Global stocks and futures were mixed during the Asian session. In China, the Shanghai index rose by 10 points while in Hong Kong, the Hang Seng declined by 100 points. The Dow and S&P500 futures declined by 40 and 6 points respectively. This week, the market has been excited about a potential trade deal between China and the United States. In a statement yesterday, China officials said that they had agreed in principle to start lowering tariffs that have upended the world trade order. However, there is some doubt among the market about whether such a deal will be possible. For example, the White House or USTR did not issue a public statement in response to one issued by Beijing.

The Japanese yen rose after the Statistics Bureau released household spending data for September. Numbers showed that spending rose to the highest level on record. Household spending rose by 9.5% on a YoY basis. This was the fastest pace of increase since 2001. It was stronger than the consensus estimates of 7.8% and was the tenth straight month of gains. These gains happened as the Japanese rushed to shop ahead of a planned sales tax hike. The same scenario happened in March 2014 when sales jumped by 7.2% before a tax hike.

Later today, the market will receive important data from Europe. In Switzerland, they will receive unemployment rate data. Unemployment rate is expected to increase slightly from 2.1% to 2.2%. In Germany, they will receive trade numbers for September. Exports are expected to have increased by just 0.4% while imports are expected to remain unchanged. The market will receive trade and payroll data from France. Meanwhile, thy will receive employment data from Canada.

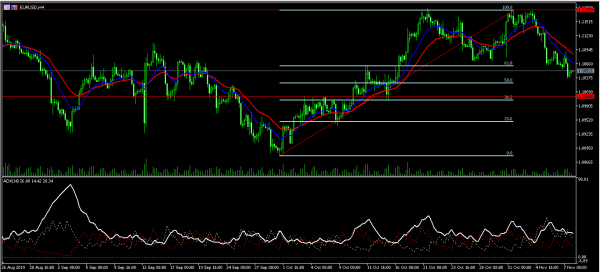

EUR/USD

The EUR/USD pair declined in the American session to a low of 1.1033. On the hourly chart, this was slightly above the 50% Fibonacci Retracement level. The price is slightly below the 14-day and 28-day moving averages, which made a bearish crossover on Tuesday. The average directional index is at 26, which is a signal that the downward trend may continue. The pair may continue moving lower to test the important support of 1.1000.

GBP/USD

The GBP/USD pair was unchanged during the Asian session as the market reflected on the statement by the Bank of England. The pair is trading at 1.2813, which is slightly above the important support of 1.2800. On the hourly chart, the price is above the 14-day and 28-day moving averages. The Average True Range indicator has declined, which is a signal that there is no volatility. The pair is in a strong support range, which is an indication that it may move higher today.

USD/JPY

The USD/JPY pair declined today after impressive retail data from Japan. The pair declined from a high of 109.50 to a low of 109.15. On the hourly chart, the pair is along the 14-day moving average. It is slightly above the 28-day EMA. The RSI has dropped from a high of 73 to a low of 53. The signal line of the MACD has started to move lower. The pair may continue the downward trend to test the important support of 109.00.