U.S. Highlights

- Global bond yields moved higher this week following cautiously hawkish statements by central bankers last week.

- Above-trend economic growth in advanced economies is expected to persist. But, inflation is expected to lag owing to a number of structural factors working to suppress price growth.

- Altogether, model simulations of shocks to inflation and the unemployment rate supports the FOMC’s cautious pace of monetary policy normalization. The last thing the Fed or other global central banks would want to do is to have to reverse course several quarters from now, and risk impairing their credibility.

Canadian Highlights

- The Bank of Canada will meet next week to decide on interest rates. A continuing trend of strong economic data this week makes it likely that the Bank will announce an increase in the overnight rate, removing one of the two emergency rate cuts it made in 2015 as cushion against falling oil prices.

- Despite strong economic growth, there is little urgency on the inflation front. Indeed, inflation has been moving away from the Bank of Canada’s 2% target over the past several months. Given an inflation target that is intended to be symmetric

U.S. – Fed is Right to be Concerned with Low Inflation

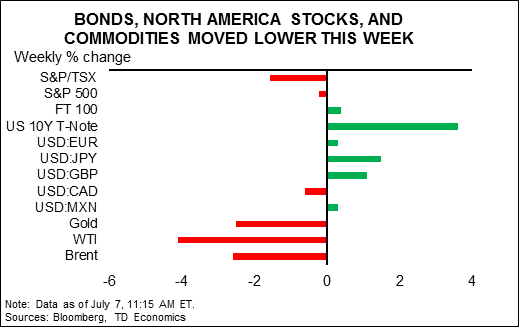

Although a short week, the bond sell-off resumed on global financial markets, taking yields higher following cautiously hawkish statements by central bankers last week (Chart 1). Selling pressures intensified domestically and across the pond, with European markets reacting in advance of the tapering of ECB asset purchases expected to begin early next year.

Curiously, this repricing episode has little to do with a material change in underlying economic fundamentals. Indeed, economic growth in advanced economies has exceeded trend for a number of quarters and is expected to continue to do so through next year. Similarly, labor markets continue to tighten. This morning’s payrolls report shows that U.S. labor demand remains very healthy. The economy added 222k jobs in June – well above the estimated 80-100k jobs necessary to hold the unemployment rate constant. Furthermore, wage growth is encouraging, but still historically subdued given estimated tightness of the labor market.

Instead, markets had been caught overly discounting future inflation and rate guidance by central banks, and for good reason. Subdued inflation is a key concern of global policymakers, including the Fed, as the minutes of June’s FOMC minutes revealed this week. Participants are clearly concerned about the persistence of weak underlying inflation, even while they deemed risks to the near-term inflation outlook as broadly balanced.

Unlike in the past, monetary tightening this time around is likely to be more a leap of faith. Economists and monetary policymakers alike continue to believe that the relationship between economic slack and prices will eventually reassert itself, leading to sufficient price pressures to overcome some of the structural issues that are suppressing prices. Indeed, there is evidence that permanently weaker energy prices, changes in global supply chains, the expansion of the world’s effective labor force, and the persistence of global excess capacity are factors partly responsible for weakness in underlying inflation in the U.S. and abroad.

Worryingly, these structural factors are not expected to recede anytime soon. As such, the question remains of how inflation-targeting central banks plan to respond to a world of rising demand but weak inflation. Historically, this combination has signaled a positive global supply shock, requiring a more accommodative stance of monetary policy, the exact opposite of what has been communicated by some central banks recently. This is because low interest rates are less stimulative to the real economy if price growth is more subdued.

Model simulations utilizing the Fed’s FRB/US model highlights the need for a more accommodative monetary policy stance (Chart 2). The persistence of a -0.5 ppt shock to underlying inflation in the U.S. implies that the fed funds rate should fall by up to 60bps a year from now. In stark contrast, further labor market tightening, in which the unemployment rate persists 50 bps below the natural rate, would imply an immediate 50bps increase in the fed funds rate. Altogether, this simulation justifies the FOMC’s cautious pace of monetary policy normalization. The last thing the Fed or other global central banks would want to do is to have to reverse course several quarters from now and risk impairing their credibility.

Chart 1: Hawkish central bank Rhetoric Has Helped to Reprice Bonds Globally

Chart 2: Model Simulations Reaffirms need for Caution By the Fed

Canada – Strong Growth and Weak Inflation

Next week, on July 12, the Bank of Canada will announce its policy for the overnight rate. The hawkish turn in central bank communications over the past several weeks has led financial markets to anticipate a rate hike. The justification cited is simple: past rate cuts put in place to cushion the Canadian economy against falling oil prices "have done their job." This is evidenced in robust economic growth that has continued well into the second quarter. The most recent economic data out this week confirm the story, with strong gains in exports in April and another blockbuster job report in June.

With consistently above-trend growth, the economy has made considerable strides in reducing excess capacity. The unemployment rate currently sits at 6.5%, the lowest level in over eight years. The Bank of Canada’s measure of the output gap, which it previously estimated would be closed by the first half of 2018, is either already closed or will be closed before the end of this year.

The missing ingredient is inflation. Rather than moving higher, inflation has decelerated in recent months. Both the headline rate – at 1.3% – and the Bank of Canada’s three preferred core inflation measures – averaging between 1.2% and 1.5% – have been moving away from the Bank of Canada’s target. What is more, the same weakness observed in the price data can be seen in wages. Average hourly wages of permanent employees were up just 1.0% over the past year in June.

Governor Poloz commented on this seeming contradiction in his most-recent interview, noting that the current weakness in inflation is a result of past (oil-induced) weakness in economic growth. The current strong rate of economic growth is anticipated to gradually feed through to higher inflation over the next 18 to 24 months.

Still, there is room for caution. Inflation has been weak globally and is also low and decelerating in regions such as the United States and Europe where economic growth has been more consistent over the past two years. The relationship between economic slack and inflation appears to have diminished to the point where there is little reason to expect a rapid turn higher in inflation.

The risk is that by raising rates in an environment of decelerating inflation, the Bank could tighten financial conditions in a way that makes achieving a return to 2% inflation more difficult. The recent moves higher in the Canadian dollar will not be helpful in supporting the rotation in growth towards exports. Furthermore, it risks anchoring inflation expectations below 2%. There is already evidence that this is occurring. The Bank’s Business Outlook Survey shows the vast majority of businesses (70%) expect inflation to be between 1% and 2%, while less than a quarter expect it to run between 2% and 3%.

Given an inflation target that is intended to be symmetric around 2.0% (with undershoots treated equally to overshoots), and given the heightened level of uncertainty around the outlook for future growth (with upcoming NAFTA negotiations and macroprudential measures slowing housing markets in Ontario), a pause to confirm that inflation is indeed moving in the right direction, would not be out of the question.

Chart 1: Little in the Way of Economic Slack

Chart 2: Inflation Moving Lower, Not Higher

U.S.: Upcoming Key Economic Releases

U.S. Consumer Price Index – June

Release Date: July 14, 2017

Previous Result: -0.1% m/m, core 0.1% m/m

TD Forecast: 0.0% m/m, core 0.1% m/m

Consensus: 0.1% m/m, core 0.2% m/m

Headline CPI inflation is expected to slip to 1.7% y/y in June, with prices flat on the month. We look for energy prices to drive the deceleration, with declines across the board in fuels, electricity and natural gas. Offsetting are further gains in food prices, which are expected to recover further on a y/y basis. We look for another relatively modest 0.1% gain in the core, keeping the core inflation rate stable at 1.8% y/y. While the drag from wireless services prices is likely to dissipate, negative contributions from vehicle prices should continue into June.

U.S. Retail Sales – June

Release Date: July 14, 2017

Previous Result: -0.3%, ex-auto -0.3%

TD Forecast: 0.1%, ex-auto 0.2%

Consensus: 0.1%, ex-auto 0.2%

We expect retail sales post a 0.1% increase in June, as drags from lower auto and gasoline station sales are more than offset by a solid pickup in core sales figures. Motor vehicle sales disappointed for the fifth straight month and eased to a 16.4m unit annual rate vs 16.6m in May, and another sizeable decline in gasoline prices suggests lower gasoline station sales receipts. Core sales – excluding food services, building materials and the above categories – are expected to partially offset these declines with a solid 0.4% increase. These projections would be consistent with Q2 real PCE near a healthy 3% pace.

Canada: Upcoming Key Economic Releases

Canadian Housing Starts – June

Release Date: July 11, 2017

March Result: 195k

TD Forecast: 205k

Consensus: 200k

Housing starts are forecast to post a moderate rebound to a 205k pace in June after two months of deceleration. While data from the Toronto Real Estate Board indicates that the market is still adjusting to new macroprudential measures through June, building permit data suggests that a soft resale market is not yet dissuading development in the region. Building permits also showed a sharp pickup for single and multi-unit projects, suggesting that both could see greater construction activity in June. We do not expect housing starts to recover fully to the six month trend of 215k.

Bank of Canada Rate Decision

Release Date: July 12, 2017

Previous Result: 0.50%

TD Forecast: 0.50%

Consensus: 0.75%

We expect the Bank of Canada to leave rates unchanged at the July decision but acknowledge it is a very close call. Despite the current market pricing, we believe that the Bank’s risk management framework favours an October liftoff over July. Conditions in the wider economy are still largely consistent with April MPR projections and such a rapid shift in tone over such a short period absent of a major shock risks damaging the Bank’s forward looking credibility. Moreover, inflation is weaker than in the April MPR. Looking past the Bank’s decision to leave rates unchanged, the rest of the statement and MPR should confirm a hawkish tone conveyed in Wilkins’ speech, citing the strength of the labour market and domestic demand while playing down soft levels of inflation as a lagged symptom of prior excess slack. In the press conference, Poloz will likely acknowledge that removing accommodation was discussed and that future rate hikes will be gradual and consistent with the evolution of economic data, particularly inflation.