U.S. Review

Hiring Report Telling You Be of Good Cheer

- The latest hiring data are an encouraging sign that the U.S. economy is withstanding the global slowdown and continued trade-related uncertainty. Solid labor market conditions echo the Fed’s assessment that the current stance of monetary policy remains appropriate. The FOMC will be on hold next week.

- Despite encouraging signals from the labor market, the trade war remains a headwind. Murmurs of a possible “Phase I” trade deal flooded news headlines this week, but continue to be void of details. Trade uncertainty continues to weigh on manufacturing and has permeated into the service sector, though not nearly to the same extent.

Hiring Report Telling You Be of Good Cheer

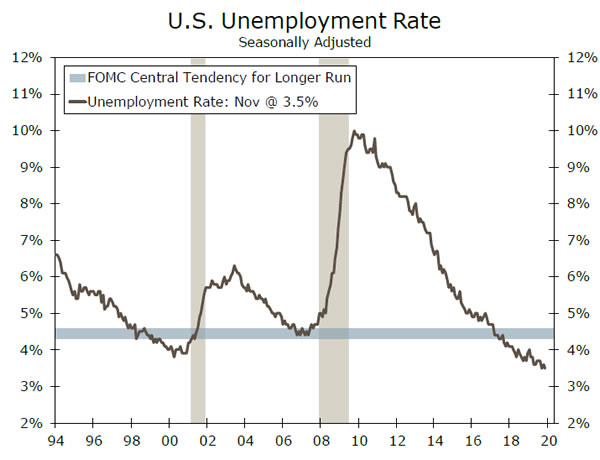

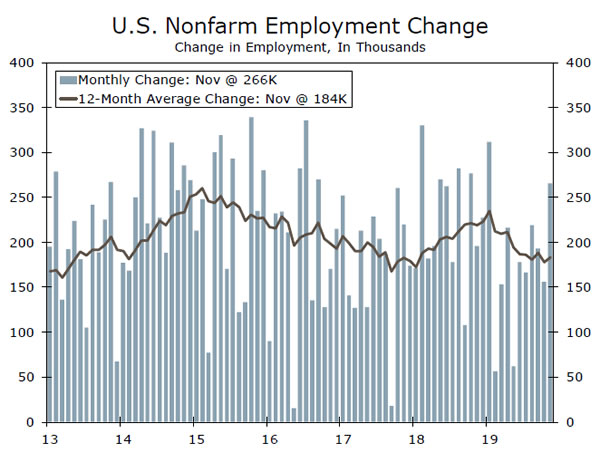

Hiring came roaring back in November, as employers added a whopping 266K net new jobs. Employers also hired more workers in October than previously thought with the revised data showing a gain of 156K, up from 128K previously estimated. The unemployment rate ticked back down to its 50-year low of 3.5%.

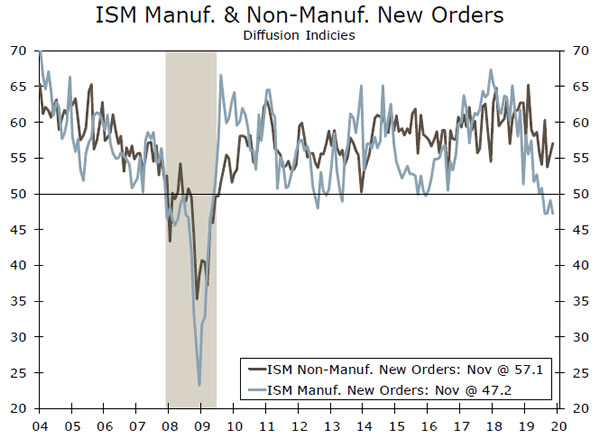

The recent hiring data are an encouraging sign that the U.S. economy is withstanding the global slowdown and continued trade-related uncertainty. Manufacturing employment rebounded in November, partly due to a reversal of the GM strike in the October data. But still, this was a welcome sign considering the employment component of the November ISM manufacturing survey earlier this week pointed to weakening manufacturing employment. Manufacturing data, more broadly, remain weak with the ISM manufacturing index in negative territory—below 50—for the fourth straight month. There is little sign of recent weakness abating as the forward-looking new orders component slipped to tie its August reading for the lowest of the expansion.

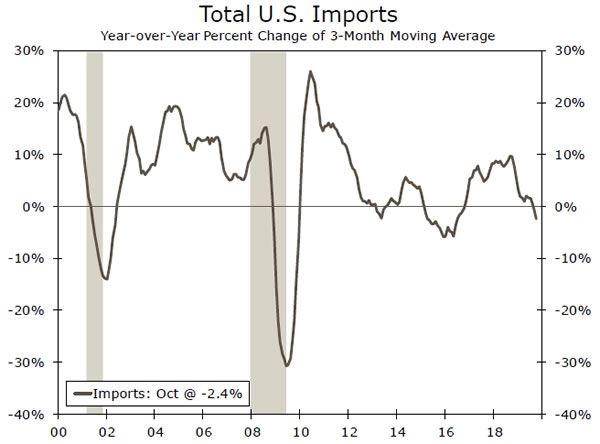

Thankfully, the much larger service sector has held up fairly well, as hiring continues to show few signs of spillovers from the weakness in manufacturing. Notably, the ISM non-manufacturing index remains in expansionary territory, and new orders point to continued growth in the sector. There appears to be some pressure from the trade war, however, as respondents from several industries highlighted cost pressures specifically linked to tariffs, and the import component of the survey remained in contraction for the third straight month. This is corroborated by a 1.7% drop in October imports. The weakness was concentrated in goods imports as services imports actually rose to a record high. Good imports were depressed by a decline in consumer and auto imports—likely trade-related payback (consumer goods imports, which surged in August, were likely pulled forward to get ahead of the consumerfocused tariffs that went into effect in September) and the effects from the GM strike. Still, trade in goods with China continues to slide as negotiations drag on.

We would understand if you feel you’re getting whiplash from the trade headlines. Wednesday opened to news that both sides were moving closer to agreement and that U.S. negotiators expect a “Phase I” deal to be agreed upon before the December 15 tariff deadline. That came after President Trump said on Tuesday that he would be happy to wait until after the 2020 election to make a trade deal with China. There is still little detail to the more recent trade optimism, and we cannot justify hearsay as our base-case forecast. As such, we have stuck with our assumption that the additional tariffs will go into effect on December 15, though we acknowledge if a “Phase I” deal is reached these tariffs could be delayed or postponed indefinitely.

For an FOMC that will be meeting next week, the most recent slab of data corroborates its view that the current stance of monetary policy remains appropriate. The FOMC will be on hold next week, and if the solid read on the labor market is sustained, barring any escalation in the trade war, the case for further easing is weaker.

U.S. Outlook

NFIB Small Business Optimism • Tuesday

Small business owners have remained generally upbeat about overall economic conditions, and sentiment probably got a further boost in November from renewed optimism surrounding a “Phase I” trade deal and the ensuing stock market rally. Both the October NFIB survey and our own Q4 Wells Fargo Small Business Survey rose solidly, and to levels that might seem overly sanguine given the current stage of the economic cycle, recession fears earlier this summer and the unresolved nature of the trade war. Still, the survey results are instructive—small firms typically have less exposure to trade and global growth, and their optimism is perhaps another piece of evidence that the domestic economy is resilient enough to avoid significant spillover from the faltering sectors of the global economy.

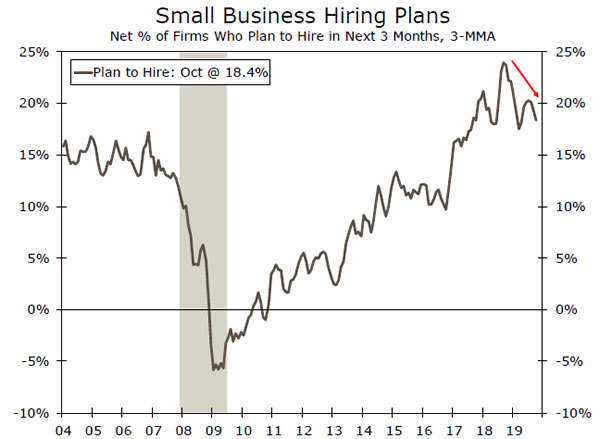

We are closely watching small business hiring plans, which often lead overall payroll growth. This leading indicator peaked in August 2018 and is auguring for a slowdown in nonfarm hiring.

Previous: 102.4 Consensus: 103.0

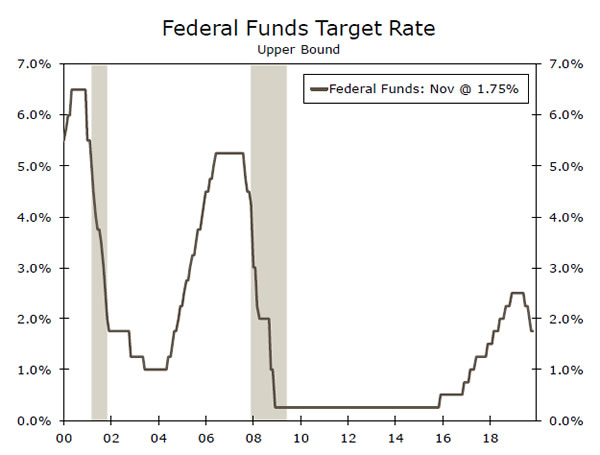

FOMC Meeting & CPI • Wednesday

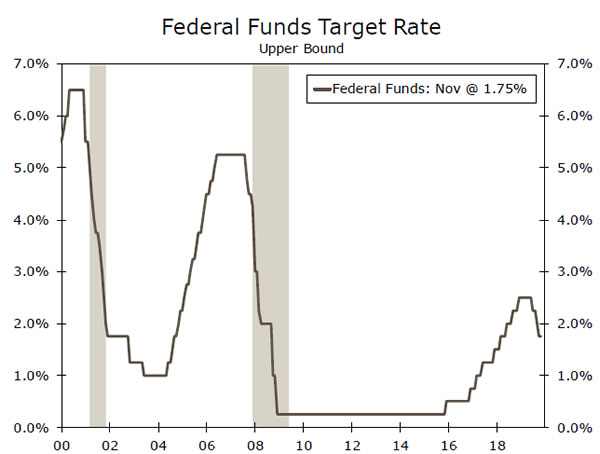

After cutting rates at three consecutive meetings, the FOMC will be on pause at its final meeting of 2019. The implied probability of a cut has fallen to 0% from above 50% as recently as October, while the probability of a hike has actually climbed to around 3%. We take this, along with the steepening of the yield curve and the general easing of financial conditions this fall, as a reasonable indication of the efficacy of the 75 bps of insurance cuts. With no changes to the fed funds rate in store, we will instead be focusing on the new Summary of Economic Projections, which is published every other FOMC meeting and includes a new dot plot, and any comments on funding market volatility as we approach year-end.

The FOMC has also demonstrated a willingness to let inflation run a little hot, or at least above its symmetric 2% target. It has yet to do so, however, and likely will not in the November CPI report. We expect just a 0.2% gain, pushing the year-over-year rate to 2.0%.

Previous: 1.75% & 0.4% Wells Fargo: 1.75% & 0.2% Consensus: 1.75% & 0.2% (Month-over-Month)

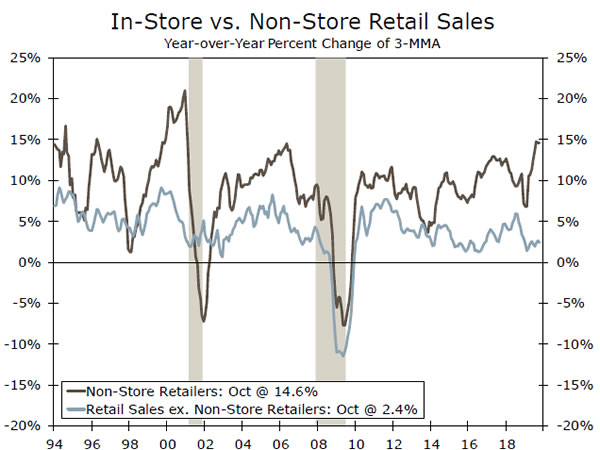

Retail Sales • Friday

We expect consumers entered the holiday sales season ready to spend, pushing retail sales a solid 0.5% higher in November, slightly above consensus. The 266K-job gain in November, and the firming in hiring the past six months, support our belief that consumer fundamentals remain sturdy enough to support continued growth in consumer spending. More broadly, we expect holiday sales—in November and December, excluding car, gas and restaurant sales— to post a 5.0% year-over-year gain. This reflects in large part the very weak year-ago comparison, but it does also reflect our belief that consumers will continue to hold up overall economic growth.

Other issues to watch: the explosion in non-store retail sales—mostly online shopping—and how this is changing the retail landscape. More immediate is how the imposition of tariffs on a new tranche of consumer goods on December 15 will play out. A “Phase I” deal could delay this, but we’re now just a week away with no deal in hand.

Previous: 0.3% Wells Fargo: 0.5% Consensus: 0.4% (Month-over-Month)

Global Review

Are We There Yet?

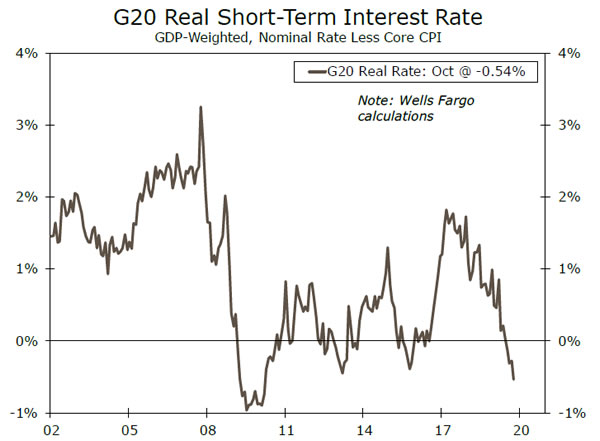

- While the global bias remains towards easier monetary policy, there are some hints we may be getting closer to the end of this global easing cycle. Among the several announcements this past week, central banks in Australia, Canada, India and Chile all held rates steady, while Canada and Chile also hinted at rates remaining on hold for the foreseeable future.

- The news from the Eurozone was mixed this week. The Q3 GDP details showed a reasonably solid domestic economy as underlying final domestic demand rose 0.4% quarter-overquarter, but Eurozone retail sales and German industrial output both registered large declines in October.

Peering Below the Surface of the Eurozone Economy

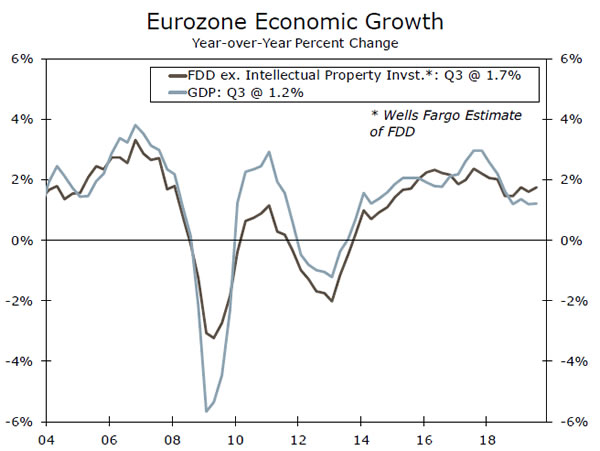

Although there was no decisive new economic news from the Eurozone this week, the detailed release of Eurozone Q3 GDP figures offered some interesting insights into the sectoral performance of the region’s economy. Overall GDP growth was unrevised at 0.2% quarter-over-quarter and 1.2% year-over-year. However, the details showed some resilience in domestic demand with consumer spending up 0.5% quarter-over-quarter (consistent with solid household income growth) and gross fixed investment up 0.3%. For Q3, our estimate of Eurozone underlying final domestic demand rose 0.4% quarter-over-quarter.

Indeed, we believe the resilience of the consumer and services sector will help the Eurozone economy avoid recession despite weakness in industrial output, which fell 0.4% quarter-overquarter in Q3. That said, the signs from the industrial sector are still somewhat mixed. The Eurozone November manufacturing PMI rose to 46.9, a second straight gain, but German October industrial output slumped 1.7% month-over-month. Altogether we see Eurozone GDP growth of 1.1% in 2019 and 1.0% in 2020.

The RBA Turns More Constructive, but the Data Do Not Cooperate

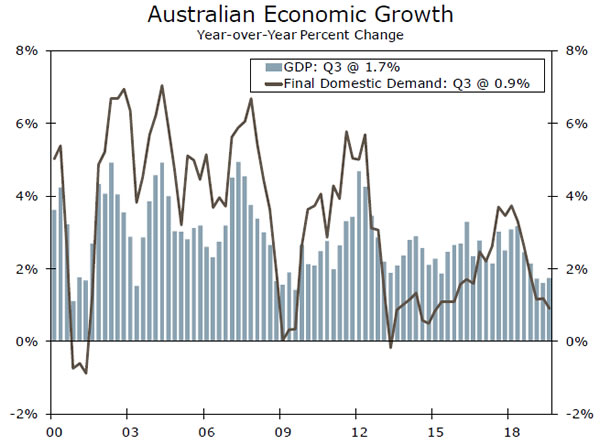

The Reserve Bank of Australia (RBA) held its Cash Rate at 0.75% this week and was somewhat more upbeat in its assessment of the economy, saying that rate cuts were supporting employment and income growth, risks to the global economy had lessened and that there was some turnaround in the housing market. Still, the RBA said it was prepared to ease policy further if needed, and this week’s data have not exactly conformed to the central bank’s more constructive view. Australia’s Q3 GDP rose 0.4% quarter-overquarter, a slight downside surprise, while final domestic demand continues to grow at an even more subdued pace, rising just 0.2%. Meanwhile retail sales were flat in October, instead of rising as expected. With the Australian economy still underperforming to some extent, we expect further monetary easing from the RBA in 2020.

The Bank of Canada Looks More Comfortably on Hold

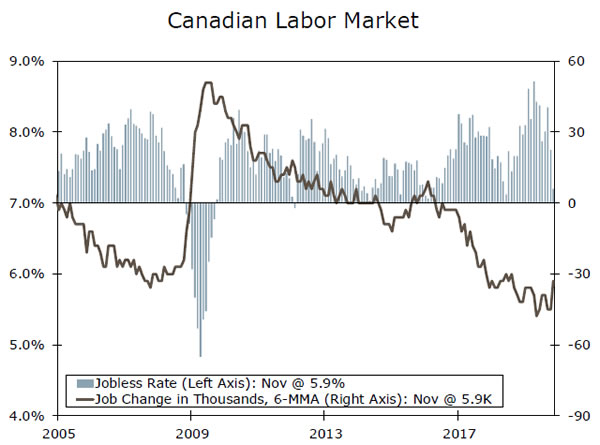

The Bank of Canada also kept its policy rate steady at 1.75% this week, but appears somewhat more comfortable with its “on hold” monetary policy stance. The central bank said there was nascent evidence the global economy was stabilizing and that recession concerns were waning. Specifically related to Canada, the BoC cited strong wage growth and solid investment spending in Q3, adding that overall economic growth performed as expected during the third quarter. Meanwhile, the BoC did not offer any hints of forthcoming monetary policy easing.

Canada’s November jobs report was a significant disappointment, as employment dropped 71,200, bringing the average job gain over the past six months to just 5,900 per month. In addition, the unemployment rate jumped to 5.9%. Despite the weak report we don’t think this one data point will be enough to change the central bank’s monetary policy outlook, and we still expect the Bank of Canada to remain on hold for the foreseeable future.

Global Outlook

U.K. Monthly GDP • Tuesday

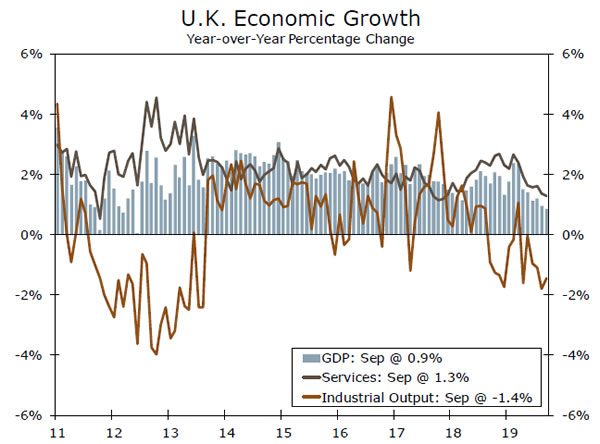

U.K. growth has displayed a decided downshift as Brexit uncertainties appear to have finally caught up with the economy. For October the consensus forecast is for GDP to rise a moderate 0.1% month-over-month, although that comes after consecutive declines in August and September. By sector, services output is expected to rise by 0.1% in October, after being unchanged in September, while industrial output is expected to rise by 0.2%, which would be the first increase since July. Given the sub par growth performance of the U.K. economy, we expect the Bank of England will keep monetary policy on hold for the foreseeable future.

Next week also sees the U.K. general election, with some opinion polls suggesting the Conservative party might secure an outright parliamentary majority. Should that occur the chances of an initial Brexit deal should jump higher, though we do not view that as a panacea that would fully resolve all economic uncertainties.

Previous: -0.1% Consensus: +0.1% (Month-over-Month)

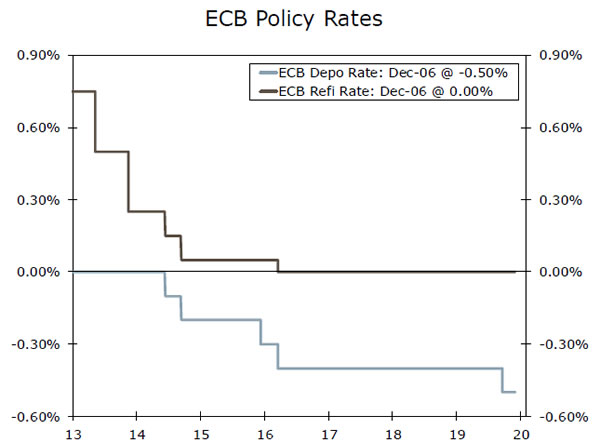

European Central Bank • Thursday

The European Central Bank (ECB) makes its final monetary policy announcement for 2019 next week. The ECB announced a range of easing measures in September including, among things, a 10 bps cut in its deposit rate, a resumption of its asset purchases program and easier terms and conditions for its targeted medium-term loans. For December, however, we expect the ECB will hold monetary policy steady, reflecting some mild stabilization in recent economic data, the lack of especially clear signals from policymakers of further easing and allowing time for the September easing to take effect before taking further policy action. That said, we still believe the underwhelming performance of the Eurozone economy could lead to further easing, and we expect a rate cut in March next year.

The Swiss National Bank (SNB) also announces monetary policy next week—despite negative inflation and dovish comments, the SNB is forecast to hold its SNB policy rate steady at -0.75%.

Previous: -0.50% Wells Fargo: -0.50% Consensus: -0.50%

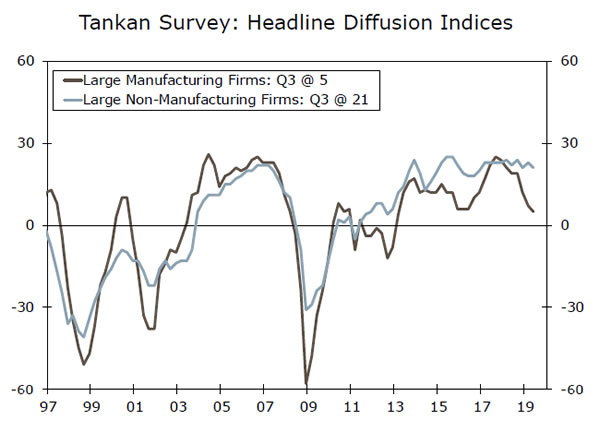

Japan Tankan Survey • Friday

The Tankan survey is one of Japan’s most closely followed economic releases, with next week’s Q4-2019 survey coming well ahead of the official GDP release. The Q4 survey should provide some interesting insights on the sectoral performance of Japan’s economy. The large manufacturers’ index has fallen in recent quarters, to +5 in Q3, consistent with the manufacturing slowdown seen globally. For Q4 some further deterioration is expected, with the large manufacturers’ index expected fall to +3.

Another key question surrounding the growth outlook is how Japan’s economy is coping with the consumption tax increase that was implemented in October. The large non-manufacturers’ index, covering the service sector, may provide clues. That index is forecast to fall to +16 in Q4, from a reading of +21 in Q3. That would be the same as the five-point decline seen in the large non-manufacturers index at the time of the 2014 consumption tax hike.

Previous: 5 (Large Mfg Index), 21 (Large Non-Mfg Index) Consensus: 3 (Large Mfg Index), 16 (Large Non-Mfg Index)

Point of View

Interest Rate Watch

FOMC Presses Pause

The FOMC’s signaling since October that it will be on hold for at least a bit looks prescient in light of the renewed strength in hiring signaled by the past two employment reports. Along with most economists and financial market participants, we expect the Fed to keep rates unchanged at its meeting next Wednesday after cutting rates in each of the past three meetings.

With “insurance” now taken out, it will come down to how the economy is performing. Said differently, it is back to data dependency rather than risk dependency. Chairman Powell noted during his press conference following the last FOMC meeting that the committee will need to see a “material” weakening in the outlook before cutting rates again.

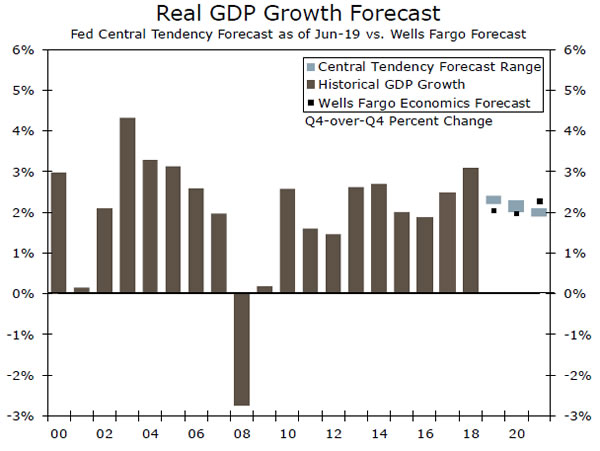

The December meeting will provide an update to the FOMC’s economic outlook through its Summary of Economic Projections. Based on the most recent data, we do not anticipate any meaningful adjustments to GDP and unemployment projections for this year or next. The median estimates for both GDP and the unemployment rate should remain favorable relative to longer-run estimates. Expectations for core inflation may sink a bit further below 2%, however. With inflation still expected to struggle to meet 2%, let alone rise above it for a time to demonstrate the “symmetric” nature of the target, we would expect the Fed to maintain its easing bias.

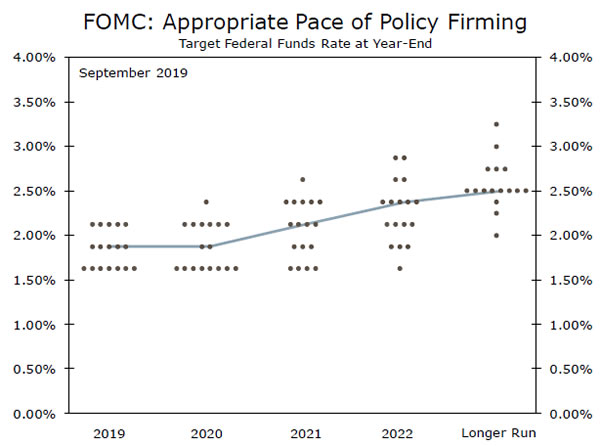

The easier policy stance the FOMC has settled upon is likely to become evident in the dot plot. The fed funds rate is already below the median estimates for 2019-2022. The extent to which the dots shift lower over the next few years will offer some clues as to whether officials think they can reverse this year’s “mid-cycle adjustment.”

We will also be paying attention for any guidance on its balance sheet tools. Though we expect that the Fed will eventually create a standing repo facility that will be available on a “permanent” basis, we do not expect that facility will be operational until next year, and think it’s a bit premature to expect that technical details of such a facility will be announced at next week’s meeting.

Credit Market Insights

Lower Rates Already Helping Housing

The FOMC is widely expected to keep rates steady next week, as it takes a step back to watch how its three rate cuts since July filter through the economy. One area where lower interest rates have already had a material impact is the housing sector. Initially, it appeared lower interest rates were just enticing current homeowners to refinance. In the months following the FOMC’s first rate cut of the cycle, mortgage rates hit a three year low of 3.49%, as the Mortgage Bankers Association’s refinancing index hit a three year high. Looking back at the past few months of data, however, it is clear that lower rates have also encouraged more home buying. October sales of existing homes brought the three-month average up to a 5.44 million-unit pace since August, above a 5.36 million-unit pace over the same period last year. Meanwhile, sales of new homes have averaged a 726,000-unit pace over the past three months, the fastest pace since August 2007. This increase in demand has spurred more homebuilding. Singlefamily housing starts in particular are up to a 921,000-unit pace, which is the fastest since October 2007.

The decision to buy a new home does not just come down to borrowing costs, however. Rising incomes and a strong labor market have also played a key role in improving affordability for home buyers. With the Fed not signaling for rate hikes any time soon and the labor market’s continued resilience, we anticipate that this improvement in the housing market should continue into 2020.

Topic of the Week

The Beginning of the End?

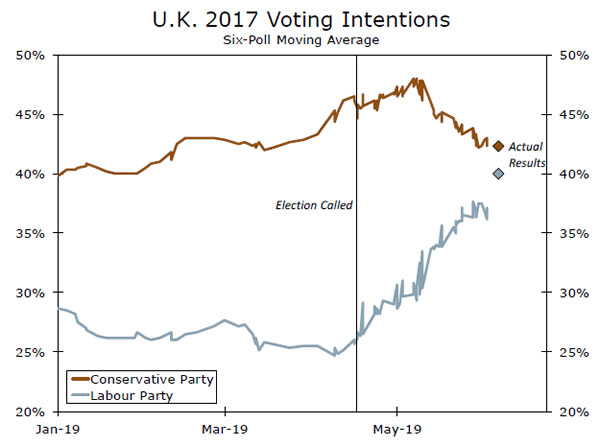

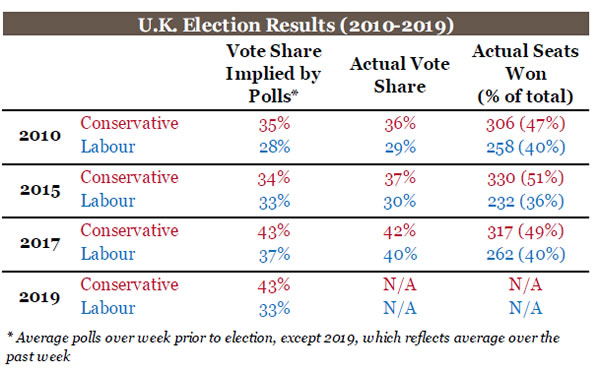

With a week to go until the United Kingdom’s highly anticipated general election on December 12, we note that as the 2017 election showed us, polls can shift abruptly in a short period of time ahead of elections (top chart). Based on the average of all polls over the past week, Conservatives are currently polling at around 43% of the vote, while Labour is in a fairly distant second with 33% of the vote. As the bottom table shows, the Conservatives currently enjoy a larger lead in the polls compared to past elections, and importantly compared to the 2017 election, when they surprisingly lost their parliamentary majority.

The most likely outcome based on current polling, and current market pricing, is one in which the Conservative Party secures a majority in U.K. Parliament and Boris Johnson remains the prime minister. There are few, if any, certainties when it comes to the Brexit process, but we can say with a substantial degree of confidence that if the Conservatives win an outright majority in Parliament, they will likely ratify the withdrawal agreement and leave the European Union with a deal by January 31, 2020. This outcome, which is also our base-case scenario, would provide some safeguard against the most economically damaging Brexit scenarios and would allow the U.K. to finally leave the E.U. with a deal in place. As we have previously noted, this would not end the Brexit process, but instead be the beginning of “phase two,” or longerterm E.U.-U.K. trade talks.

If the Conservatives do not win a majority, a second referendum is a very real possibility, although this would likely be asking voters some version of “do you want to leave the E.U. with a deal or not leave the E.U. at all?” We also see a considerable chance the Bank of England could cut rates as early as December amid uncertainty over the next steps in any other scenario other than a Conservative majority. As a final note, a “no deal” Brexit is still a possible outcome. If the Conservatives fall short of a majority in the election, we see a risk that a minority or coalition government could face the same disagreements as the current government, and could stumble toward the January 31 deadline with no plan for how to proceed with the Brexit process.