Possible delay to US-China phase 1

As mentioned in yesterday’s SPECIAL REPORT: The US-China Art Of War, there are longer-term downside risks to US-China trade optimism that likely remain under-appreciated and therefore under-priced. Reuters released an exclusive this morning with headlines suggesting it was “possible China trade pact will not be reached” and that the “deal could be delayed until December”. Iowa, initially put forward as a venue for a Trump-Xi meeting, looks unlikely. While Switzerland, Sweden and London were also touted as potential options. USDJPY on announcement expectedly worked its way lower -30pips and is back under the 109 handle. Equities were marginally softer too.

Softbank (9984.T) shows significant loss

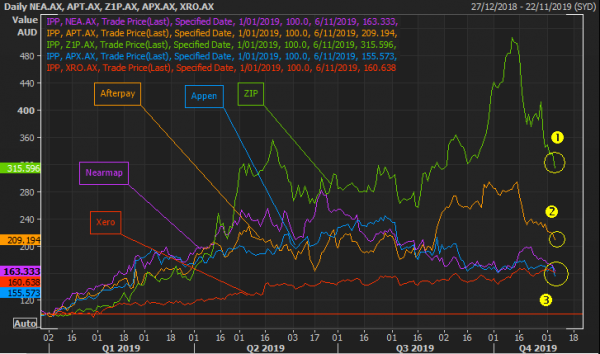

Softbank, the substantial owner of WeWork and Uber, suffered a $8.9bn loss in its pivotal Vision Fund yesterday. The losses driven by Softbank’s investment in WeWork – an excessively overvalued and poorly governed business – was a stark awakening or reminder of the lofty multiples markets were applying to loss-making technology businesses. In our view, Softbank has simply put on a pedestal the need for market participants to rethink valuations across the growth board and in particular, companies that have no clear pathway to profitability. In the context of the ASX 200, this narrative is likely to drive, if not already, some consolidation within major ASX tech darlings. Look out for potentially more Afterpay (APT.AX), Nearmap (NEA.AX) and Appen (APX.AX) selling.

Indexed price performance rebased Jan 1, 2019.

Returns for ASX Tech stocks have done well in 2019 but seem challenged in Q4. Source: Eikon

NAB (NAB.AX) falls in line

NAB, one of Australia’s Big 4 banks, was unable to avoid the pervasive challenges afflicting Aussie financials and banks driven by the current low growth, low-rate environment. NAB this morning released its full-year earnings, reporting an 11% drop in cash earnings for the year ended Sep. 30 slightly below analyst expectations. Similar to Westpac in recent times, NAB also elected to cut it final dividend to 83c from 99c seen in the prior year. Customer remediation expenses, below trend growth and regulatory/capital requirements were recognised as forward challenges. Not to mention the squeeze in net interest margin driven by the RBA’s easing cycle.