To eat or not to eat

If you’ve ever played chess before you’ll know Scandinavian defence is one of the oldest recorded openings typically made by beginners. The tactic involves each player’s pawn sitting in front of the King to be moved forward two spaces. Both pawns then stand-off as minor plays take place around it until one side cracks and impulsively decides to eat the other, thereby expediting end-game. In our view, the highly controversial HK Human Rights and Democracy Bill and its potential enactment via the House of Reps is analogous to the impulsive move that expedites end-game.

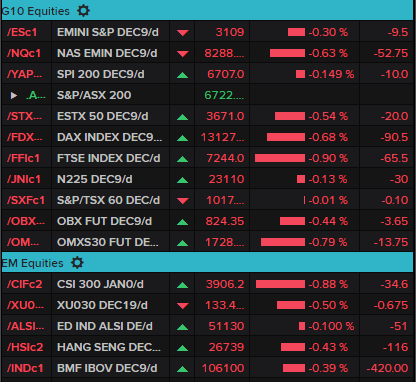

Higher volatility bad for equities

Up till this point, the stand-off between US and China, going on for some two years now, has always been promoted and held on the economic front. This has meant to some extent negotiations have stayed fluid, pointed and focussed on those key buzzwords in trade, agricultural purchases, industrial subsidies and intellectual property. But, by effectively meddling in China’s “domestic affairs” or 22-year governance over Hong Kong, it – in our view – raises the stakes significantly and shifts the US-China trade war paradigm towards a more volatile, uncertain and unpredictable state. After all, China’s uncompromising rule over its provinces and states is what China cares most about. Therefore, should the bill come to pass the House of Reps, we’d expect meaningful bearish pressure to squeeze broad equity index returns in H1 2020 as VIX climbs back towards 20 levels and US-China trade downside risks play out.

ASX set to follow NY sell-off

Scheduled data risk overnight offered little surprises. An in-line print for CAD CPI helped USDCAD fall back to 1.33 levels. FOMC Minutes maintained a data-dependent stance and showed the Fed was comfortable with their temporary pause to the easing cycle. US-China trade developments continued to drive markets back and forth. ASX 200 ought to open moderately down following the broad sell-off in equities which led Dec futures 10pts lower. With little data risk on the horizon, we think markets maintain a marginal USD bid across G10 and EM FX for the session.