US markets ended the day slightly higher yesterday as the markets reacted to better-than-expected data released on Wednesday. The numbers from the Bureau of Economic Analysis showed that the economy grew by 2.1% in the third quarter. This was a slight improvement from the 2.0% growth reported in the second quarter. US markets will be closed as the country celebrates the Thanksgiving weekend. This means that volume will be slightly lower. At the same time, investors will be looking at data on Black Friday spending.

The Japanese yen strengthened after the country released important economic data. The headline Tokyo CPI for October came in at 0.8%. This was higher than the previous growth of 0.4%. The unemployment rate for Japan remained unchanged at 2.4%. The preliminary industrial production data declined by -4.2% after rising by 1.7% in October. This was lower than the consensus estimates of a -2.1% decline. The Japanese economy has defied Philip’s curve, with a low unemployment rate and low inflation.

The markets will focus on Europe as the region receives important data. In Germany, the markets are waiting on October’s retail sales, unemployment change, and import price index. This will come a day after the country released weak CPI data. France will receive the preliminary CPI, GDP, and PPI data for October. From Sweden, the second reading of the third quarter GDP is due. The UK is expecting mortgage approvals and lending data. Finally, the market will receive the preliminary CPI data from Europe. Meanwhile, across the Atlantic, in Canada, the GDP, IPPI, and RMPI figures will be released.

GBP/USD

The GBP/USD pair rose yesterday after a poll predicted a landslide win for the Tories. The poll from YouGov showed that the conservative party would win 359 seats, up from the previous 317. The pair then dropped in overnight trading after Johnson failed to show up for debate. The pair is trading at 1.2908 from yesterday’s high of 1.2950. The current price is along the 50% Fibonacci Retracement level. This price is along the 14-day and 28-day moving averages while the RSI is at 50. The pair may see some more swings as the market receives more polling data.

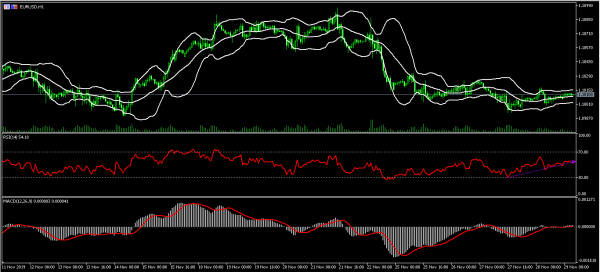

EUR/USD

The EUR/USD pair is trading at 1.1010. This is slightly higher than this week’s low of 1.0990. It is also lower than this week’s high of 1.1097. The price is along the middle line of Bollinger Bands. The RSI has been moving higher and is now trading at 54. The signal line has moved slightly above the neutral line. The pair may make a significant low-volume breakout in either direction today.

USD/JPY

The USD/JPY pair has been on an upward trend since November 21 when the pair traded at 108.25. The pair reached a high of 109.60 yesterday. It declined slightly to the current 109.45 after the market received data from Japan. The pair has formed a double top pattern on the hourly chart. The 14-day and 28-day moving averages are making a bearish crossover. This is an indication that the pair may see significant declines in the next few days.