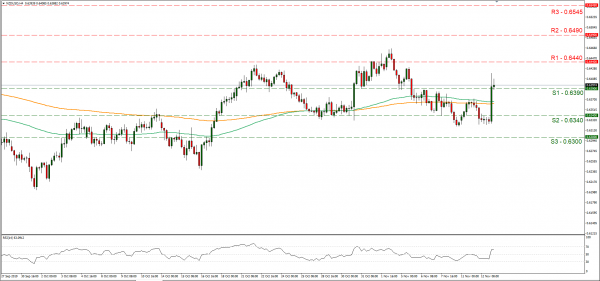

RBNZ surprised the markets during today’s Asian session, as it maintained rates unchanged at +1.00%, in contrast to market expectations of a rate cut. The decision caused the NZD to rally upon the release, strengthening against the USD by around 88 pips. In its accompanying statement, the bank stated that it will continue to monitor economic developments and remain prepared to act as required. Also, the bank stated that interest rates are to remain at low levels for a prolonged period and that it will provide further monetary stimulus if needed. In his following press conference, RBNZ Governor Adrian Orr, characterized the bank’s monetary policy as effective and added that he saw the impacts coming through. With the bank showing once again decisiveness as the decision was unanimous and given that there seems to be no interest cut in the horizon until beginnings of 2020, the monetary front for the Kiwi seems favourable. We could see NZD strengthening further especially as central bank interest rate differentials may start turning to its favour. NZD/USD rallied during the Asian session today, breaking consecutively the 0.6340 (S2) and the 0.6390 (S1) resistance lines, now turned to support. We could see the pair rising further, however as the Kiwi fundamentals are already out, the pair could be more USD driven in the near term. Should the pair come under the selling interest of the market, we could see it aiming if not breaking the 0.6390 (S1) support line and continue to aim for the 0.6340 (S2) support level. Should the pair’s long positions continue to be favoured by the market, we could see NZD/USD breaking the 0.6440 (R1) and aim for higher grounds.

… while USD traders turn to Powell for direction…

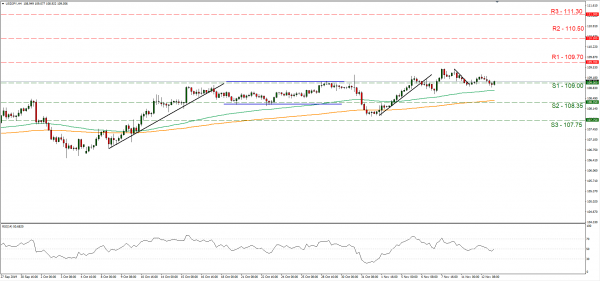

Market participants turn their attention to Fed Chair Powell’s testimony today (16:00,GMT) before Congress for further clues, about the intentions of the bank. We expect the Fed’s chair to maintain the same stance the bank had its last interest rate decision and we could see him reiterating that the bank’s monetary policy is in a “good place” and could signal some stability here. It should be noted that deviations are quite possible and in such a case the market could be taken by surprise displaying an asymmetric reaction. Bear in mind that US President Trump at a speech in New York yesterday, took a swipe at the Fed accusing it of holding the US at a competitive disadvantage against other countries. Also at his speech, President Trump stated that US and China were close to a phase 1 deal, yet they would only accept it if it’s good for the US. Later on, the US President stated that should there be no deal, the US would substantially raise tariffs on China imports. The last comments could create some uncertainty in the markets, yet for the time being traders seem to focus on Powell’s speech. USD/JPY retained a tight range movement yesterday, testing at some time the 109.00 (S1) support line, yet failing to break it. We maintain the bias for a sideways movement, yet market volatility could arise for the pair, as important financial releases for the two currencies are due out during today’s American sessions and tomorrow’s Asian session. Should the bears dictate the pair’s direction, we could see it breaking the 109.00 (S1) support line and aim for the 108.35 (S2) support barrier. On the other hand, should the bulls take over, we could see the pair aiming if not breaking the 109.70 (R1) resistance line.

Other economic highlights today and early tomorrow

During today’s European session, we get Germany’s final HICP rate, Sweden’s CPI rate and UK’s main inflation measures, all for October, as well as Eurozone’s industrial production growth rate for September. In the American session, we get the US headline and core CPI rates for October as well as the API crude oil inventories figure. During tomorrow’s Asian session, Japan’s GDP rate for Q3, China’s industrial output growth rate for October and Australia’s Employment data for October are due out. As for speakers please note that besides Fed’s Chairman Powell, Richmond Fed President Barkin and Philadelphia Fed President Harker speak.

Support: 0.6390 (S1), 0.6340 (S2), 0.6300 (S3)

Resistance: 0.6440 (R1), 0.6490 (R2), 0.6545 (R3)

Support: 109.00 (S1), 108.35 (S2), 107.75 (S3)

Resistance: 109.70 (R1), 110.50 (R2), 111.30 (R3)