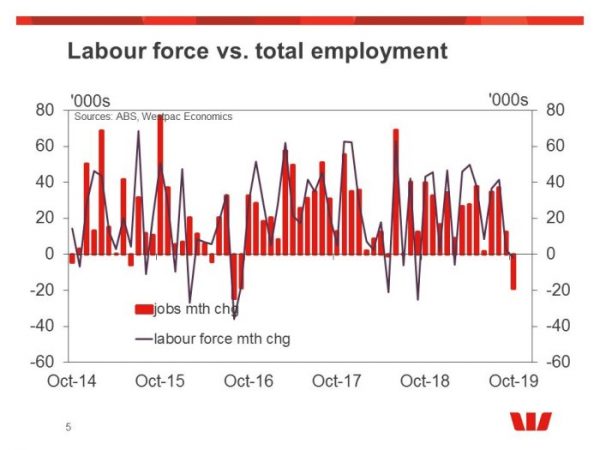

Total employment: –19.0k from 12.5k (revised from 14.7k). Unemployment rate: 5.3% from 5.2% (unrevised 5.2%). Participation rate: 66.0% from 66.1% (unrevised 66.1%).

The October Labour Force Survey surprised with a –19.0k decline in employment – the market median was for 16k while the lowest forecast in the range was +7k. It was a surprisingly soft update all the more so for while the participation rate eased back to 66.0% from 66.1%, as you would expect with a soft print on employment, the unemployment still bumped up to 5.3% (5.32% at two decimal places) from 5.2%. Westpac had been looking for a rise in unemployment as we do expect participation to remain relatively robust in the face of softer employment growth. This month also reinforced the trend that while male participation has lifted off its cyclical low it is the trend rise in female participation that driven force in the outsized gains in the labour force.

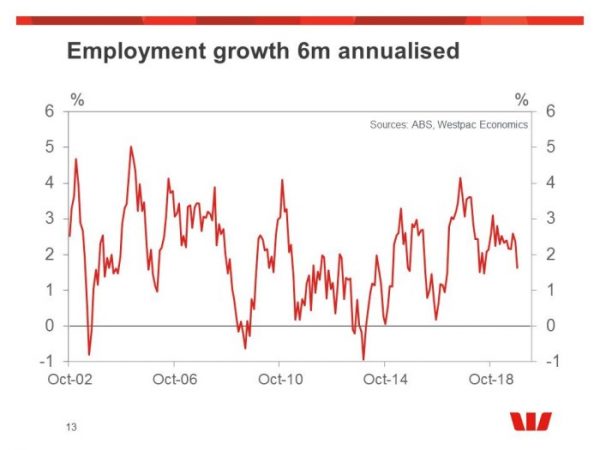

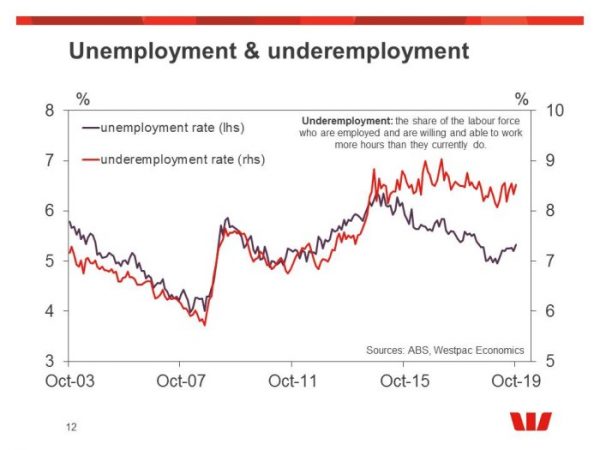

The average monthly employment gain so far in 2019 dropped from 25k in September to 20k in October with the annual pace easing back from 2.5% in September to 2.0% in October. This also saw the employment pulse slow with the six month annualise pace easing to 1.6%yr from a very robust 2.6%yr reported as recently as August. Currently, with participation remaining robust growth in the labour force was still a fast 1.9% six months annualised in October. By contrast the working age population is currently growing at a 1.6% six month annualised pace so you can see how it is rising participation, more so than population, that his holding up unemployment. As such, with the leading indicators pointing to softer employment growth we remain comfortable with our expectation that a resilient participation rate will see the unemployment rate continue its gradual trend higher into 2020. Our current forecasts is for the unemployment rate to drift higher to around 5.4% by end 2019 or early 2020 then rise to 5.6% by mid-2020.

We should also note the jump up in underemployment rate to 8.5% (8.52% at two decimal places) to from 8.3%. It was 8.54% back in August reinforcing a trend drift higher in underemployment. This month there was a contraction in both full-time and part-time employment (–10.3k full-time and –8.7k respectively) driving a 0.2% decline in hours worked. This highlights that it is a fundamental weakness in the report that is driving underemployment higher rather than some statistical shift. This trend drift higher in underemployment, and the slower pace of gain in hours worked compared to total employment (1.4%yr vs. 2.0%yr), reinforces the observation of the broader slack in the labour market slack beyond the 5.3% unemployment rate.

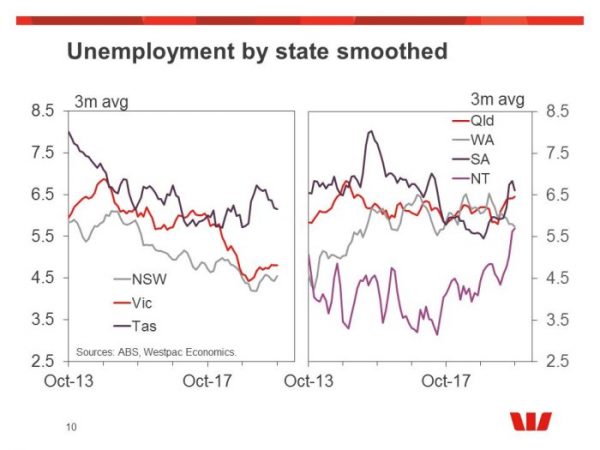

The state data is also reveals that the two largest states, NSW and Victoria, are starting to slow; NSW more so than Victoria. Total employment fell –10.3k in NSW with the unemployment rate picking up to 4.8% from 4.5%. In the year, employment growth in NSW has fallen from 3.8%yr in July to 1.5% in October. Victoria has been a bit more robust than NSW with employment lifting 2.9k there with a smaller rise in unemployment to 4.8% (now on par with NSW which has risen to meet Victoria) from 4.7%. Annual employment in Victoria is still running at a very solid 3.2%yr pace but this is a moderation from the 3.7%yr pace in June. Of the mining states, Qld reported a fall in employment of –14k while employment lifted 6.3k in WA. Unemployment was steady in both states at 6.5% in Qld, 5.7% in WA.

While today’s update was weaker than we were anticipating, it was not enough to change our view that the labour market is softening gradually which will drive a modest gradual rise in unemployment and underemployment. The Australian economy is a long way away from the RBA’s full employment aim of 4.5% and if the Bank wants to use monetary policy to drive the economy in that direction, it has a lot more work to do. However, the gradual pace of the deterioration will allow the RBA time to monitor the economy before having to act again.

In our view, while rate cuts along with the Government’s tax offset payments should help to support demand, we think it will be insufficient to get economic growth moving back to trend or above in 2020. As we see employment growth continuing to moderate in early 2020, and expect that the resulting decline in participation will provide only a partial offset, we hold to our view that unemployment is likely to hit 5.6% my mid-2020.