US stocks ended the day at record levels as investors ignored the impeachment of Donald Trump. They instead focused on the strong US economy and corporate earnings. The S&P500 ended the day above $3,200 for the first time while the Nasdaq composite gained 60 basis points. Part of the reason why impeachment did not matter to investors was that the results were already known. Meanwhile, the market received some negative housing data yesterday. Existing home sales declined by 1.7% in November to 5.35 million. That was lower than the consensus estimates of a 0.2% decline. According to the National Realtors Association, the housing sector has rebounded this year but it has been affected by a shortage of labour. The market will receive the final reading of third quarter GDP data.

The Canadian dollar declined against the USD following mixed economic data from Canada. Data from ADP showed that nonfarm employment increased by 30.9k. This was much higher than the previous 2.9k. Another data showed that wholesale sales declined by -1.1% in October, which was lower than the previous gain of 0.8%. The market will receive retail sales data from the country. Headline sales are expected to rise by 0.5% while core retail sales are expected to rise by 0.3%. The new housing index is expected to rise by 0.1%. Meanwhile, traders reacted to the passage of the USMCA deal in Congress.

Sterling declined as the markets reacted to the monetary policy decision by the Bank of England. As was widely expected, the bank left rates unchanged. 7 members voted for the rates to remain unchanged while two others voted to lower them. The bank also maintained the monthly GBP 10 billion asset purchases. At the same time, the bank was dealing with a new report that high-frequency traders had gained access to a sensitive feed that had been leaked before it became public. Meanwhile, Andrew Bailey, who heads the Financial Conduct Authority (FCA) will become the next BOE governor. The market will receive the GDP data from the UK today.

GBP/USD

The GBP/USD pair declined to a low of 1.2990 as traders reacted to mixed information from the United Kingdom. The price is below the 14-day and 28-day moving averages. It is also below the level it was before the UK election which saw Boris Johnson steal the limelight. The RSI has moved to the oversold level while the price is above the Ichimoku cloud. The pair may see some significant movements in reaction to the GDP data.

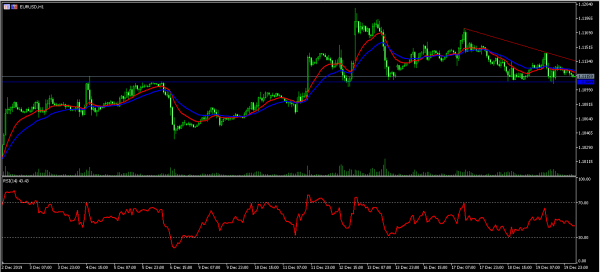

EUR/USD

The EUR/USD pair was relatively unchanged in the Asian session. The pair is trading at 1.1115. The pair has been forming a descending triangle pattern on the hourly chart. The price is slightly lower than the 14-day and 28-day moving averages while the RSI has remained at the neutral level of between 40 and 50. The level to watch will be the important support of 1.1105.

XBR/USD

The XBR/USD pair remained close to its YTD high as traders looked ahead to the new year. The pair, which is up by 15% this year, has been on an upward trend on the four-hour chart. The price is above the 14-day and 28-day moving averages while the RSI has moved to the overbought level. The average true range has been declining, a sign of low volatility. The pair may continue moving slightly higher today.