US-China complications front of mind

USDCNH has edged back above the 7 handle on negative US-China headlines. China is having trouble or feeling reticent with regards to putting a hard “numerical commitment” around agricultural purchase in the text of the phase one deal. They’re looking to save face meaning they don’t want a deal on face value to look overly one-sided in favour of the US. China are also looking to remain flexible in the scenario where US-China trade tensions escalate.

Again, are we really that surprised? No. Do we think there’s scope for more conflicting signals? Yes. Are markets underappreciating and underpricing US-China trade downside risks? In our view, yes. See SPECIAL REPORT: The US-China Art Of War.

Aussie data to get some eyeballs

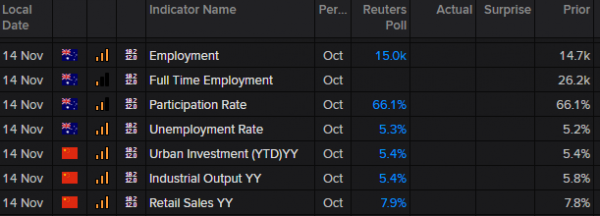

A few data points should grab the attention of markets as they hit the wires this morning. First up, we catch the Aussie jobs report at 11.30am AEDT. Oct. employment change is forecast to print 16.2k, an improvement on the prior month. The unemployment rate is expected to stay around 5.2%. Previous job reports have garnered their fair share of volatility but we think the potential reaction to this one could be relatively more muted given lower risks of an RBA December cut. The RBA are unlikely to cut in December as it stands with markets pricing in an 85% implied chance that the RBA hold. It appears more are concerned with the RBA’s call in February which is still a while away with plenty of data to be seen between now and then.

Don’t forget about China activity data

Elsewhere, on the radar scheduled for release at 1pm AEDT is China October activity data which includes Urban Investment y/y, Industrial Output y/y and Retail Sales y/y. All look to build on last month’s mostly better-than-expected prints with forecasts either at the same levels or slightly better. We watch out for a weak print here thinking it presents moderate downside risks in the session for Asia equities, which already looked soft yesterday having followed the sell-off in Hang Seng Futures.