) resistance line.

Other economic highlights today and early tomorrow

Today we get from the Czech Republic the country’s CPI rate for December, while from the UK we get the GDP rates for November and the manufacturing output for the same month. During tomorrow’s Asian session, we get Japan’s current account balance for November.

As for the rest of the week

On Tuesday, we get from Japan the current account balance for November, from China the trade data for December and from the US the core and headline CPI rates for December. On Wednesday, we get from the UK the core and headline CPI rates for December as well as Eurozone’s industrial output for November. On Thursday, we get from Japan the Corporate Goods Price for December, the machinery orders for November, from Turkey the CBRT interest rate decision, from the US retail sales for December and the Philly Fed Business Index for January, while the ECB publishes the account of its last monetary policy meeting. On Friday, we get China’s retail sales, industrial output, both for December, the GDP for Q4, UK’s retail sales for December, the US industrial output for December and the Preliminary Univ. Michigan Consumer Sentiment for January.

Support: 0.6905 (S1), 0.6875 (S2), 0.6850 (S3)

Resistance: 0.6930 (R1), 0.6957 (R2), 0.6980 (R3)

Support: 1.3015 (S1), 1.2820 (S2), 1.2600 (S3)

Resistance: 1.3170 (R1), 1.3340 (R2), 1.3500 (R3)