Friday July 7: Five things the markets are talking about

Global bond yields remain elevated as investors wait for this week’s main event, non-farm payrolls (NFP).

It seems that the market is becoming more anxious that central banks are moving towards reducing stimulus efforts that have supported debt markets. The eurozone remains at the center of the selling as the yield on 10-year German Bunds rallies to its highest level in 18-months.

The U.S Labor Department reports its official jobs figures for June at 08:30 am EDT. American employers are expected to have added around +175k jobs last month along with wage growth.

Average hourly earnings are expected to improve in today’s employment report, but not very much, the market is looking for a +0.3% monthly gain versus June’s very subdued +0.2% increase. Year-on-year, consensus is looking for earnings to rise to a +2.6%.

Note: +3% is considered the minimum necessary to boost the Fed’s most closely watched inflation measure, the PCE core.

If average hourly earnings prove a surprise in June, either improving more than expected or slowing more than expected, other headline prints (NFP and unemployment rate) may actually take a back seat for intraday moves.

Also, the G-19 + 1 summit begins in Hamburg this morning – U.S President Trump is expected to hold his first meeting with Russia’s Vladimir Putin as well as meet his Chinese counterpart Xi Jinping.

1. Global stocks under pressure from rising yields

Rising global interest rates continue to weigh on equity sentiment.

Overnight, benchmarks in Japan, Korea and Hong Kong all fell for the third session in four, while Australia’s S&P/ASX 200 has dropped three straight in recording a regional-worst -1% decline – the index has seen red for a third-consecutive week.

The outlier has been China to a certain extent; the Shanghai Composite has now risen for the ninth session in eleven with its overnight +0.2% climb.

In Europe, stocks remain under pressure following a barrage of macro data. Oil price continue to drag on energy stocks, while tightening concerns from central banks is providing added pressure.

U.S equities are set to open in the red (-0.1%).

Indices: Stoxx50 -0.2% at 3,455, FTSE -0.2% at 7,324, DAX -0.2% at 12,360, CAC-40 -0.4% at 5,133, IBEX-35 -0.4% at 10,463, FTSE MIB -0.6% at 20,967, SMI -0.3% at 8,860, S&P futures +0.1%

2. Oil prices fall on signs market still oversupplied, gold little changed

Ahead of the U.S open, oil prices are down more than -2% after data showed U.S production rose last week just as OPEC exports hit a 2017 high, basically casting doubt on efforts by producers to curb oversupply.

Brent futures are down -$1.07, or -2.2%, at +$47.04 a barrel, its weakest level in more than a week. U.S West Texas Intermediate (WTI) crude futures are trading at +$44.40 a barrel, down -$1.12 or -2.5%.

Weekly U.S government data showed yesterday that U.S. oil production rose +1% to +9.34m bpd, correcting a drop in the previous week that was down to one-off maintenance issues.

Note: The market has ignored news from the EIA that U.S crude inventories fell by -6.3m barrels in the week to June 30 to +502.9m barrels, the lowest since January.

For now, rising geopolitical risks is providing some support for gold. The precious metal is little changed (-0.2% to +$1,220.97 an ounce) overnight as tensions on the Korean peninsula stoked safe-haven demand for the metal. Nevertheless, the dollars strength is expected to provide weight for some metal prices.

3. Global yields rally on monetary policy fear

Global government bonds continue their sell off as anxiety toward less monetary policy support from central banks continue to drive investors to cut bond holdings.

The center of the selling remains in the eurozone where government bond yields have jumped broadly. The yield on the 10-year German Bund has moved back above the psychological +50 bps to +0.56%, a level not seen since early 2016. The selling pressure has spread to the U.K, the U.S, Canada, Denmark and Sweden.

Yesterday, the yield on U.S 10’s touched +2.38%, the highest level since May 11.

Elsewhere, down-under, Australia’s benchmark yield has gained +2 bps to +2.66%. Earlier this week, the Reserve Bank of Australia’s (RBA) Harper said that Aussie policy makers are “comfortable holding interest rates for now and see no reason to scare the horses at the moment” by signalling coming interest rate increases.

4. Dollar range bound until NFP

Major currency pairs sit atop some key levels ahead of NFP.

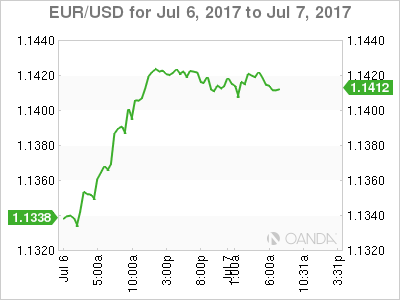

The EUR (€1.1412) remains at the high end of yesterday’s rise as recent ‘hawkish’ commentary from ECB officials continue to keep the ‘single’ unit supported. Through €1.1427 the bulls are targeting June’s high of €1.1447.

Sterling (£1.2907) is under pressure from weaker UK IP/MP data (see below), techies note support around £1.2890 area, which corresponds to the weekly lows. EUR/GBP has spiked to €0.8838, with resistance seen at €0.8845 initially.

Yen (¥113.65) is weaker in the overnight session as the Bank of Japan (BoJ) acts to slow JGB yield rise – officials announced that they would increase purchases of 5-10 year JGB’s to +¥500B from +¥450B at its upcoming QE operation.

5. British Industrial Output Falls Unexpectedly

Data this morning showed that U.K. industrial production shrank unexpectedly in May, falling -0.1% vs. +0.3% gain expected, while factory output fell by -0.2%, against expectations of +0.3% growth.

Note: Industrial output was dragged lower by a fall in manufacturing output and lower energy production.

It’s further proof that U.K economic growth has failed to pick up in Q2 after a sluggish start to the year.

Similar to other Central Bank rhetoric of late, the Bank of England (BoE) is considering raising interest rates given high inflation, however, disappointing economic data like this should surely give sterling ‘bulls’ pause for thought?