Trump signs HK Bill

President Trump finally announced to the world the highly anticipated signing of the HK Human Rights and Democracy Bill. This result was inevitable given strong support for the bill and that fact that Congress was able to offset any veto by the President with 2/3 majority support. Trump did, however, announce it in such a way that might lessen the blow, stating he hopes “China and Hong Kong can amicably settle their differences”, though, we think this will mean little to China.

Trade policy uncertainty rises

We expect the velocity of headlines highlighting possible China retaliation to increase but don’t think any economic measures will be imposed anytime soon. Rather, China are more likely to action in-kind responses of equivalence (from HK Bill) such as sanctions on individuals. As mentioned in our ASIA MORNING: ASX Reaches For The Summit, introduction of a HK decree elevates trade policy uncertainty and risks to timing, structure and substance of any phase-1 deal. USDCNH, usually a reliable bellwether of US-China trade hopes, has jumped back above 7.02 climbing 0.15%. USDKRW also rallied 0.2%.

European benchmarks to follow broad equity weakness

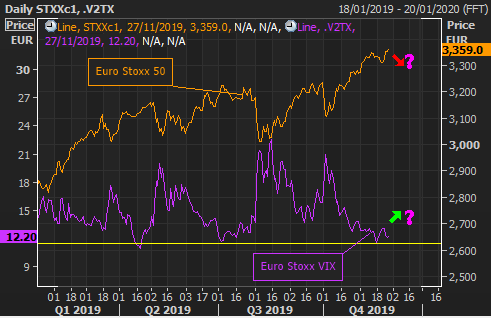

Equities across the board finished in the red as trade policy uncertainty lifted. ASX 200 though was able to buck the trend edging 0.2% higher at close. S&P 500 Futures pulled away from all-time highs and have since settled down at 3,144 at time of writing. The pullback is likely to spill into Europe with FTSE and DAX set to fall at the opening bell having had respective 29 and 23 point drops in Asia trading. We continue to keep a close eye on any extended uptick in equity implied volatility as a robust indicator of forthcoming retracement.

German CPI up ahead

Following successive prints of marginally better sentiment in the German manufacturing space, albeit still in contraction territory, preliminary y/y November inflation for Germany is forecast to print 1.3%, an improvement on the prior month’s 1.1%. The print is scheduled for release sometime before 1pm LT and is likely to tilt bias in EURUSD which battles it out with 1.1 levels, having fallen to 1.099 during London/NY cross. As it stands, EURUSD positioning is moderately net short and should continue to be weighed on by decent US data which quelled fears surrounding a slowing US consumer narrative.

Conservatives on track to win election

Some strong gains to the tune of 70pips in after-hours Europe with GBPUSD surging through 1.29 before pushing higher into 1.295. This was driven by early predictions that a Tory majority was likely, and was later confirmed by the YouGov MRP poll projecting Conservatives to win 359 seats or majority government (326 needed) in the upcoming UK election. The YouGov MRP poll which speaks to tens of thousands of voters correctly predicted Theresa May’s loss in 2017, and so, naturally carries a bit more weight in the mind of traders. While we maintain GBPUSD upside with a 1.338 target should the likely scenario of a Conservative majority take place, we’re also cognisant that polls can change very quickly in three weeks. Stay nimble.

YouGov MRP projection:

Conservatives – 359

Labour – 211

Scottish National Party – 43

Liberal Democrats – 13

Plaid Cymru – 4

Green – 1

Other – 1