Asian stocks were mixed as the market started to worry about trade again. In Japan, the Nikkei index declined by 0.45% while Chinese stocks were mostly higher. US stocks ended the day a bit higher. Traders have started worrying about trade again after CNBC reported that Chinese officials were pessimistic about a deal after Trump said that there would be no tariff rollback. Beijing thought that the two sides had agreed, on principle, to ease tensions.

The Australian dollar declined slightly after the RBA released meeting minutes. The minutes showed that the Australian central bank debated another cut but decided against it. They also talked about the fact that the economy was reacting well to the recent rate cuts. Global risks to growth were also discussed as well as the ongoing trade wars between the US and China and Japan and South Korea. As a result, they mentioned that these risks will continue in the coming year. The bank also hopes that the unemployment rate will fall below 5% in 2021.

Later today, the market will focus on corporate earnings from key American companies like Aramark, Medtronic, Kohl’s, Home Depot and Urban Outfitters among others. These companies will continue to show the outlook for America’s retail sector. In Europe, the market will receive car registration data from the UK, Italy, Germany, France and other EU members. These numbers are great because they show the performance of the economy. In the United Kingdom, the market will receive building permits and housing starts data. They will also listen to John Williams, the New York Fed President.

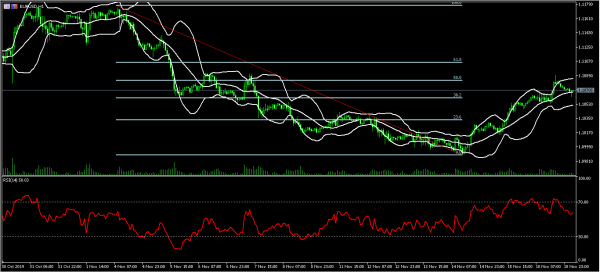

EUR/USD

The EUR/USD pair eased slightly as the market waited for data from the US and Europe. The pair declined from a high of 1.1090 to a low of 1.1.1062. The price is between the 50% and 38.2% Fibonacci Retracement level. The price is along the middle line of the Bollinger Bands. The RSI has dropped from a high of 75 to 58. The pair may resume the upward trend after the current pullback.

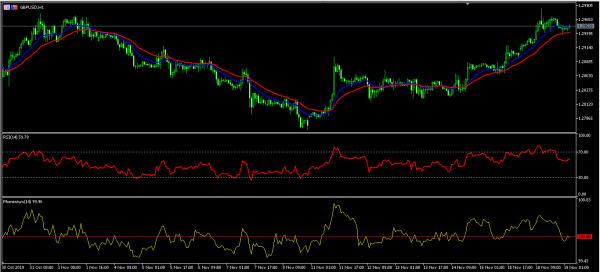

GBP/USD

The GBP/USD pair declined slightly as the market digested Boris Johnson and Jeremy Corbyn’s plans. This is after the two Prime Minister contenders delivered speeches at a conference of British companies. Jeremy Corbyn pledged higher taxes for businesses and nationalisation of key sectors. Boris Johnson pledged to lower taxes and add stimulus to the economy. The pair is trading at 1.2952, which is below yesterday’s high of 1.2985. The price is along the 14-day moving averages and slightly above the 28-day moving averages. The pair may remain along the current levels.

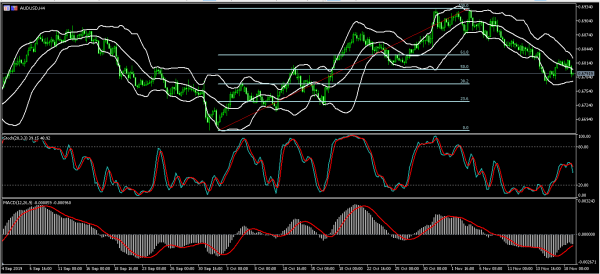

AUD/USD

The AUD/USD pair dropped from a high of 0.6820 to a low of 0.6783. This price is slightly below the 50% Fibonacci Retracement level. It is also below the middle line of the Bollinger Bands. The signal and main lines of the Stochastic Oscillator have made a bearish crossover while the signal line of the MACD is moving upwards. The pair may test the 38.2% Fibonacci Retracement level of 0.6770.