U.S. Review

A Trade War Armistice? Don’t Make it a Holiday Yet

- Optimism soared this week on hopes of a forthcoming trade deal, as equity markets hit all-time highs and the yield curve steepened.

- Due to the lack of concrete details, we are sticking to our assumption that the 15% tariffs on $156 billion of consumer goods imports will go into effect on December 15, but recognize there is some upside potential to growth and rates if a deal is reached.

- Regardless, the economy has shown signs of stabilizing. The ISM non-manufacturing survey beat expectations this week by climbing to 54.7 from a three-year low of 52.6 last month.

A Trade War Armistice? Don’t Make it a Holiday Yet

Optimism soared this week on hopes of a forthcoming trade deal. Equity markets rose to all-time highs and interest rates climbed— the ten-year rose almost 20 bps this week to 1.91 and is now up nearly 50 bps from just a month ago—but market chatter about a “phase one” deal has been completely devoid of any concrete details. Until we hear reports of a material pause or de-escalation in the trade war, we are sticking to our assumption that the 15% tariffs on $156 billion of consumer goods imports will go into effect on December 15. We recognize that a delay or cancellation of this new tranche is possible—and would warrant some of the repricing of higher growth prospects seen in financial markets this week—but we have been down this road lined with rumor mills too many times to change our underlying assumptions just yet.

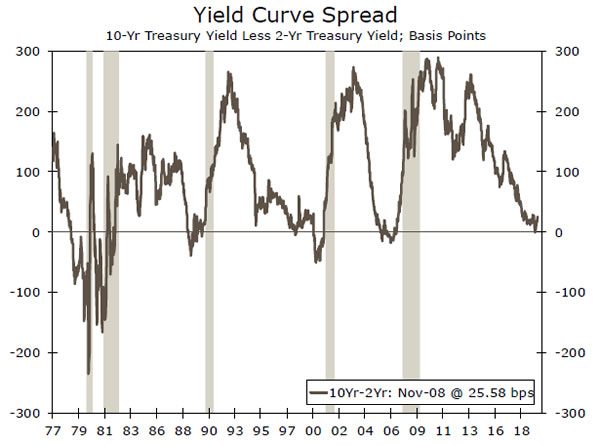

Still, the economy has shown signs of stabilizing. The Fed’s willingness to adjust policy to confront factors largely outside of its control—trade policy shocks and slowing global growth—and its actions to shore up liquidity in short-term funding markets have eased fears of a recession. Moreover, the most recent economic data have come in slightly above expectations, resulting in a healthy steepening of the yield curve—the 1os-2s spread has risen to 26 bps from its brush with negative territory in August.

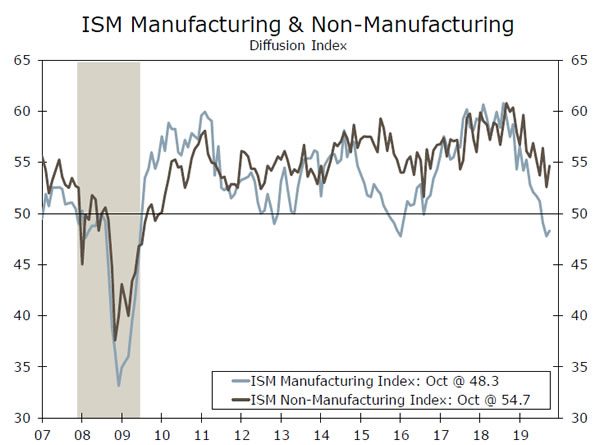

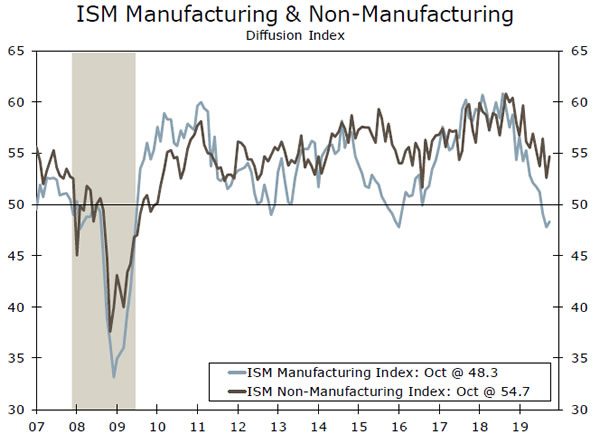

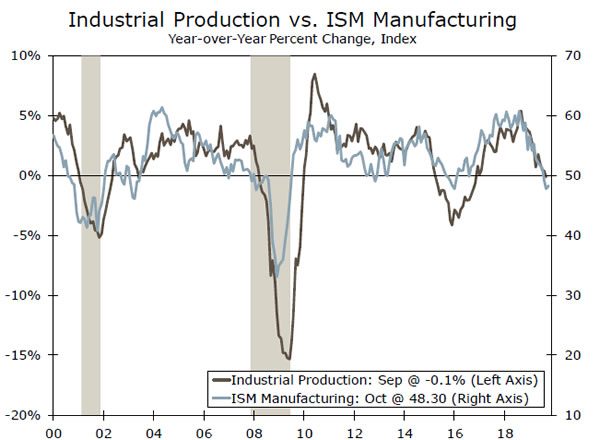

The ISM non-manufacturing index, a measure of the breadth of activity in the U.S. service sector, beat expectations this week by climbing to 54.7 from a three-year low of 52.6 last month. The multiyear low of the non-man survey was especially concerning last month because it came just two days after its manufacturing counterpart fell to 47.8, indicating outright contraction at the fastest rate since 2009. The improvement of the surveys (the manufacturing survey rose to 48.3) was a welcome sign of stabilization, particularly given that the forward-looking new orders component rose in both surveys. To be clear, the manufacturing survey still indicates contracting activity, but the greater worry continues to be manufacturing weakness spilling over into the much larger service sector. That remains a risk, but the spread between the two rose in September (top chart) and healthy consumer fundamentals point to continued resilience.

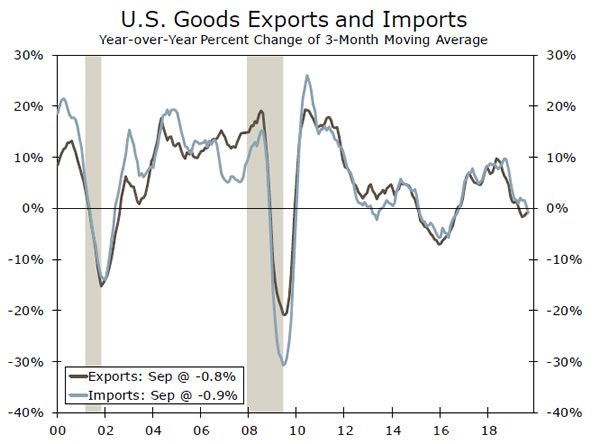

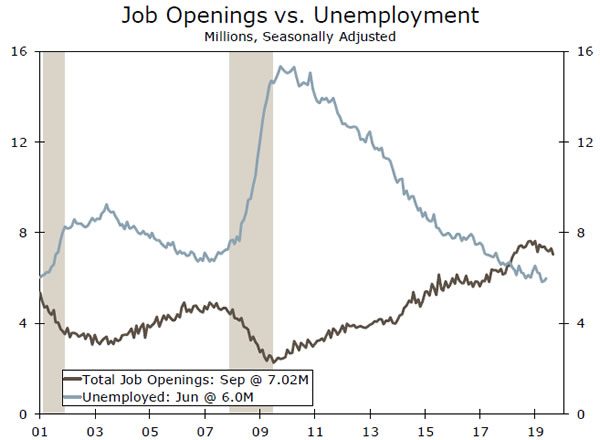

Yet while there may be a short-term rebound in store, the trade war has already exacted long-term damage on the economy. Business fixed investment, which drives productivity growth in the long run, has fallen the past two quarters. The latest data released this week showed productivity declined 0.3% annualized in Q2, the weakest pace since 2015. Tariffs have played a large role in the slower pace of capital formation—imports of industrial supplies and capital goods are down 14.8% and 6.0%, respectively, over the past year. The slowdown in productivity growth along with steady compensation growth lifted unit labor cost growth to the highest pace in five years, perhaps not surprising given the gap between job openings and unemployment (bottom chart), but not indicative of a major uptick in inflation.

The recent string of improving data and hopes of a trade deal shift the risks to our forecast to the upside. Markets seem to agree, with the implied probability of more Fed easing evaporating. For now, we are not so sure and still see scope for another cut early next year. However, if a trade deal does in fact materialize, we think the Fed would be content to pause, with monetary policy in “a good place.”

U.S. Outlook

Consumer Price Index (CPI) • Wednesday

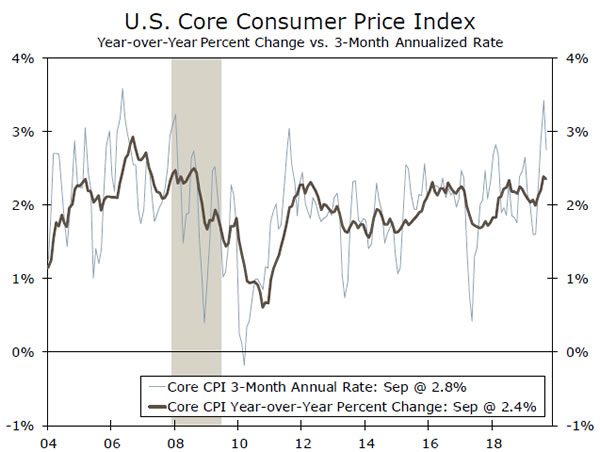

Below-target inflation has been a key reason for the Fed’s monetary policy bias toward easing. After all, the PCE deflator has run below the FOMC’s 2% target for all but 11 months of the 10+ year expansion, while inflation expectations are at the low end of historical ranges. Concerns about inflation, therefore, remain skewed toward it running too cool, not too hot. Even as the trend in inflation has firmed in recent months, it remains sufficiently tame for the Fed. The core CPI is up 2.4% over the past year, and tends to run 0.2-0.3 points higher than the core PCE deflator, the Fed’s preferred inflation gauge.

We suspect prices excluding food and energy were up 2.3% on a year-over-year basis in October. Inflation should continue to firm, but not break meaningfully above the Fed’s 2% target. In the absence of significant price pressure, the Fed will likely keep rates steady in the near-term.

Previous: 0.0% Wells Fargo: 0.3% Consensus: 0.3% (Month-over-Month)

Retail Sales • Friday

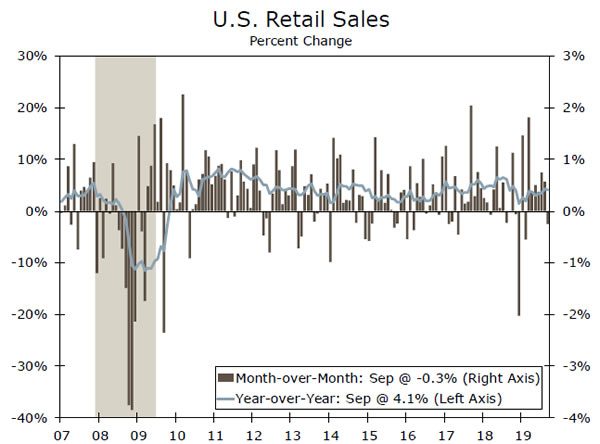

Retailers’ sales for October will be reported on Friday. We expect total retail sales rose 0.2% after declining 0.3% in September, which marked the first monthly decline in seven months, and demonstrated how consumers’ apprehension about an impending recession and trade policy uncertainty can weigh on spending. Declines in spending are particularly worrisome today, as consumer spending is a key area of growth in the U.S. economy.

Consumer fundamentals remain strong, with a high saving rate, low debt service and rising incomes. But, while consumers should continue to have the means to spend, do they have the will to do so? Consumer confidence measures remain near cycle-highs but have moved sideways since the start of 2017. A pronounced drop in confidence could restrain spending. Next week’s release is important, in that it will give the latest read on how consumers are faring in the current environment of uncertainty.

Previous: -0.3% Wells Fargo: 0.2% Consensus: 0.2% (Month-over-Month)

Industrial Production (IP) • Friday

The industrial sector has been under pressure since the start of the year from slower global growth and ongoing trade policy uncertainty. Manufacturing production—which accounts for 75% of the industrial production index—in particular is responsible for the sustained decline in industrial output. We expect IP declined 0.4% in October.

Auto production will likely weigh on the headline again this month, as workers at GM did not return back to work until October 26. But, even manufacturing outside the auto industry likely remained weak. Survey evidence from the Institute for Supply Management (ISM) suggests that while manufacturing activity did not get any worse in October it did not significantly improve. Still, the slight uptick in the ISM was a reassuring development after it fell to its lowest level of the cycle in September. But, with a full resolution to the trade war still not yet in the cards, we continue to expect the manufacturing sector to remain weak in coming months.

Previous: -0.4% Wells Fargo: -0.4% Consensus: -0.3% (Month-over-Month)

Global Review

Central Banks Still Center Stage This Week

- Central banks were back in focus this week, starting with Australia. The Reserve Bank of Australia kept its official Cash Rate steady at 0.75% and reiterated that it was prepared to ease policy further if needed.

- Elsewhere, the Bank of England opted to keep its Bank Rate at 0.75%, but two BoE members unexpectedly voted to cut interest rates.

- Canada’s labor market added fewer jobs than expected in October; however, the unemployment rate remained at a near-record low. Even with the slight drop in October, the Canadian labor market is still performing relatively well.

RBA Holds Key Rate Steady

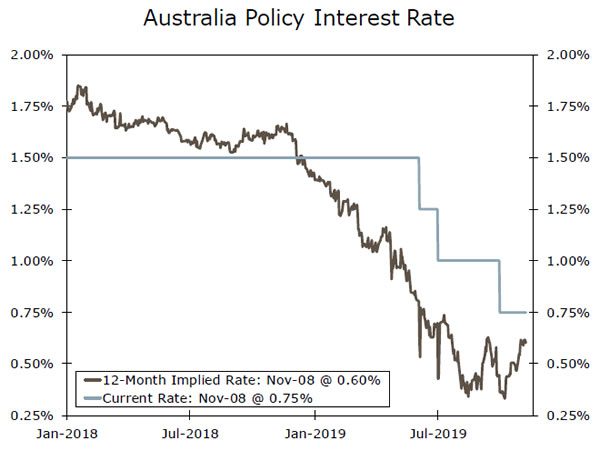

The Reserve Bank of Australia (RBA) held its Cash Rate steady at 0.75% at its meeting this week, after a total of 75 bps of cuts this year, most recently in October. The central bank reiterated that it was prepared to ease policy further if needed, although it sounded a bit more upbeat on the domestic economy. In the accompanying statement, the RBA noted that after a soft patch in the second half of last year, a gentle turning point appears to have been reached. The RBA statement also noted that the easing of monetary policy since June has supported employment and income growth in Australia, and called for a gradual return of inflation to the medium-target range over time. As of now, we expect the RBA to remain on hold through the end of 2019, but cut rates another 25 bps in Q1-2020, given our expectations that the United States moves ahead with tariffs on China, while inflationary pressures remain muted and wage growth stagnates. We also expect continued downward pressure on the Australian dollar for the next several months.

BoE Surprises as Two Officials Push for Rate Cut

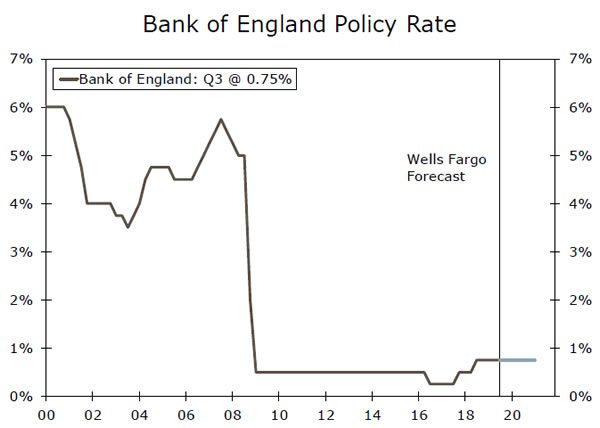

The Bank of England (BoE) also kept its main interest rate steady at 0.75% this week, as expected, but two BoE members unexpectedly voted to cut interest rates. Compared to its last forecasts in August, the BoE cut its 2020 GDP forecasts to 1.2%— which would be the worst yearly growth since 2009—from 1.3%, and its 2021 forecasts to 1.8% from 2.3%. The central bank also cut its CPI inflation forecasts for 2020 and 2021 to 1.4% and 1.9% from 1.9% and 2.2%, respectively. The pound slid, along with U.K. bond yields, after the BoE’s relatively dovish policy announcement. For now, the BoE remains on hold, but the committee’s comments after the announcement suggest it is split on the next monetary policy action. In our view, the softness in the U.K. currency is not likely to persist over the coming months as we anticipate a Brexit deal is likely on the horizon. Based on the BoE’s communications, a scenario in which a Brexit deal is in fact reached, it would likely take a rate cut off the table, and perhaps even see a return of expectations of future rate hikes.

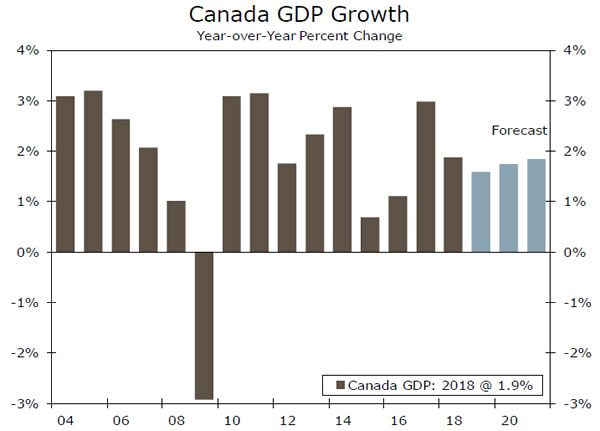

Canada’s Labor Market Slips in October

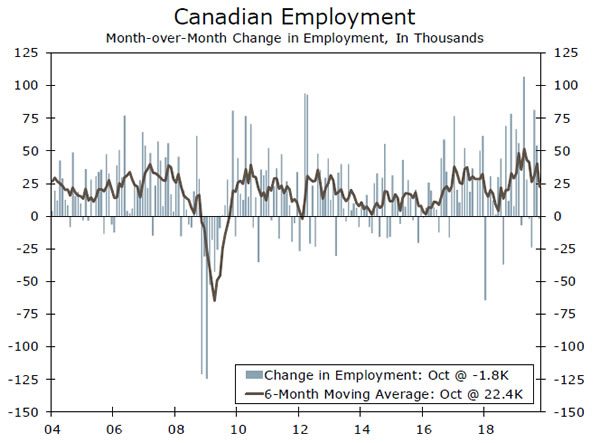

Canada’s labor market shed 1.8K jobs last month after two months of solid gains, sending the Canadian dollar lower. Despite the decline in employment, the unemployment rate remained steady at 5.5% in September. The underlying details of the report were mixed with average hourly wages firming to 4.4% year-over-year from 4.3%, while the participation rate remained steady at 65.7% and the number of full-time jobs declined by 16.1K. Even with the slight drop in October, the Canadian labor market is still performing relatively well, while the overall economy has remained steady amid weaker global growth. However, with global monetary policy dovish in nature—led by the Fed—we maintain our expectations for the Bank of Canada to cut policy rates in December, for the first time since 2015.

Global Outlook

United Kingdom GDP • Monday

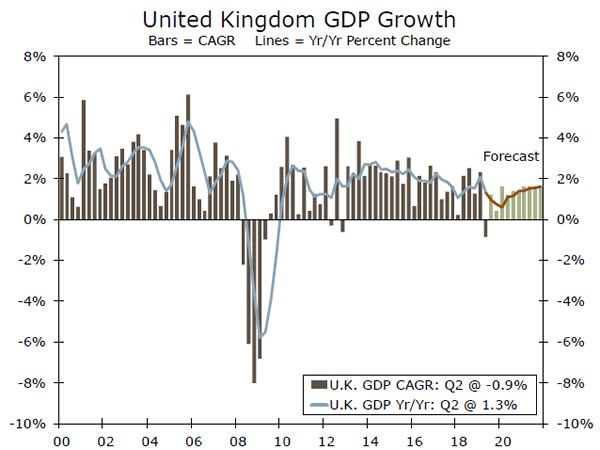

Although the U.K. economy managed relatively strong growth in Q1, it experienced a notable slowdown in Q2. The headline figure was pulled down by a drop in inventories and net exports; however, private consumption was stronger than expected. Over the past few months, leading indicators of economic activity have softened, with industrial production falling 0.6% month-over-month in August, while manufacturing production also contracted 0.7% month-over-month in August.

Next week’s GDP release will provide additional insight into the health of the U.K. economy. We expect decent positive growth in Q3, boosted by an inventory buildup ahead of the October 31 Brexit deadline. We expect GDP to increase 0.3% quarter-over-quarter.

Previous: -0.2% Wells Fargo: 0.3% Consensus: 0.4% (Quarter-over-Quarter)

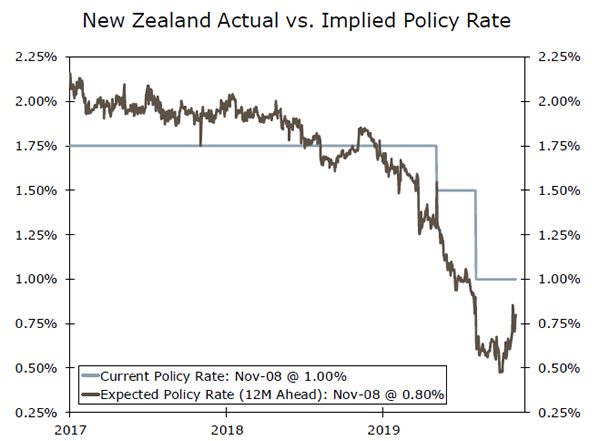

RBNZ Policy Decision • Tuesday

The Reserve Bank of New Zealand held its official Cash Rate at 1.00% at its last monetary policy meeting, following its moreaggressive- than-expected 50 bps rate cut in August. In the accompanying statement the central bank noted that there remains further scope for additional stimulus, if necessary. Meanwhile, RBNZ Governor Orr said the central bank was pleased with the outcome of its August easing to date and that it was unlikely to need “unconventional” monetary policy tools.

Given that activity data and confidence surveys have remained subdued, markets are leaning toward a November rate cut, with markets currently implying around a two-thirds chance of a rate cut at next week’s meeting. That said, even if the central bank opts to leave rates on hold next week, it will be important to watch whether the central bank signals further rate cuts ahead.

Previous: 1.00% Consensus: 0.75%

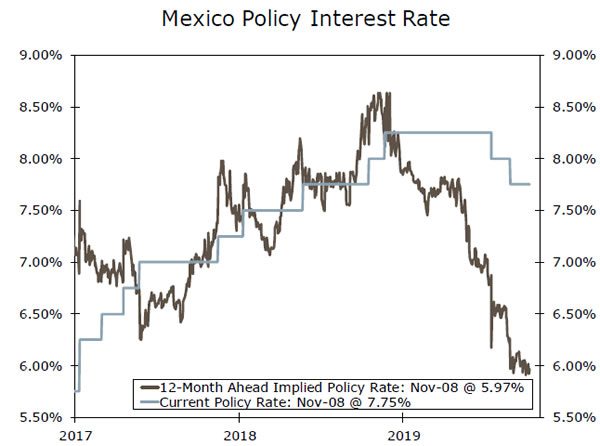

Banxico Policy Decision • Thursday

The Bank of Mexico opted to ease monetary policy at its last meeting, cutting its main policy rate 25 bps to 7.75%, the second such move this year. The accompanying policy statement was quite dovish, signaling additional rate cuts could be coming.

With core inflation falling for the fourth consecutive month and growth expectations still subdued, we expect the central bank to cut rates another 25 bps at next week’s meeting and continue easing policy into 2020. Also supporting the case for more easing from Mexico’s central bank, the Mexican peso has been relatively steady over the past month. At present, markets are priced for 179 bps of additional easing over the next year by the Bank of Mexico. For comparison, markets are priced for 17 bps of additional central bank easing in the United States over the same period, and 18 bps of easing in Canada.

Previous: 7.75% Consensus: 7.50%

Point of View

Interest Rate Watch

Bond Yields on the Move

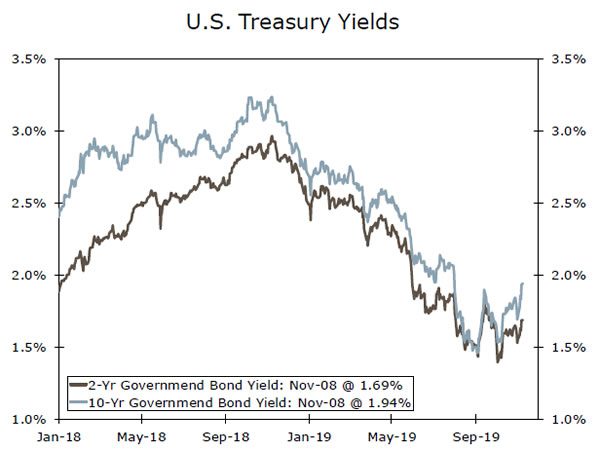

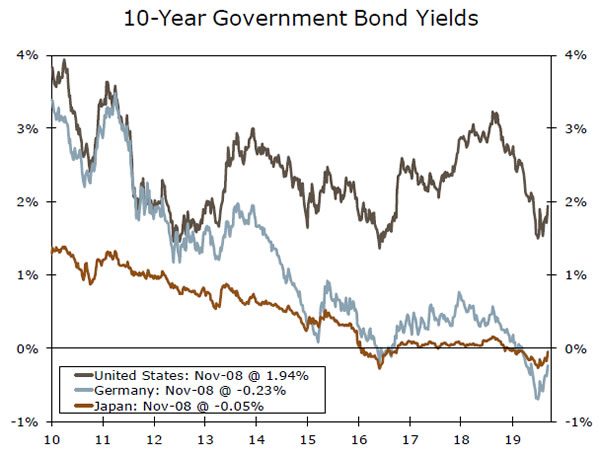

U.S. bond yields have trended higher in recent weeks. For example, the yield on the 10-year Treasury security, which fell to a three-year low of 1.45% in early September, has subsequently risen about 50 bps (top chart). Meanwhile, the yield on the two-year note is up about 25 bps over that period. Consequently, the spread between the two yields, which sparked fears of recession when it briefly fell into negative territory in August, is firmly back in positive territory (middle chart). What is going on with Treasury yields?

Part of the answer reflects a run of stronger-than- expected economic data recently that has reduced fears of impending recession. For example, the economy created more jobs in October than most investors had expected, and the ISM non-manufacturing index bounced higher last month, which alleviated some concerns that weakness in the industrial sector was spreading to the service sector. Consequently, expectations of further monetary easing by the Federal Reserve have been dialed back over the past few weeks. The recent easing of trade tensions between the United States and China has also improved the economic outlook. If the two countries do indeed sign a trade accord in coming weeks, then the case for further Fed easing would not be as compelling as it was previously.

How high could yields rise? As we wrote in our recent Monthly Economic Outlook, we look for the FOMC to cut rates one more time (by 25 bps) early next year. Although we readily acknowledge that the FOMC may opt to keep rates on hold in coming months, it is unlikely that the FOMC will be raising rates again anytime soon. As long as expectations of Fed tightening remain muted, a sharp rise in Treasury rates does not seem likely.

Furthermore, external factors will have an influence on Treasury rates. As shown in the bottom chart, long-term yields in major foreign economies such as Germany and Japan remain extraordinarily low, which will help to restrain any increase in U.S. rates. We forecast that the 10-year Treasury rate will end the year below 2% and below 2.25% at the end of next year.

Credit Market Insights

Firms Find Little Reason to Borrow

The Senior Loan Officer Opinion Survey released by the Federal Reserve this week reiterated the continued divergence between businesses and consumers. Firms’ appetite for borrowing remained subdued in Q3, as the net share of banks reporting weaker demand for commercial & industrial (C&I) loans continued to increase. Demand for credit was not only weaker among large and middle-market firms, but smaller firms, which have generally been more upbeat, also showed less willingness to take on debt. The reasons cited for this weaker demand do not instill much confidence for business fixed investment going forward. About 86% of banks reporting weaker demand for C&I loans cited decreased plans for investment as either somewhat important (+63.6%) or very important (+22.7%) to their customers’ decision.

On the consumer side, around a third of banks reported stronger demand in most categories of mortgage loans. While less robust, demand for credit and auto loans also picked up in the third quarter, suggesting consumers are still poised to continue spending. Consumers’ propensity to borrow might suggest some optimism about the future, but banks appear less certain. A major share of banks reported that they were less likely to approve auto loans or credit card applications for borrowers at the lower end of the credit risk spectrum compared to earlier this year, often citing a more uncertain economic or reduced risk tolerance as important reasons for their change.

Topic of the Week

How Exposed Are Services to Goods Sector Weakness?

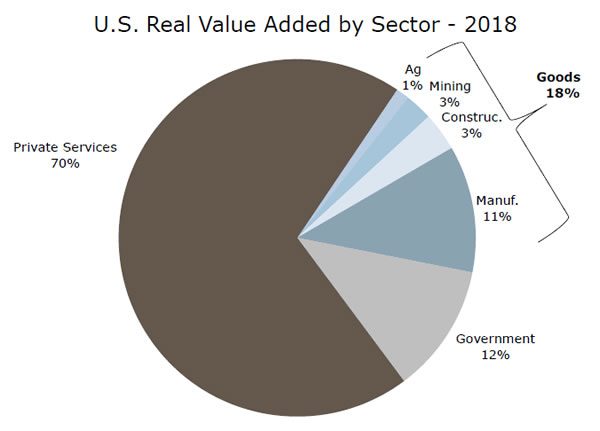

A solid October jobs report eased fears about an impending U.S. recession, but with weak growth abroad and uncertainty surrounding trade policy still high, activity in the goods sector continues to flounder. With the goods-producing sector struggling, the service sector, which represents about 70% of the value added in the U.S. economy, has been able to keep the economy afloat. Yet, there still is the risk of weakness in the goodsproducing sector spreading into services. Even though the goods sector accounts for a minority of the economy, it still weighs on activity in the service sector. Most directly, demand could weaken for related support services, such as legal work, financing or transportation. More indirectly, job cuts in the goods sector could weigh on services industries reliant on consumer spending. Therefore, if sufficiently large, a pullback in U.S. goods production could spill over into services and trigger a recession.

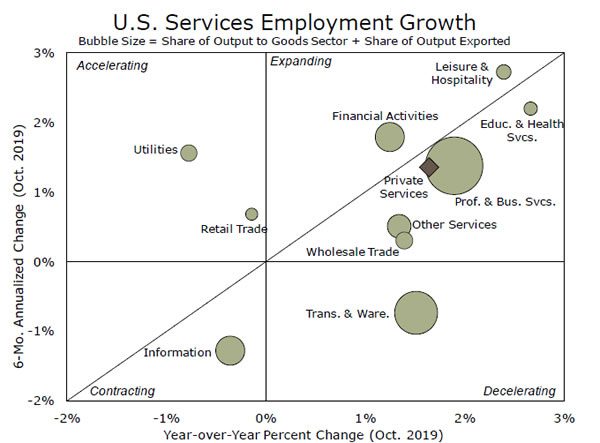

In a recent report, we estimated that it would take two or more consecutive quarters of meaningful declines in value added in the goods sector to produce a drop in value added in the service sector. Outside of recession such declines are quite rare, but, as the weakness continues, it is important to consider where the signs of a spillover might first appear. Support services, such as transportation & warehousing and business & professional services, send the greatest amount of their output to the goods-producing sector, relative to the other services sectors. The bottom chart shows the pace of job growth in each major area of the service sector over the past six and twelve months, with the size of the bubble corresponding to each sector’s exposure to domestic goods-producers and the global economy. Hiring has slowed most notably in the transportation & warehousing industry, but to only some extent in the professional & businesses services. At the same time, hiring in more insulated industries like education & health services has also eased up, suggesting there are other factors at play. Signs of a spillover appear limited so far, but it remains a dynamic worth monitoring.