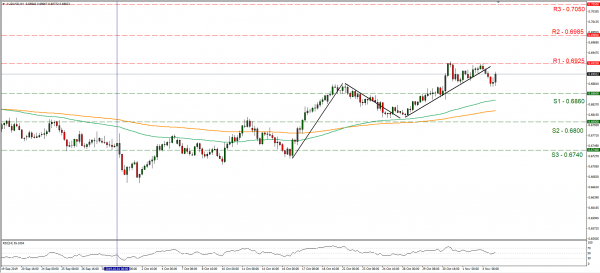

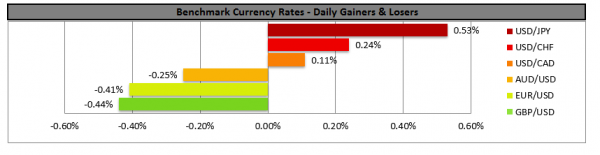

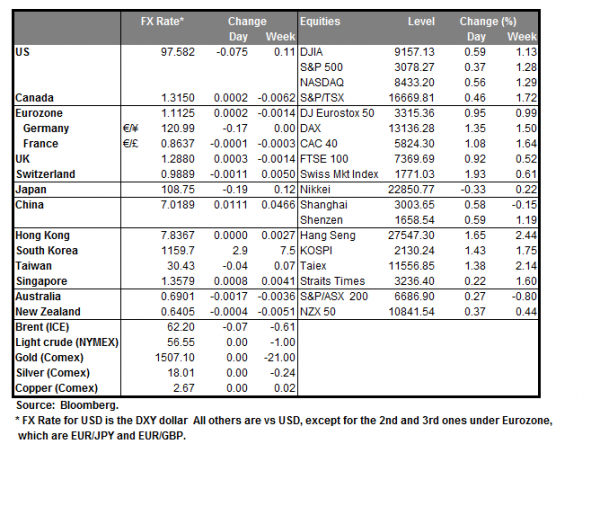

A was widely expected RBA remained on hold at +0.75% today, yet the accompanying statement strengthened the Aussie somewhat. In its accompanying statement the bank stated that a gentle turning point appears to have been reached. The bank’s forecasts included inflation to be close to 2% in 2020, while growth is to close around 2.25% and then to pick up to 3.00% in 2021. On the flipside the bank seems to continue to see that the risks to the global economy are tilted to the downside, albeit the outlook remains reasonable. The bank may be hinting to a pause of its easing cycle as it stated that the easing of monetary policy since June is supporting employment and growth. The outlook for the Aussie from a monetary policy perspective seems to open and central bank differentials may continue to support it. AUD/USD dropped after testing the 0.6925 (R1) resistance line, yet RBA’s interest rate decision provided some support regaining partially yesterday’s losses. As the pair broke the upward trendline incepted since the 28th of October, we switch our bullish outlook for a sideways scenario. Should the bulls take charge of the pair’s direction once again, we could see it breaking the 0.6925 (R1) resistance line and aim for the 0.6985 (R2) resistance level. Should the bears dictate the pair’s direction, we could see AUD/USD breaking the 0.6860 (S1) support line and aim for the 0.6800 (S2) support level.

… JPY weakens on trade hopes…

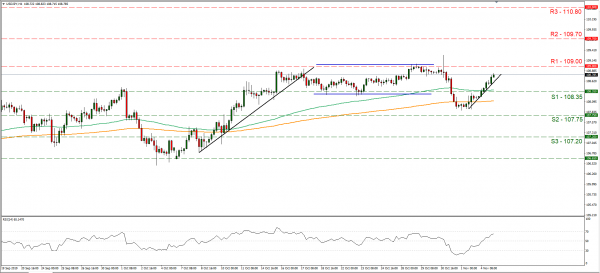

JPY weakened against the USD yesterday as growing optimism about the US and China being close to sign a “phase 1” deal pushed downwards. There were promising signs as the US seems to be willing to drop some of its tariffs of Chinese products, while China asks for more tariff roll backs. Also media report that China seems to be reviewing locations in the US in order for the two countries to sign a possible preliminary deal. However, it remains to be seen if the partial deal will be actually touching the core disputes of the two countries. Analysts tend to note that the mood is more risk on in the markets and it would be indicative that US stock-markets had gains yesterday. We tend to expect that any further signs for a partial resolution of the US-Sino trade differences could boost the USD as well as riskier assets. USD/JPY rose yesterday breaking the 108.35 (S1) resistance line, now turned to support. We maintain a bullish outlook for the pair, as the pair’s price action is forming un upward trendline, since the 1st of the month. Should the pair find fresh buying orders along its path, we could see it breaking the 109.00 (R1) resistance line and aim for the 109.70 (R2) resistance hurdle. Should the pair come under the selling interest of the market, it could break the 108.35 (S1) support line and aim for the 107.75 (S2) support barrier.

Other economic highlights today and early tomorrow

Today during the European session, we get Turkey’s CPI rate, Germany’s final Manufacturing PMI and UK’s construction PMI all for October, as well as Eurozone’s Sentix investor sentiment for November. In the American session, we get the US factory orders growth rate for September and in tomorrow’s Asian session China’s Caixin Services PMI for October.

As for the week ahead

Today during the European session, we get the UK services and a composite PMIs for October as well as Eurozone’s PPI growth rate for September. In the American session, we get the US and Canada’s trade data for September as well as the US ISM non-manufacturing PMI for October and the API weekly crude oil inventories figure. Just before the Asian session starts, we get New Zealand’s employment data for Q3 and later on Japan’s services PMI for October. As for speakers, Richmond Fed President Barkin, Dallas Fed President Kaplan and Minneapolis Fed President Kashkari speak, while BoJ releases Minutes of the September meeting.

Support: 0.6860 (S1), 0.6800 (S2), 0.6740 (S3)

Resistance: 0.6925 (R1), 0.6985 (R2), 0.7050 (R3)

Support: 108.35 (S1), 107.75 (S2), 107.20 (S3)

Resistance: 109.00 (R1), 109.70 (R2), 110.80 (R3)