The price of crude oil declined sharply on Friday as the market remained pessimistic about the upcoming OPEC meeting. The price of Brent fell from $63.05 to $60.17. The price rose slightly during the Asian session after the Wall Street Journal (WSJ) reported about the meeting. The journal, citing sources, said that Saudi Arabia would push for an extension of oil production cuts through mid-2020. The country hopes that commitments to supply cuts would lead to the higher oil price. It would also boost the Saudi Aramco stock price. However, talks of supply cuts are being overshadowed by growing unrest in the Middle East. Another key concern is that a number of OPEC members like Nigeria and Iraq are not complying with these supply cuts.

Asian stocks rose sharply in reaction to positive data from China. The country released the manufacturing PMI data for November on Saturday. The manufacturing PMI came in at 50.2. This was the first time the country reported a PMI above 50 since April this year. A PMI above 50 is usually a sign of expansion. Non-manufacturing PMI came in at 54.4, which was higher than the 52.8 released last month. The composite PMI was 53.7. These numbers came at a time when the market is optimistic that a trade deal between China and the US would be reached in December. The Nikkei, Shanghai index, and ASX rose by 228, 12, and 33 points respectively.

The Australian dollar rose slightly in reaction to strong Chinese data. Meanwhile, data released from the country showed that the economy was struggling. Private house approvals declined by 7% in October after rising by 2.8% in September. Company gross operating profits declined by -0.8% in the third quarter after rising by 4.5% in the previous quarter. Business inventories declined by -0.4% in the third quarter while building approvals declined by 8.1%. They had risen by 7.6% in September. On a positive note, the country’s manufacturing PMI rose to 49.4 in November. Later today, the market will receive PMI data from European, South Africa, Asian, and North American countries.

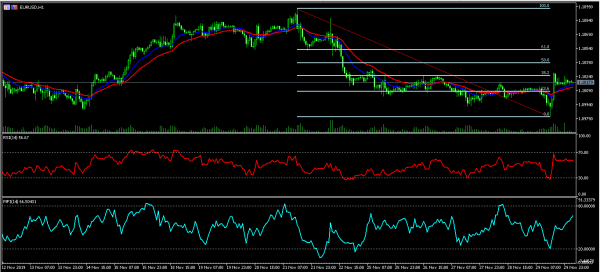

EUR/USD

The EUR/USD pair was slightly unchanged during the Asian session. The pair is trading at 1.1017, which is between the 23.6% and 38.2% Fibonacci Retracement. The price is slightly above the 14-day and 28-day moving averages. The RSI has stabilised along the 55 level while the money flow index has risen. The pair may breakout in either direction as the market receives important PMI data.

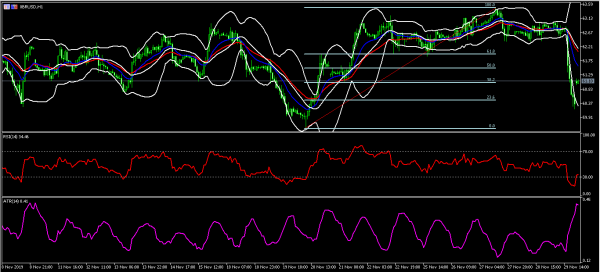

XBR/USD

The XBR/USD pair declined from 63.05 to a low of 60.17 on Friday. The price rose to an intraday high of 61.10 during the Asian session today. The price was along the 38.2% Fibonacci Retracement level. The price is also below the 14-day and 28-day moving averages. It is also between the lower and middle line of the Bollinger Bands. The ATR has also risen sharply, which is a sign of increased volatility. The pair may be a bit volatile this week as OPEC members meet.

XAU/USD

The XAU/USD pair declined to a low of 1459.97 during the Asian session. This was slightly below the day’s high of 1466.58. This price was below the 38.2% Fibonacci Retracement level. The price is along the 14-day moving average and slightly above the 28-day moving averages. The RSI has moved from a high of 70 to the current 53. The pair may continue to decline to a low of 1450.